Cruise Stocks Running Aground

The CDC issued guidance this week on how cruise operators can run test cruises in order to move closer to returning to ‘normal’ cruising operations. At the surface, one would assume that anything that moves the industry closer to returning back to business would be a positive for the sector, but when the cruise stocks have already bounced so much off their lows, a lot of the good news appears to be priced in.

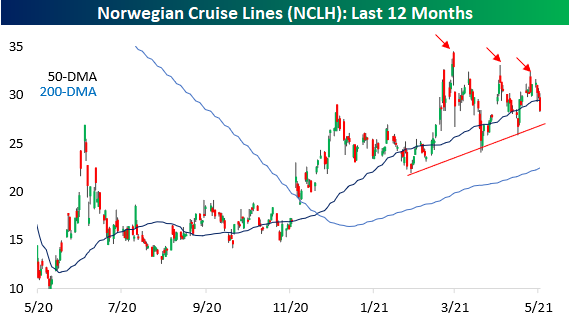

A key sign of good news being priced into a stock happens when you start to see selling into strength, and that’s exactly what we’ve seen over the last several weeks in the cruise operators. The charts below show the performance of Carnival (CCL), Norwegian Cruise Lines (NCLH), and Royal Caribbean (RCL).In each chart, we have included red arrows over days when the stocks saw strong intraday gains only to reverse lower from their highs into the close. Not only have we seen a number of these types of reversals in the last several weeks, but in most cases, each successive intraday high has been lower than the prior peak. The fact that investors are selling strength at progressively lower levels suggests a degree of eagerness to exit positions. If you’re willing to sell something for $38 today that you were selling for $40 last week, you’re what they call a motivated seller.

While the selling into strength in these cruise stocks may be disheartening if you are long, at this point the cruise operators haven’t yet shown any meaningful signs of breaking down. CCL still remains comfortably above its highs from last June and December, and each recent sell-off has been met with some buying at higher levels (motivated buyers) causing a series of higher lows. For NCLH, it’s a similar story. Of the three stocks, the only one that has been experiencing lower lows from each reversal has been RCL, but while it is currently modestly below its late 2020 high, it has yet to show a meaningful breakdown.

Looking for full access to our research and market analysis? Sign up for a two-week trial ...

more