Crocs: Rising Among The Pandemic

Introduction

Crocs (CROX) has been on a phenomenal run, albeit relatively, as the stock is marginally in green, well ahead of the other beaten down peers which are down 30-50% YTD, while Adidas performed better given its focus on the Athleisure segment and the COVID-19 pandemic augmenting the sales within the segment.

Data by YCharts

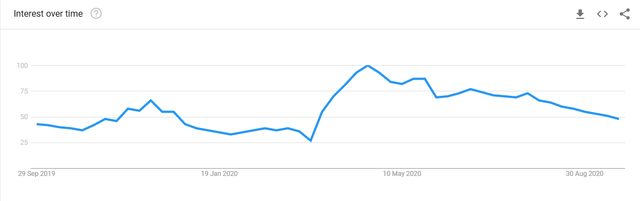

Although Crocs product portfolio scantly includes athleisure footwear, its focus on comfort wear has been the biggest catch for millions of people staying home as well as for professionals looking to hunker down from the formal shoes to comfy footwear, which is why the company has been able to do relatively better than most of the peers. The same was reaffirmed by the google search trends as the "Crocs" popularity reached the peak at the height of the pandemic in April and continues to do well.

The relative outperformance was echoed by the company's top executive in the Q2 conference call. Given the company's dominance

Our business both from a top and bottom line perspective performed exceptionally well during the second quarter of 2020 despite the worldwide challenges presented by the COVID-19 pandemic.

- Andrew Rees, CEO

We believe the company's relative resilience amidst the pandemic, massive growth potential (forms >1% of the footwear market), attractive and diversified product range, and value for money products to the work from home crowd would enable the company to produce continued growth in the coming quarters.

Earnings Corner

The company posted a marginal 6-8% dip in revenues in the worst affected quarters for Corporate Inc as the pandemic ravaged through globally. This was in stark contrast to a significant decline in revenues for most of the retailers and apparel players as more consumers preferred to stay home and did not find the need to replenish their wardrobe. E-commerce revenues grew a staggering 68% for Q2 with revenues in Americas growing triple digits. It also donated about 860,000 pairs of Crocs to frontline healthcare workers which also helped the company generate a positive brand push.

Data by YCharts

Average footwear selling price during Q2 increased 10.3% to $20.29 with the increase attributable to higher prices, lower discounting, increased sales of charms for shoe, and channel mix. Along with tighter cost-cutting initiatives, this led the company to improve its operating margin by a massive 800 bps. All of this put together helped the company to post a staggering 71% rise in EPS to $1.01 smashing all the estimates.

Valuation

We believe the company would continue to post robust growth in the coming quarters amidst the strong market growth potential in a niche market along with consumers increasingly staying home and working looking for a comfort pair. Valuation-wise, the stock trades at 18.4x Fwd EPS which is cheap compared to the 3-year median and we believe the stock would warrant a PE expansion as it continues to deliver positive and strong earnings growth. Initiate with a BUY recommendation.

Data by YCharts

Hey, if we are going to be stuck at home, we might as well be comfortable doing it!

This article is interesting and educational at the same time. It seems that CROCS has found a good niche that does not have many players. Perhaps good leadership choices and market analysis? I doubt that it was "just good luck."

Absolutely. Also, the company was on the verge of bankruptcy a decade ago after a meteoric rise in its early years.

money.cnn.com/2009/07/17/smallbusiness/crocs.smb/

Post that, With a new management and about $200mn of equity investment, it became more nimble closing down several owned stores, closing factories and transferring control of others to distributors and keep its focus razor-sharp on one thing: Making stylish and attractive comfy footwear.