Credit Loss Provisions Soar As Banks Brace For Pain

While some were more interested in how banks did in Q4 - a quarter which we already knew would see catastrophic banking revenues (due to the lack of IPOs and bond offerings thanks to the plunging market), and mediocre at best for FICC and equity trading offset by very strong net interest income courtesy of soaring credit card fees - we were much more curious in how banks saw the future not by their always cheerful conference calls, but by how much loan loss reserves they took out in anticipation of the coming recession.

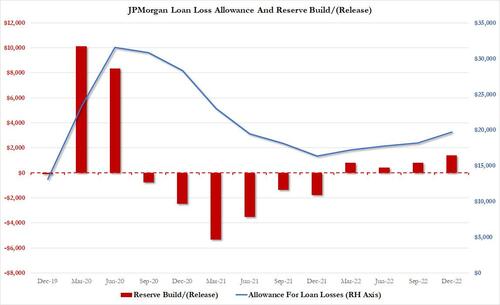

The results were concerning: let's start with the largest US commercial bank, JPMorgan, which in Q4 almost double its reserve build from $808MM to $1.4 billion, the biggest reserve build since the fateful Q2 2020 quarter when covid locked down the US economy and nobody knew what would happen.

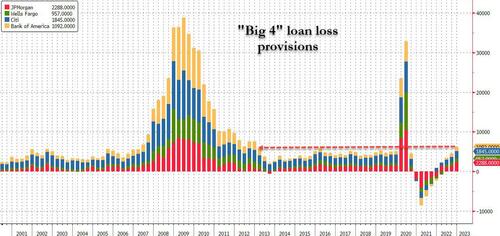

What about other banks? Well, as the chart below shows, it wasn't just JPM. In fact, all the Big 4 banks saw their reserve provisions surge, and as shown in the chart below, the total for the 4 largest US banks was $6.2 trillion, which - if one excludes the outlier covid period - was the largest reserve build quarter since the start of 2013.

It was therefore hardly a surprise why the banks' earnings reports were met - at least initially - with widespread selling (which has since abated for the time being), amid clear signs that a shakier economy lies ahead. As Bloomberg notes, beats on revenue and profit didn’t do much to impress investors who were instead much more focused on how much money the lenders put aside to cover loans that might go bad. In most cases, the sums were more than analysts had reckoned.

Courtesy of Bloomberg, here is a summary of what the big banks have reported so far:

JPMorgan (JPM)

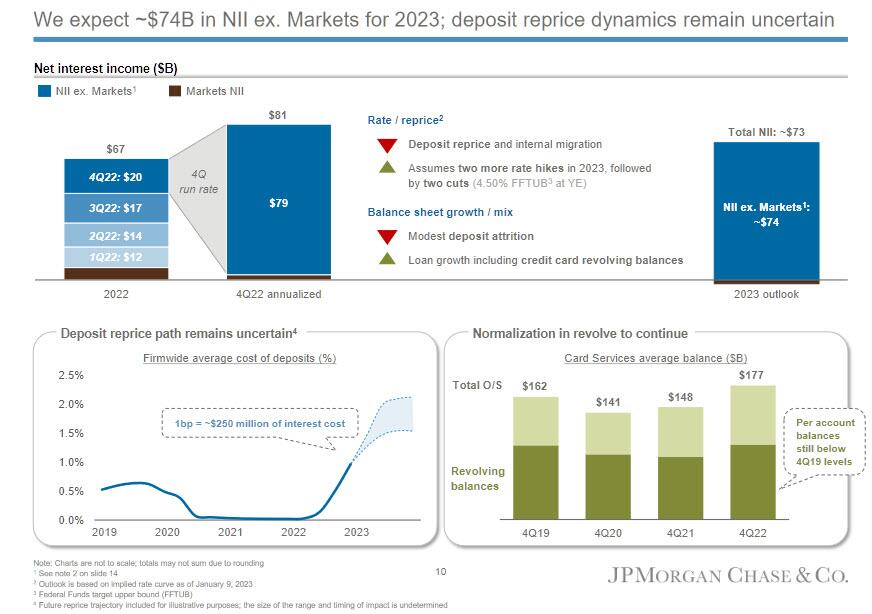

The biggest US bank said this year’s net interest income will be lower than analysts expected because the economy shows signs of slippage. NII, a major revenue source, will be about $73 billion this year, far below the $74.4 billion estimate. The forecast ironically followed a record haul of $20.2 billion from net interest income in the fourth quarter.

(Click on image to enlarge)

“The US economy currently remains strong with consumers still spending excess cash and businesses healthy,” Chief Executive Officer Jamie Dimon said in a statement Friday. “We still do not know the ultimate effect of the headwinds coming from geopolitical tensions including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation that is eroding purchasing power and has pushed interest rates higher, and the unprecedented quantitative tightening.”

The company also warned of a “modest deterioration” in its macroeconomic outlook.

Wells Fargo (WFC)

Wells Fargo posted higher-than-expected fourth-quarter expenses, even after the firm warned of a hefty loss tied to a regulatory sanction last month. The firm spent $16.2 billion in the last three months of the year, exceeding analyst estimates. That included $3.3 billion in operating losses after Wells Fargo said last month it would book costs for a settlement with the Consumer Financial Protection Bureau and other legal issues.One bright spot: Wells Fargo pulled in a record $13.4 billion in net interest income in the quarter, a 45% gain, handily beating analyst expectations.

“Though the quarter was significantly impacted by previously disclosed operating losses, our underlying performance reflected the progress we are making to improve returns,” CEO Charlie Scharf said in a statement. “Rising interest rates drove strong net interest income growth, credit losses have continued to increase slowly but credit quality remained strong, and we continue to make progress on our efficiency initiatives.”

Bank of America (BAC)

Bank of America traders beat analysts’ estimates as they reaped the benefits of dramatic market swings, and lending income rose along with interest rates while falling short of expectations. Net interest income, the revenue collected from loan payments minus what depositors are paid, rose 29% to $14.7 billion in the fourth quarter on higher rates and loan growth, though the increase was smaller than forecast. Trading revenue soared 27% from a year earlier, with the best results in fixed income, more than the 13% gain analysts had expected.

“We ended the year on a strong note growing earnings year over year in the fourth quarter in an increasingly slowing economic environment,” CEO Brian Moynihan said.

Citigroup (C)

Citigroup fixed-income traders turned in a record-setting finale to 2022 as the bank, under pressure to improve returns, braced itself for a less certain economy. Customers’ bets on rates and currencies boosted revenue from fixed-income trading 31% to $3.2 billion, the firm’s largest haul ever for a fourth quarter. Total trading was up 18% — trouncing the 10% increase predicted by executives just last month. “We intentionally designed a strategy that can deliver for our shareholders in different environments,” CEO Jane Fraser said in a statement announcing results Friday. The bank is “very much on track” to meet targets for improving returns, she said.

Goldman Sachs (GS)

While the investment bank doesn’t report until next week, it gave an early look at results from a new division carved out to house what’s left of its once-ambitious foray into Main Street banking. The segment formerly called Marcus and which recently changed its name to Platform Solutions, racked up more than $1.2 billion in pretax losses in last year’s first nine months, with the drop accelerating every quarter, the bank reported. From the start of 2020 through the end of September, pretax losses piled up to $3 billion, according to a filing. When the latest quarter’s figures get added to it next week, that cumulative loss will approach $4 billion in the three-year span and $2 billion for the year, driven by loan-loss provisions. And since Goldman - ironically - targets mostly subprime consumers, the bank which made a killing by shorting subprime in 2008, is itself about to get crushed by the next recession which will hammer subprime borrowers the hardest.

More By This Author:

BofA Reports Solid Q4 Earnings, Beats FICC Even As Credit Loss Provisions Soars Above $1 Billion

BlackRock To Lay Off About 500 Employees

Services CPI Soars To Highest In 40 Years, Real Wages Shrink For 21st Month In A Row

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more