BofA Reports Solid Q4 Earnings, Beats FICC Even As Credit Loss Provisions Soars Above $1 Billion

While traditionally it is JPMorgan that is the first bank to report earnings in the quarter, today - by a margin of about 2 minutes, it was Bank of America that moments ago reported earnings that were generally stronger than expected.

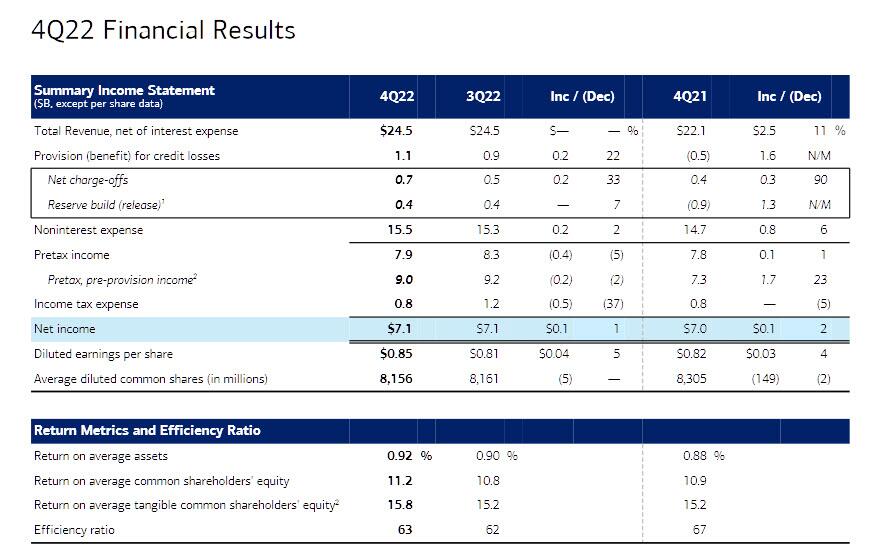

Here are the highlights for the just concluded Q4:

- Revenue $24.5BN, up 11% Y/Y from $22.1BN year ago, and beating exp. of $24.33BN

- EPS 85c, up 4% Y/Y from 82c a year ago, and beating exp. of 77c.

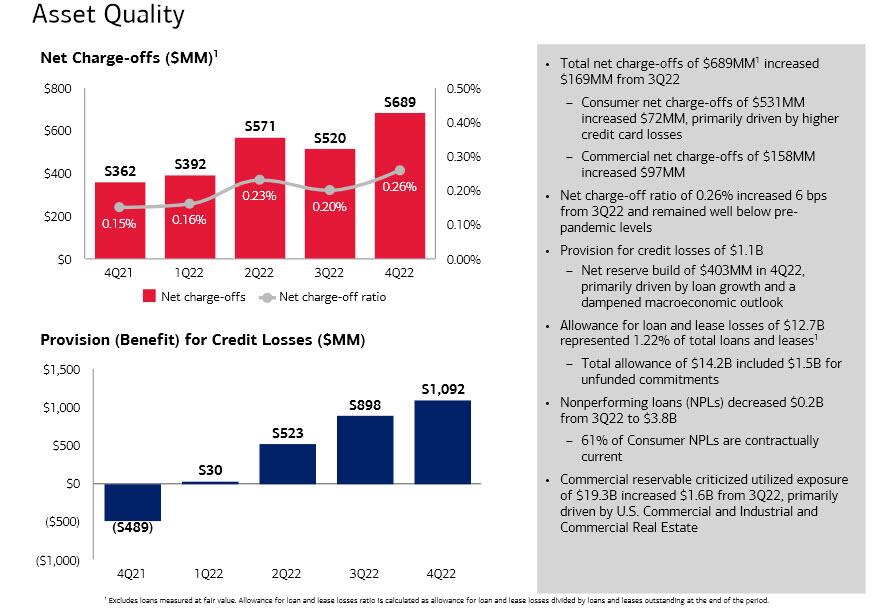

Asset quality revealed net charge-offs of $689MM, more than the exp. $640MM and up $169MM from Q3. This translated into a net charge-off ratio of 0.26%, up 6 bps from 3Q22 and remained well below pre-pandemic levels. This was driven by:

- Consumer net charge-offs of $531MM increased by $72MM, primarily driven by higher credit card losses

- Commercial net charge-offs of $158MM increased $97MM

In a preview of the economic trouble to come, BofA's provision for credit losses soared to $1.1BN, more than the est. $1.02BN, and compares to a benefit of $489MM Y/Y in 4Q21.

BofA's net charge-offs (NCOs) of $689MM increased compared to 4Q21 and 3Q22 but has remained below pre-pandemic levels (for now). Adding it up, the bank reported a reserve build of $403MM vs. release of $851MM in 4Q21; and a build of $378MM in 3Q 22. The reserve build was "primarily driven by loan growth and a dampened macroeconomic outlook." Finally, the allowance for loan and lease losses of $12.7B represented 1.22% of total loans and leases; the total allowance of $14.2B included $1.5B for unfunded commitments.

Digging deeper into the numbers we find:

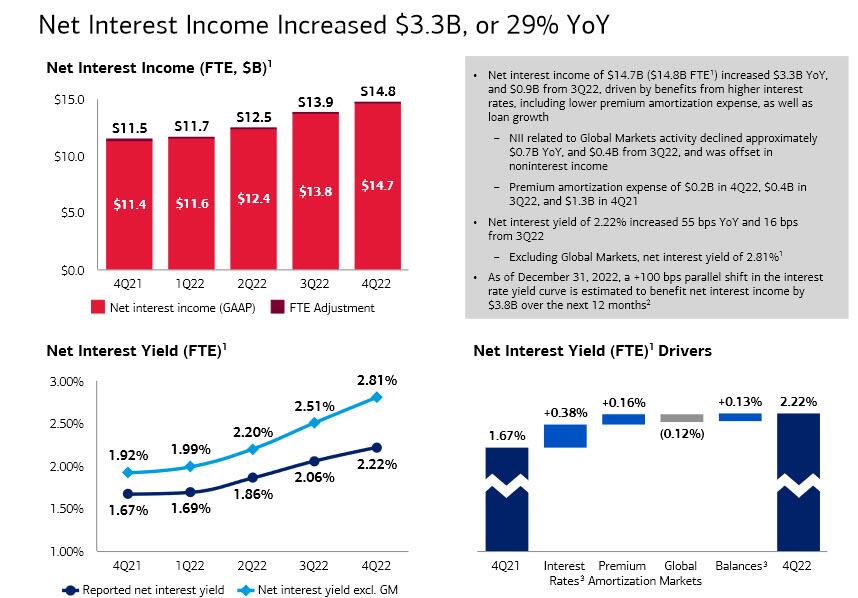

Net interest income (NII) of $14.7B ($14.8B FTE) increased $3.3B, or 29% but was not enough to beat the estimate of $14.95BN, driven by benefits from higher interest rates, including lower premium amortization expense, and loan growth

- NII related to Global Markets activity declined approximately $0.7B YoY, and $0.4B from 3Q22, and was offset by noninterest income

- Premium amortization expense of $0.2B in 4Q22, $0.4B in 3Q22, and $1.3B in 4Q21

Net interest yield of 2.22% increased 55 bps YoY and 16 bps from 3Q22; Excluding Global Markets, net interest yield of 2.81%

Also according to BofA, as of December 31, 2022, a +100 bps parallel shift in the interest rate yield curve is estimated to benefit net interest income by $3.8B over the next 12 months

Turning to noninterest income, BofA reported $9.9BN of revenue which decreased $0.8B, or 8%, as declines in investment banking and asset management fees, as well as lower service charges, which offset higher sales and trading revenue.

On the expense side, the noninterest expense of $15.5B increased $0.8B, or 6%, vs. 4Q21. Compensation expenses in Q4 were $9.16 billion, in line with the estimate of $9.17 billion.

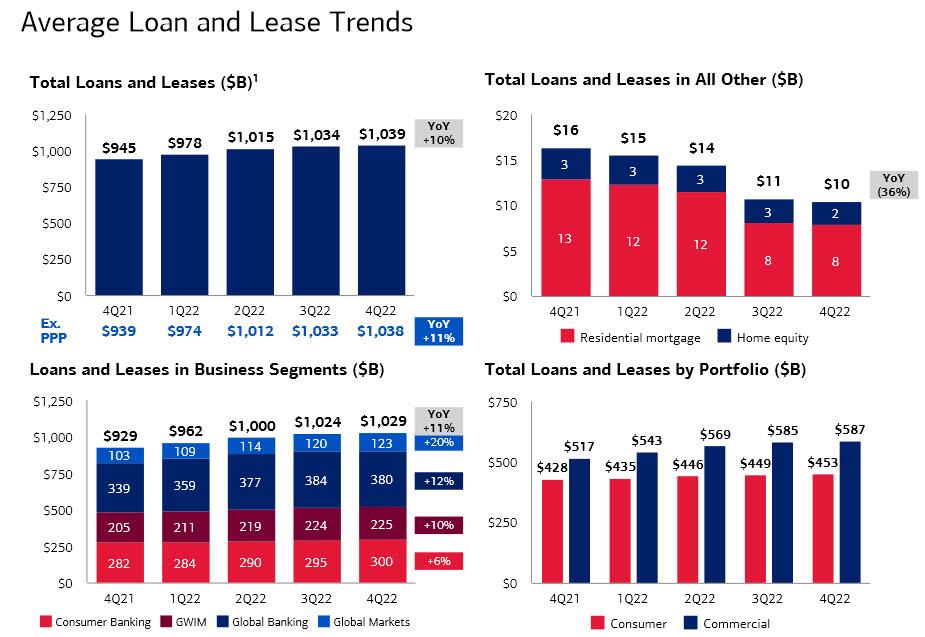

Next, a quick look at the balance sheet shows that:

- Average loans and leases grew $94B from 4Q'21; loans ended at $1.05 trillion, above the estimate of $1.04 trillion.

- Average deposits decreased $92B from 4Q21 (to be expected in a time of QT); total deposits ended the year at $1.93 trillion, also above the estimate $1.9 trillion.

Some more balance sheet details here:

- Common Equity Tier 1 (CET1) ratio of 11.2% increased 25 bps from 3Q22, est. 11.1%

- Average Global Liquidity Sources (GLS) of $868B

- Return on average equity 11.2%, estimate 10.2%

- Return on average assets 0.92%, estimate 0.84%

- Return on average tangible common equity 15.8%, estimate 14.9%

- Basel III common equity Tier 1 ratio fully phased-in, advanced approach 12.8%, estimate 12.8%

- Paid $1.8B in common dividends and repurchased $1.0B of common stock, including repurchases to offset shares awarded under equity-based compensation plans

Turning to the bank's investment bank and trading operations, the bank reported results that were generally stronger than expected, to wit:

- Trading revenue excluding DVA $3.72 billion, beating the estimate $3.31 billion

- FICC trading revenue excluding DVA $2.34 billion, beating the estimate $1.93 billion

- Equities trading revenue excluding DVA $1.38 billion, in line with estimate $1.38 billion

Some more details:

Revenue incl DVA of $3.9B increased 1% from 4Q21, primarily driven by higher sales and trading revenue, partially offset by lower investment banking fees.

Reported sales and trading revenue of $3.5B increased 20% from 4Q21:

- Fixed income, currencies, and commodities (FICC) revenue increased 37% to $2.2B, driven by improved performance across currencies, interest rates, and credit products

- Equities revenue increased marginally, or less than 1%, to $1.4B

Excluding net DVA, sales and trading revenue of $3.7B increased 27% from 4Q'21

- FICC revenue of $2.3B increased 49%

- Equities revenue of $1.4B increased 1%

Noninterest expense of $3.2B increased 10% vs. 4Q21, driven by higher activity-related expenses and investments in the business, including technology and strategic hiring.

Finally, the average VaR of $117MM in 4Q, up almost double from the 63 a year ago.

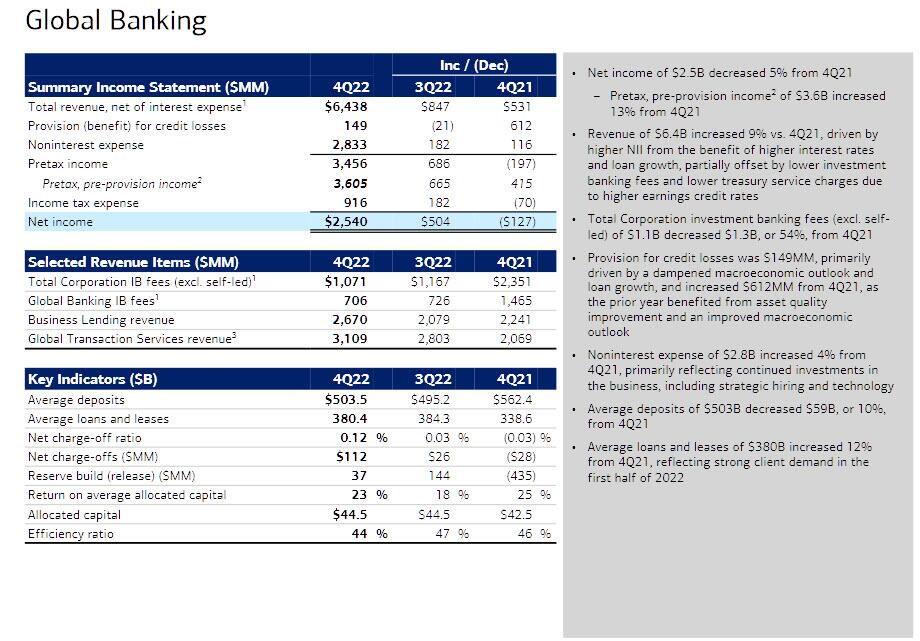

Finally, turning to the bank's Global Banking division, investment banking revenue $1.07 billion dropped 54% from $2.351BN a year ago, and was just below the estimate of $1.08 billion

Some more details on the group:

- Revenue of $6.4B increased 9% vs. 4Q21, driven by higher NII from the benefit of higher interest rates and loan growth, partially offset by lower investment banking fees and lower treasury service charges due to higher earnings credit rates

- Provision for credit losses was $149MM, primarily driven by a dampened macroeconomic outlook and loan growth, and increased $612MM from 4Q21, as the prior year benefited from asset quality improvement and an improved macroeconomic outlook

- Noninterest expense of $2.8B increased 4% from 4Q21, primarily reflecting continued investments in the business, including strategic hiring and technology

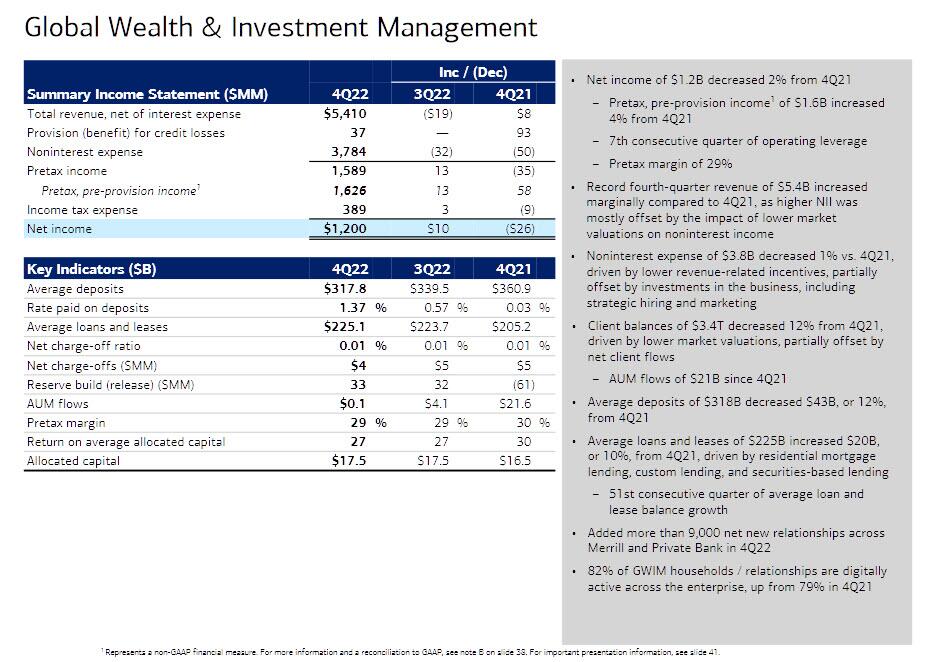

A quick look at the bank's Global wealth and investment management shows that AUM balances of $1.4 trillion declined $237 billion; $21 billion of AUM flows since Q4-21. GWIM Net income of $1.2B decreased 2% from 4Q21; Pretax, pre-provision income of $1.6B increased 4% from 4Q21; Record fourth-quarter revenue of $5.4B increased marginally compared to 4Q21, as higher NII was mostly offset by the impact of lower market valuations on noninterest income.

Commenting on the quarter, CEO Moynihan said that “we ended the year on a strong note growing earnings year over year in the 4th quarter in an increasingly slowing economic environment." He also said that earnings "represent one of the best years ever for the bank, reflecting our long-term focus on client relationships and our responsible growth strategy. We believe we are well positioned as we begin 2023 to deliver for our clients, shareholders and the communities we serve.”

CFO Alastair Borthwick chimed in, saying that the said $3.3BN increase y/y in net interest income was largely passed along "to the benefit of shareholders" and added that "Prudent management of capital in the quarter helped us to grow loans, buy back shares and increase our capital buffer on top of our regulatory requirements.”

Despite the solid earnings and the beat across the board, BofA stock dipped in premarket trading perhaps dragged down by the far uglier results at JPMorgan (we will discuss those next).

(Click on image to enlarge)

The company's full Q4 earnings deck is below (pdf link)

More By This Author:

BlackRock To Lay Off About 500 EmployeesServices CPI Soars To Highest In 40 Years, Real Wages Shrink For 21st Month In A Row

U.S. To Hit Debt Ceiling One Week From Today, Starting Countdown To Epic Chaos

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Loading comments, please wait...