Creating A Legacy: Intergenerational Wealth

Image Source: Unsplash

Some people have the goal of spending everything while still living and not leaving anything for their kids. While there is some logic to this, it’s a dangerous plan, for the simple reason that nobody knows when their time will come, so there is a good chance of being penniless when you need it most.

Others have accumulated so much wealth that they couldn’t possibly spend it on anything they would like to spend it on. In either case, whether creating a legacy is the plan or just the side effect of being prudent, there are a host of things to consider.

Even for a family with modest wealth, mistakes in estate planning can leave the money tied up for years in litigation and erode the value of the estate as fees accumulate. The problems become even more taxing as families accumulate great wealth. There are countless examples of great family fortunes, such as the Vanderbilts, that disappear within a couple of generations.

However, many of the pitfalls can be avoided by creating a family legacy plan. These are some of the key elements to creating a robust plan:

Open and transparent family communication. One of the things many wealthy people fear is that their kids will be torn apart fighting over an inheritance. This can happen even when the wealth is not huge because of all the emotions and history different family members bring to the table. Starting with a family meeting and continuing to involve heirs in important discussions can help set expectations and maintain family harmony. Discussions can include things such as family wealth philosophy, life goals, educational goals, entrepreneurial goals, business succession, managing health and mobility with age, protecting against fraud, and many other important issues.

Assembling a well-balanced team. This will usually include an attorney, a tax specialist, a financial advisor, and trusted family members. It may also include a variety of specialists, depending on the situation.

Preparing the key documents and structures. The foundation usually involves a will, durable power of attorney, advance directive, healthcare proxy, titling the assets, appointing a guardian for minors, and preparing college savings options. It may also include an ethical will, letter of intentions, and various trusts for transfer, tax, or charitable planning.

Preparing children to manage wealth. When someone suddenly comes into a substantial amount of money and is not prepared to manage it, they could quickly lose it due to overspending, bad investments, or even fraud. Some lose the incentive to work or pursue life goals. The key to preventing this is early and ongoing education and experience managing money. This could start as early as 3-6 years old with managing an allowance and saving in a piggy bank, grow to basic budgeting and saving at a bank, and finally to selecting investments. Older or adult children can benefit greatly by meeting their parents’ advisors and attending meetings with them when possible.

Following tax efficient strategies. With the estate exemption set to fall from $10 million to $5 million in 2026, unless there is a change in the law, tax strategies are on the minds of many wealthy. There are a variety of strategies and tools available, such as taking advantage of step ups in basis, loans, grantor retained annuity trusts, sales to intentionally defective grantor trusts, generation-skipping trusts, and more.

Creating a legacy of philanthropy that reflects your values. For the charitably inclined, there are many good options to make a difference in the areas you care about. It starts by defining your values and sharing the stories that shaped your values and helped develop your character. This can be continued with a family “board” that is familiar with your values and desires and can guide ongoing gifts. Depending on the goals and situation, vehicles for charitable giving include donor-advised funds, a charitable lead trust, a charitable remainder trust, and a private foundation.

You have an enormous amount of flexibility in designing your intergenerational wealth plan. It can range from the basics of ensuring an orderly and efficient transition when the time comes to something designed to last for decades or even multiple generations. Most importantly, it is an opportunity to involve your family so your children are well-prepared for the future and it contributes to their life rather than becoming a source of stress.

Key Wealth Principles

- Invest in quality businesses at an attractive price

- Build a portfolio of good businesses in different industries

- Maintain appropriate reserves and income sources

- Consider your financial circumstances, goals, and risk exposure

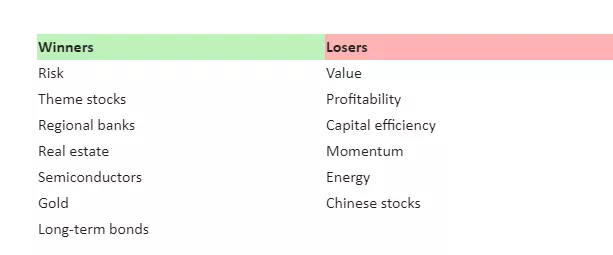

Last Month’s Winners and Losers

There was a strong reversal last month, with long-term interest rates falling sharply. This led to an increased appetite for risky stocks and theme stocks, as well as for interest-sensitive areas, such as regional banks, real estate, and bonds. The underperformers during the month were value-oriented stocks, profitable companies, and momentum stocks.

Stocks

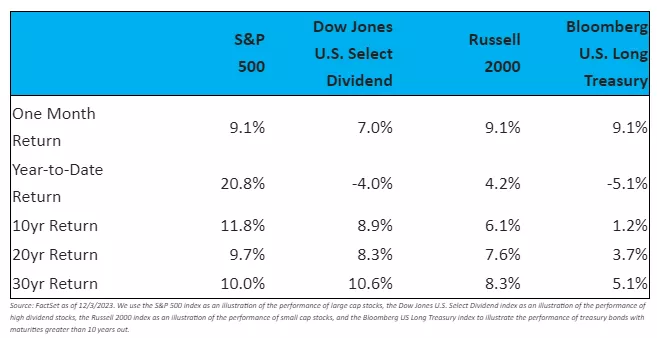

Source: FactSet as of 12/3/2023. We use the S&P 500 index as an illustration of the performance of large cap stocks, the Dow Jones U.S. Select Dividend index as an illustration of the performance of high dividend stocks, the Russell 2000 index as an illustration of the performance of small cap stocks, and the Bloomberg US Long Treasury index to illustrate the performance of treasury bonds with maturities greater than 10 years out.

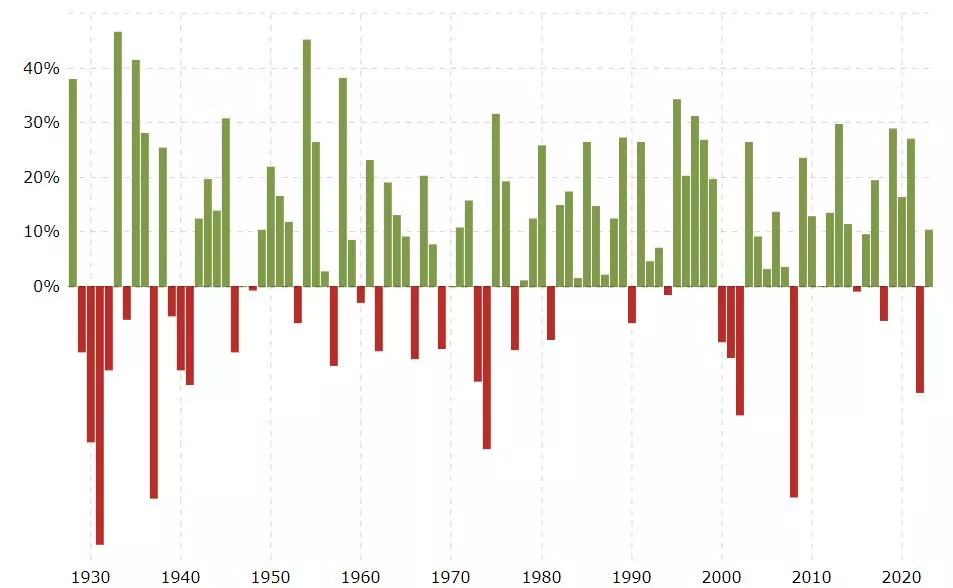

This year has seen a huge disconnect in the returns of the large growth stocks dominating the S&P 500, small cap stocks, and more prosaic dividend stocks, which have been influenced more by changing interest rates. However, recent returns have been similar as interest rates have fallen, so that may be normalizing. Long-term, I would still expect an 8-10% average annual return on any broad segment of the equity market, with substantial volatility from year-to-year.

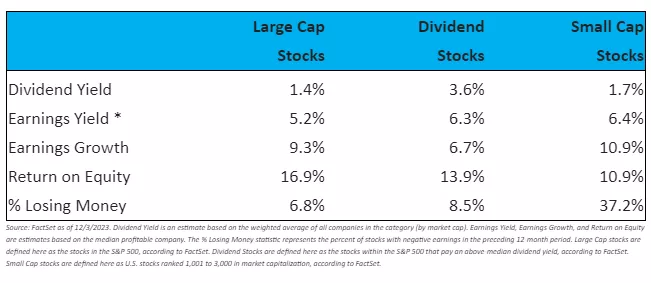

Looking at the characteristics of different equity markets, they seem appealing to long-term investors. Earnings yields average around 5-6%, depending on which segment of the market you’re looking at, and earnings growth expectations range from 7% to 11%, depending on the segment. When I look at individual stocks, I do not have a problem finding ones I think are appealing from a value perspective.

Source: FactSet as of 12/3/2023. Dividend Yield is an estimate based on the weighted average of all companies in the category (by market cap). Earnings Yield, Earnings Growth, and Return on Equity are estimates based on the median profitable company. The % Losing Money statistic represents the percent of stocks with negative earnings in the preceding 12-month period. Large Cap stocks are defined here as the stocks in the S&P 500, according to FactSet. Dividend Stocks are defined here as the stocks within the S&P 500 that pay an above-median dividend yield, according to FactSet. Small Cap stocks are defined here as U.S. stocks ranked 1,001 to 3,000 in market capitalization, according to FactSet.

* “Earnings yield” is an investor’s share of earnings for every dollar invested (i.e., earnings per share/price per share). It’s the same as the more famous Price / Earnings (P/E) ratio, but expressed as a yield rather than as a multiple. I use it to compare stocks more clearly with bonds and other asset classes.“Equity Risk Premium” equals the Earnings Yield minus the 10-year Treasury Inflation Protected Securities yield.

Income Investing

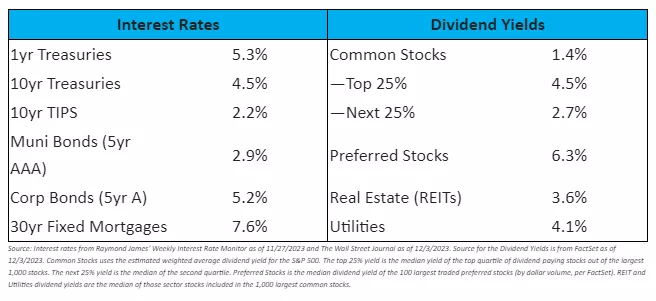

Source: Interest rates from Raymond James’ Weekly Interest Rate Monitor as of 11/27/2023 and The Wall Street Journal as of 12/3/2023. Source for the Dividend Yields is from FactSet as of 12/3/2023. Common Stocks uses the estimated weighted average dividend yield for the S&P 500. The top 25% yield is the median yield of the top quartile of dividend-paying stocks out of the largest 1,000 stocks. The next 25% yield is the median of the second quartile. Preferred Stocks is the median dividend yield of the 100 largest traded preferred stocks (by dollar volume, per FactSet). REIT and Utilities dividend yields are the median of those sector stocks included in the 1,000 largest common stocks.

Long-term yields fell across the board last month on everything ranging from long-term Treasury bonds to mortgages to dividend yields. Short-term rates held steady. Part of the reason I think is that investors felt rates had reached an attractive level and rushed in to buy them, as shown by large fund flows into funds.

The driver is probably a combination of increasing confidence that inflation is under control and continued nervousness over the economy and world events.

Core inflation continues to come in at around a 3% level if you annualize recent months. This reduces the pressure on the Federal Reserve to raise short-term rates, and so far they seem to be doing just that: holding rates steady. The market expects around 2.3% average inflation over the next 10 years.*

* Implied inflation expectations are derived from taking the 10-Year Treasury rate and subtracting the 10-Year Treasury Inflation Protected Securities (TIPS) rate. For example, if the yield on 10-year treasuries is 2.8% and the yield on 10-year TIPS is 0.4%, they are roughly equivalent investments if inflation comes in at the difference (2.8% - 0.4% = 2.4%).

The Long View

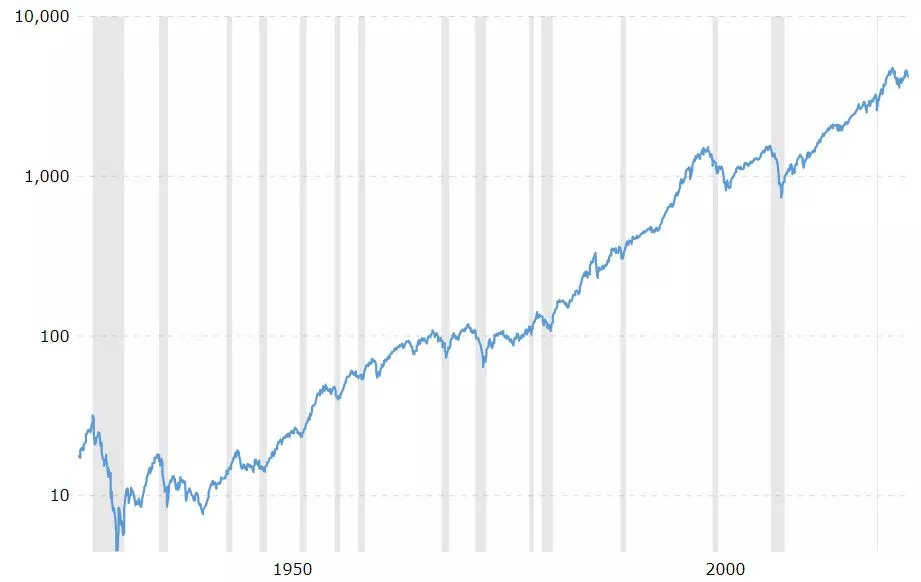

S&P 500, Jan. 1928 to Oct. 2023

Source: MacroTrends.net

For the last 20, 30, and 100 years, stocks have averaged around an 8-10% return, driven by dividend yield, reinvestment of earnings, and earnings growth. Long-term bonds have yielded about 5% on average over the last century while inflation has been about 3%.

Throughout this period, there have been major upheavals, such as the Great Depression, World War II, The Korean War, The Vietnam War, dropping the gold standard, 1970s high inflation, 1987’s Black Monday Crash, the Dot.com bust, the 9/11 terror attacks, the Global Financial Crisis, and the Covid Crash, among others.

These events led to severe market downturns about once every decade, with a median price decline of 33% and a median time to recover back to the previous high of 3.5 years. If we were to include dividends, the recovery to previous highs is actually a little faster. *

Meanwhile, a 3% inflation rate results in a 59% decline in the value of a dollar over 30 years. This means that people who retire at 60 years old on a fixed income face a high risk of a lower quality of life as they get further into retirement. *

The Price of Market Returns: Significant Volatility

S&P 500 Yearly Returns, 1928 to 2023. Source: MacroTrends.net

* Source: Morningstar Direct via cfainstitute.org, FactSet. Past performance is not necessarily indicative of future performance. Depreciation of the dollar: $1 / (1 + 3%)^30 = $0.41 real value 30 years later.

Market Outlook

Now I’ll put on my “Nostradamus Hat” and make some predictions, for whatever they’re worth:

- Inflation will average 2-4% over the next 10 years.

- Interest rates will fall in the 4-6% range for 10yr Treasuries over the next several years, in line with inflation and historical experience.

- The economy will grow 2-3% in real terms over the next several years, though we will probably slip into a recession this year.

- Stocks will average an 8-10% return over the next 10+ years. After subtracting inflation, this will translate into about a 5% real return. There is likely to be at least one big decline every decade or so.

From the standpoint of where you and your family will be in 30 years, none of this matters. What matters is finding good quality investments that are likely to grow over the decades. For this reason, I largely ignore my own general market forecast and invest whenever I find a business that I am confident in and that trades at an attractive valuation.

More By This Author:

Is A Hard Rain A-Gonna Fall?

When The Unexpected Happens

Advanced Tax Deferral Options In Retirement Plans

Disclosures: Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request ...

more