When The Unexpected Happens

Image Source: Unsplash

One of the people I invited to a seminar on retirement planning told me that retirement would be the worst thing that could happen to him and he planned on working until he died. I can certainly understand that viewpoint as I love what I do and find it fulfilling to make a difference in other people's lives. I plan on working as long as I'm healthy and able to do so.

But the unfortunate reality is that sometimes we don't have a choice in the matter or priorities change for reasons we didn't anticipate. Sometimes it can be something traumatic that happens to you, like a car accident, stroke, or illness. Sometimes it could be something that happens to a loved one or in life that changes priorities.

Retirement is a wonderful new phase of life for many people, where they can do all the things they wanted to do but never had time to do before. Or simply relax after a lifetime of stress. For other people, they may be forced into retirement for a variety of reasons or reluctantly driven to retirement as other priorities become more important.

The important thing is to be well-prepared for whatever comes about and to have options that will make your life better. Even if you have no desire to retire, having the means to be financially independent so that work is a choice and you can handle any unexpected stresses is certainly helpful for your peace of mind.

Key Wealth Principles

- Invest in quality businesses at an attractive price

- Build a portfolio of good businesses in different industries

- Maintain appropriate reserves and income sources

- Consider your financial circumstances, goals, and risk exposure

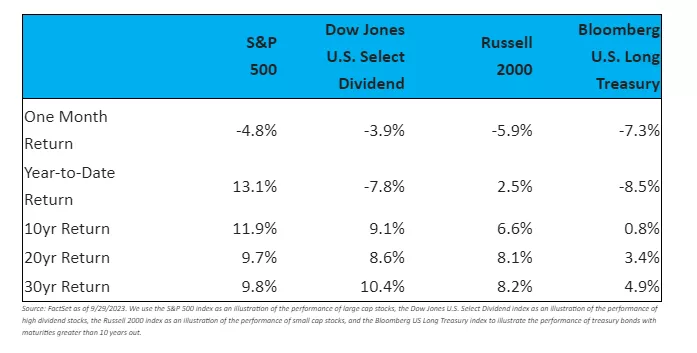

Last Month’s Winners and Losers

Long-term interest rates rose substantially last month, which hurt the value of long-term bonds and dividend-oriented sectors, such as real estate and utilities.

The rise in long-term interest rates also put continued pressure on regional banks, which have to pay more for their CDs and deposits while also having low-interest mortgages and commercial real estate loans on their balance sheet. The commercial real estate loans are facing credit quality issues with the amount of empty office space out there. There was also a move away from riskier stocks and highly leveraged companies.

True winners were rare last month. Crude oil, energy, and mining stocks did well on rising commodity prices. Relatively speaking, large cap did better than small cap, value did better than growth, and profitable companies did better than unprofitable companies.

Stocks

Source: FactSet as of 9/29/2023. We use the S&P 500 index as an illustration of the performance of large cap stocks, the Dow Jones U.S. Select Dividend index as an illustration of the performance of high dividend stocks, the Russell 2000 index as an illustration of the performance of small cap stocks, and the Bloomberg US Long Treasury index to illustrate the performance of treasury bonds with maturities greater than 10 years out.

While most sectors and asset classes were down last month, this year has seen a wide disparity in performance. The S&P 500, which is driven mostly by large tech companies, has been a relatively strong performer year-to-date (YTD), after turning in negative performance last year. In contrast, high dividend stocks have actually been down this year, after holding up relatively well last year.

Interestingly enough, the performance of dividend stocks has been similar to that of long-term treasury bonds this year. There is probably some relationship between the performance of bonds and dividend stocks as both are popular with income-oriented investors and a rise in long-term interest rates puts downward pressure on the price of bonds and dividend-oriented stocks.

However, stocks also potentially benefit from long-term earnings growth and the performance of dividend stocks tends to be similar to that of the general stock market over time. They can sometimes follow dramatically different cycles, as we've seen in the last two years, but cycles tend to even out over time.

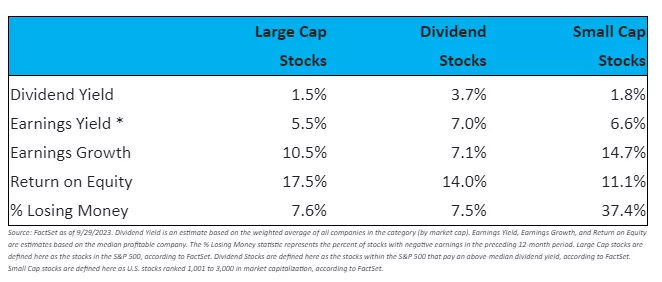

Regardless of your allocation to growth-oriented or income-oriented investments, I think it is appropriate to be somewhat cautious, minimize debt, and maintain adequate safety reserves. Total returns consist of both current yield and long-term growth. I am still seeing plenty of good quality companies trading at 5-7% earnings yields and offering expected earnings growth of around 7-10% a year. At those earnings yields and growth rates, I am happy to invest for the long-term.

Source: FactSet as of 9/29/2023. Dividend Yield is an estimate based on the weighted average of all companies in the category (by market cap). Earnings Yield, Earnings Growth, and Return on Equity are estimates based on the median profitable company. The % Losing Money statistic represents the percent of stocks with negative earnings in the preceding 12-month period. Large Cap stocks are defined here as the stocks in the S&P 500, according to FactSet. Dividend Stocks are defined here as the stocks within the S&P 500 that pay an above-median dividend yield, according to FactSet. Small Cap stocks are defined here as U.S. stocks ranked 1,001 to 3,000 in market capitalization, according to FactSet.

* “Earnings yield” is an investor’s share of earnings for every dollar invested (i.e., earnings per share / price per share). It’s the same as the more famous Price / Earnings (P/E) ratio, but expressed as a yield rather than as a multiple. I use it to compare stocks more clearly with bonds and other asset classes.“Equity Risk Premium” equals the Earnings Yield minus the 10-year Treasury Inflation Protected Securities yield.

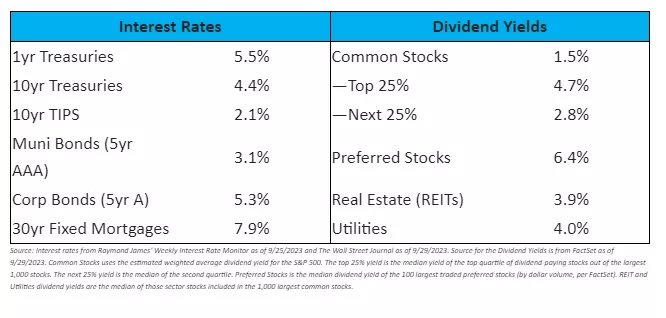

Income Investing

Source: Interest rates from Raymond James’ Weekly Interest Rate Monitor as of 9/25/2023 and The Wall Street Journal as of 9/29/2023. Source for the Dividend Yields is from FactSet as of 9/29/2023. Common Stocks uses the estimated weighted average dividend yield for the S&P 500. The top 25% yield is the median yield of the top quartile of dividend-paying stocks out of the largest 1,000 stocks. The next 25% yield is the median of the second quartile. Preferred Stocks is the median dividend yield of the 100 largest traded preferred stocks (by dollar volume, per FactSet). REIT and Utilities dividend yields are the median of those sector stocks included in the 1,000 largest common stocks.

Core inflation continues to be in the 2-4% range if you annualize recent months. This reduces the pressure on the Federal Reserve to keep raising short-term rates, though they might do one more if the economy stays strong. The market expects around 2.3% average inflation over the next 10 years* but I am a little more cautious and am estimating a continuation of the 2-4% range.

The bigger story is that long-term rates have also increased substantially, which has hurt the value of long-term bonds. I have heard a lot of talk about this being more sustained due to continuously high federal budget deficits requiring ongoing bond issuance, which drives up the interest rate required.

Although this is unpleasant for people who currently hold long-term bonds, it is making newer issues more balanced vs. alternatives. I wouldn't say that they're attractive vs. the yields that have historically been available, as bond yields are still below historical levels over the last 100 years, but the trade-off between stocks and bonds is starting to become more balanced.

As I think there is still a risk that long-term interest rates will rise further, I would continue to favor short-term bonds, treasury bills, CDs, and money market funds for now in order to reduce the risk of market value losses while still earning a reasonable yield.

* Implied inflation expectations are derived from taking the 10-Year Treasury rate and subtracting the 10-Year Treasury Inflation Protected Securities (TIPS) rate. For example, if the yield on 10-year treasuries is 2.8% and the yield on 10-year TIPS is 0.4%, they are roughly equivalent investments if inflation comes in at the difference (2.8% - 0.4% = 2.4%).

The Long View

S&P 500, Jan. 1928 to Aug. 2023

Source: MacroTrends.net

For the last 20, 30, and 100 years, stocks have averaged around an 8-10% return, driven by dividend yield, reinvestment of earnings, and earnings growth. Long-term bonds have yielded about 5% on average over the last century while inflation has been about 3%.

Throughout this period, there have been major upheavals, such as the Great Depression, World War II, The Korean War, The Vietnam War, the dropping of the gold standard, 1970s high inflation, 1987’s Black Monday Crash, the Dot.com bust, the 9/11 terror attacks, the Global Financial Crisis, and the Covid Crash, among others.

These events led to severe market downturns about once every decade, with a median price decline of 33% and a median time to recover back to the previous high of 3.5 years. If we were to include dividends, the recovery to previous highs is actually a little faster. *

Meanwhile, a 3% inflation rate results in a 59% decline in the value of a dollar over 30 years. This means that people who retire at 60 years old on a fixed income face a high risk of a lower quality of life as they get further into retirement. *

* Source: Morningstar Direct via cfainstitute.org, FactSet. Past performance is not necessarily indicative of future performance. Depreciation of the dollar: $1 / (1 + 3%)^30 = $0.41 real value 30 years later.

Market Outlook

Now I’ll put on my “Nostradamus Hat” and make some predictions, for whatever they’re worth:

- Inflation will average 2-4% over the next 10 years.

- Interest rates will fall in the 3-5% range for 10yr Treasuries over the next several years, in line with inflation and historical experience.

- The economy will grow 2-3% in real terms over the next several years, though we will probably slip into a recession this year.

- Stocks will average an 8-10% return over the next 10+ years. After subtracting inflation, this will translate into about a 5% real return. There is likely to be at least one big decline every decade or so.

From the standpoint of where you and your family will be in 30 years, none of this matters. What matters is finding good quality investments that are likely to grow over the decades. For this reason, I largely ignore my own general market forecast and invest whenever I find a business that I am confident in and that trades at an attractive valuation.

More By This Author:

Advanced Tax Deferral Options In Retirement Plans

Equities: The Bull Returns

Can We Trust the Machines?

General: If you would like to learn more about how I can help you organize your finances and get on the path to a comfortable, secure, and stress-free retirement, please visit my calendar online ...

more