Could Tesla Trigger The Next Market Meltdown?

“When the $#@* hits the fan, you sell what you can!”

I’m not sure who coined that phrase. But it’s been on my mind as I watch this crazy market action play out.

As you’ve probably seen, global stock markets have been unhinged lately — largely due to concerns over global investment bank Credit Suisse (CS).

Investors are worried that Credit Suisse could fail. The situation resembles the “Lehman Brothers” crisis that set off the Great Financial Crisis.

And while it appears the worst may now be over for CS, there’s another major risk factor I’ve been watching this week.

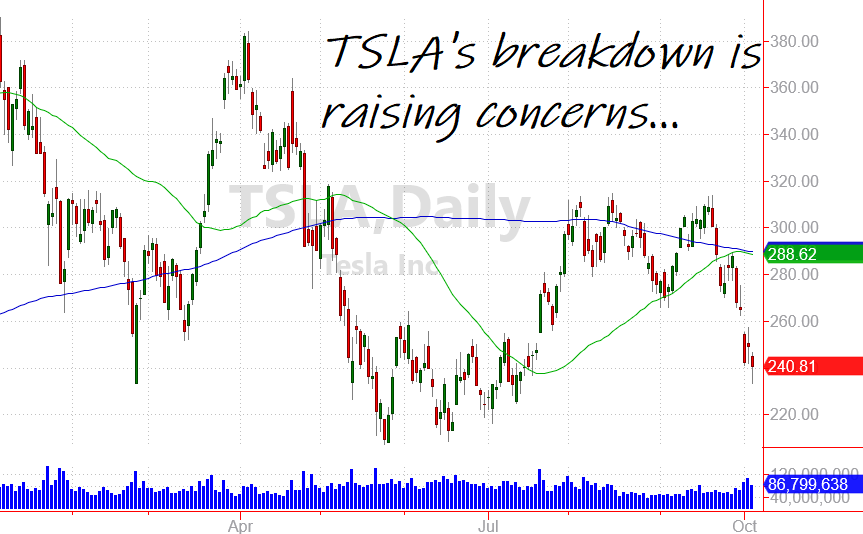

The breakdown of Tesla Inc. (TSLA).

Shares are down more than 16% over the past week. And this could be just the start of a much larger move.

More importantly, TSLA’s breakdown could cause a ripple effect in other areas of the stock market. Here’s why…

Tesla’s Growth Story is Growing Up

As I write this note, I’m already worried that many of my readers will be offended. That’s because TSLA is one of the most popular stocks for individual investors to own…

Which is exactly the problem.

So while I welcome your comments and emails about why you may own shares of TSLA, please hear me out. Because if I’m right, this selloff for TSLA could cause a much bigger problem.

Individual investors who own TSLA tend to be some of the more aggressive traders in the market. And for years, these investors have been conditioned to “buy the dip” for this stock. (They’ve been rewarded for doing so up until now.)

Tesla has been a great growth story for the past few years. But the company is now “grown up” with a $750 billion market cap and a more predictable growth pattern.

This means fundamental metrics are now more influential on the stock price.

Add in the challenge of higher interest rates, and rising competition, and it’s not surprising to see shares of TSLA moving lower.

But lately, that move has been picking up momentum. Just take a look at the recent action in TSLA (and remember the last three days have been positive for the overall market)

As TSLA loses value, risks of contagion are rising.

A Time Bomb for Retail Traders

The lower Tesla trades, the more value shareholders are losing. And while that’s clearly a “captain obvious” statement, remember that many TSLA shareholders are quite aggressive (and leveraged).

Retail investors who hold leveraged positions in Tesla could soon face a margin call.

This happens when investors borrow money to buy shares — and then the shares move lower. (Leveraged institutional investors could also be at risk.)

At a certain level, the lending brokerage firm will automatically start liquidating positions to raise cash. This way, the lender can be assured there will be enough cash left to repay the loan.

And if a large number of Tesla shareholders receive margin calls, the selling could affect other stocks as well.

Remember the Wall Street statement we started with?

Sellers will liquidate what they can sell… And if these investors decide that they don’t want to part with their TSLA shares, they may decide to sell other speculative stocks they hold in the same margin account.

So TSLA’s 16% drop over the past week could actually trigger another wave of selling for speculative growth stocks that aren’t directly tied to the electric vehicle company.

TSLA’s slide has erased nearly $150 billion in market value over the past week. At a time when other speculative stocks moved higher.

Please beware the risk of selling in these higher stocks to meet margin calls if TSLA continues to slide.

A Disclaimer

To be perfectly clear, I own bearish put contracts on TSLA in my Speculative Trading Program.

This program makes aggressive bets on stocks I expect to trade higher. And I also use it to take bearish positions on stocks I expect to fall.

TSLA currently trades for about 39 times next year’s expected profits. And this at a time when expensive growth stocks are being punished by higher interest rates and a slowing economy.

My guess is that TSLA will soon test the lows near $207. And if that level doesn’t hold, there’s plenty of room for TSLA to continue much lower.

That’s why I’m holding put contracts in my Speculative Trading Program — which is a proxy for how I’m trading my own family’s investment account.

More By This Author:

The Bear Market Does Not Make You An Idiot

What To Expect In The Fourth Quarter

Nike’s 44% Bomb Is Good News For These Two Stocks