Communication Services Regaining Its Footing

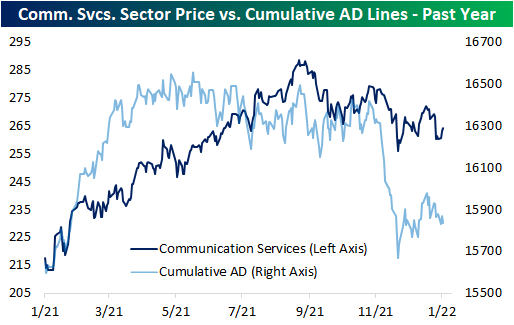

In the past year, one interesting internal disconnect for the S&P 500’s Communication Services sector has been between price and breadth. By the time price peaked in the late summer, breadth, as measured by the cumulative advance-decline (A/D) line, had been trending lower for several months. In other words, in the middle of last year, an increasingly smaller number of stocks were pulling the sector higher. This past fall, bad breadth hit a climax as the cumulative (A/D) line started to collapse just after the sector’s price set a lower high. Since the recent low for both price and breadth in the first days of December, the two lines have been moving more in tandem with each other.

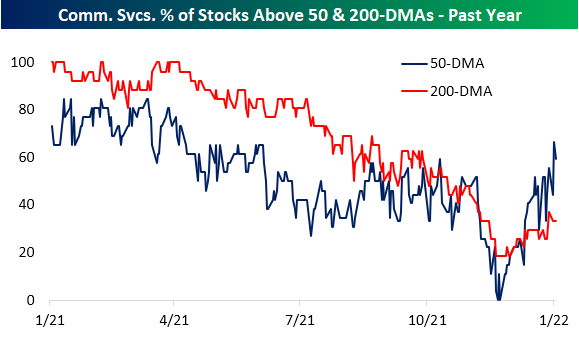

While the cumulative A/D line and price still have plenty of room for further improvement, there has been a significant pickup in the percentage of the sector’s stocks that are trading above their 50 and 200-DMAs. While the reading pulled back slightly to 59.26% yesterday, two-thirds of the sector finished last week above their 50-DMAs which was the strongest reading since April of last year. That reading comes just a little over a month after there was not even a single stock in the sector above its 50-day. The percentage of stocks above their longer-term 200-DMAs has been less impressive with only a third of stocks in the sector currently above that level, but that too has improved in recent weeks. The start of December saw readings in the high teens which marked the worst readings since the COVID Crash.