Coinbase Stock Suffers Downgrade After Disappointing Q2 Earnings

Image: PiggyBank/Unsplash

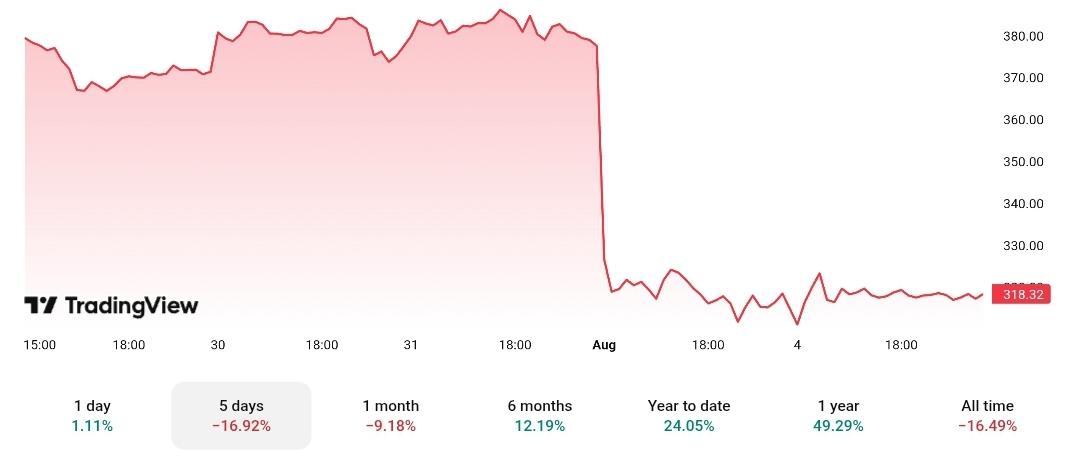

Coinbase (COIN) has suffered a significant downgrade from Compass Point analysts, who now rate the stock a “Sell,” down from “Neutral,” following the recent crypto sell-off. The downgrade follows Coinbase’s 14% stock decline on Friday, Aug. 1, the sharpest intraday loss since April, after its Q2 earnings report on July 31 revealed disappointing trading volume.

The crypto exchange posted total revenue of $1.50 billion in Q2 2025, up slightly from $1.45 billion a year earlier, but still fell short of the $1.59 billion consensus estimate from FactSet. Transaction revenue came in at $764.3 million, down from $1.26 billion the prior quarter and slightly below $780.9 million a year earlier.

Meanwhile, trading volume fell to $237 billion from $393 billion in Q1, though it was slightly above the $226 billion posted in Q2 last year. Adjusted EBITDA dropped to $512 million in Q2, down from $596 million during the same period last year.

COIN is traded slightly higher on Monday at $316 following last week’s earnings-related 18% plunge.

(Click on image to enlarge)

Source: TradingView

Crypto sell-off hits amid revenue miss, rising stablecoin competition

Coinbase’s latest earnings report showed revenue falling short of expectations, largely due to a decline in trading activity driven by the recent crypto market downturn.

The crypto market has seen a steep drop in recent days, triggered by mounting U.S. tariffs, weak employment data, and the Federal Reserve’s decision to pause rate cuts, pushing Bitcoin below $114K and Ethereum near $3,500.

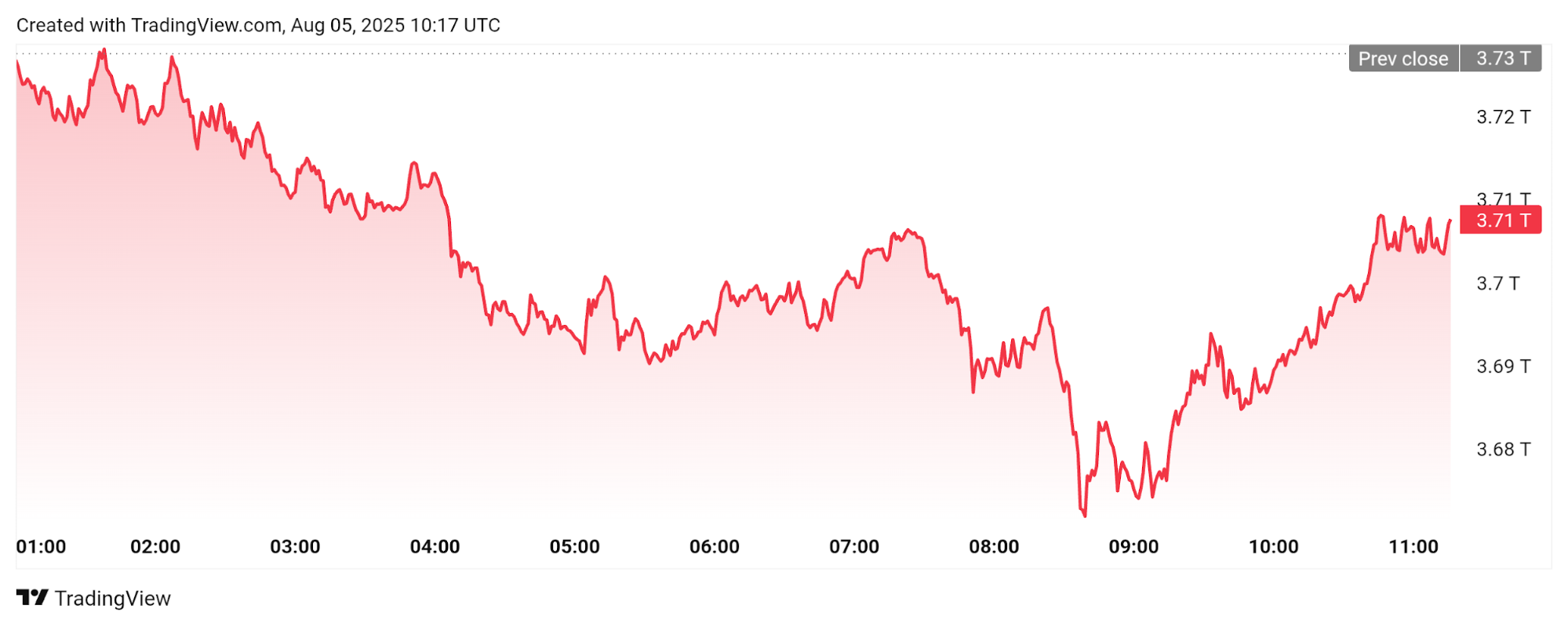

According to TradingView data, the total cryptocurrency market cap has declined by approximately 1.7% over the last 24 hours, falling to $3.71 trillion and erasing about $64 billion in value. This shows a significant crypto sell-off over the past week, reflecting hugely on COIN.

(Click on image to enlarge)

Source: TradingView data

Compass Point analyst Ed Engel downgraded Coinbase from Neutral to Sell on Sunday night, lowering the price target from $330 to $248 per share, a 21% decline from Friday’s closing price.

“While we remain constructive on the current crypto cycle, we expect a choppy 3Q alongside weak August/September seasonality and waning retail interest in crypto treasury stocks,” analyst Ed Engel wrote in a note issued Sunday night.

“As such, we see limited support for COIN’s valuation if crypto markets sell off further,” he added.

Compass Point indicated Coinbase’s Subscription and Services (S&S) revenue, which came in at $655.8 million, below Wall Street’s estimate of $715.2 million.

Engel pointed out that recurring fees hold a premium in the current valuation model. “Investors place a higher premium on these recurring fees; thus, disappointing S&S fees have a more pronounced impact on COIN’s valuation,” Engel noted.

Engel also warned that rising competition in the stablecoin sector could negatively affect Coinbase and its partner Circle (CRCL). Circle, which issues USDC, shares part of its interest income revenue with Coinbase. As competition for stablecoin dominance intensifies, the margins on such partnerships are expected to shrink.

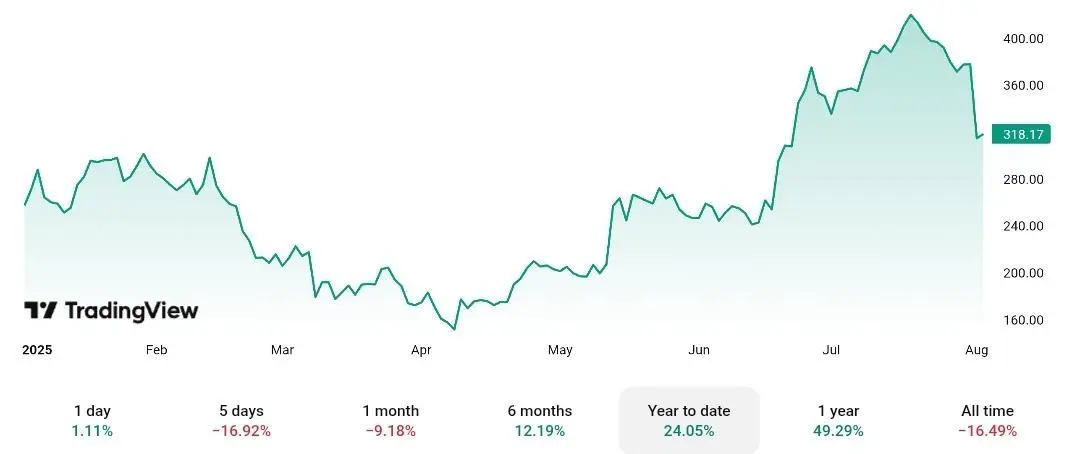

Mixed analyst outlook as shares rise 24% year-to-date

Several Wall Street analysts appear to align with Ed Engel’s bearish reassessment of Coinbase, citing concerns over weak earnings and a challenging transaction environment.

JPMorgan’s Kenneth Worthington took a sharper stance, slashing his target to $215 from $276 and warning that worsening transaction trends could dent future earnings.

CFRA’s Michael Elliott echoed those concerns, lowering his target to $325 and stressing Coinbase’s heavy reliance on volatile crypto trading, which makes up 61% of its revenue. Barclays’ Benjamin Budish also reduced his target, highlighting missed revenue and rising expenses, though he acknowledged the company’s confidence in future growth.

Not all analysts share this cautious view. Bernstein remains firmly bullish, reiterating an Outperform rating and a $510 price target. In a recent note, analysts there likened Coinbase to the “Amazon of crypto services”. They urged investors to focus on the firm’s long-term positioning as a fully integrated “everything exchange.”

Additionally, Bloomberg data shows 19 Buy recommendations, 16 Hold, and only 5 Sell ratings for Coinbase.

Significantly, Coinbase shares remain up approximately 24% year-to-date.

(Click on image to enlarge)

Source: TradingView data

CEO Brian Armstrong, during the Q2 2025 earnings call, emphasized Coinbase’s future plans, including support for tokenized equities and derivatives, pointing to a shift toward more diverse financial offerings on the platform.

“We believe tokenized equities are more efficient with global coverage, 24/7 trading, instant settlement, and the ability to offer perpetual futures,” Armstrong said.

More By This Author:

Apple Bounces 10% After Committing $600b To U.S. Manufacturing

These Two Dividend ETFs Are the Ultimate Hack For Consistent Yield

Can Disney Score Another Big Earnings Beat?

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more