Apple Bounces 10% After Committing $600b To U.S. Manufacturing

Image Source: Unsplash

Tech giant Apple (Nasdaq: AAPL) is on the move after the company announced another $100b to manufacturing in the USA, which should help it escape tariffs for the time being.

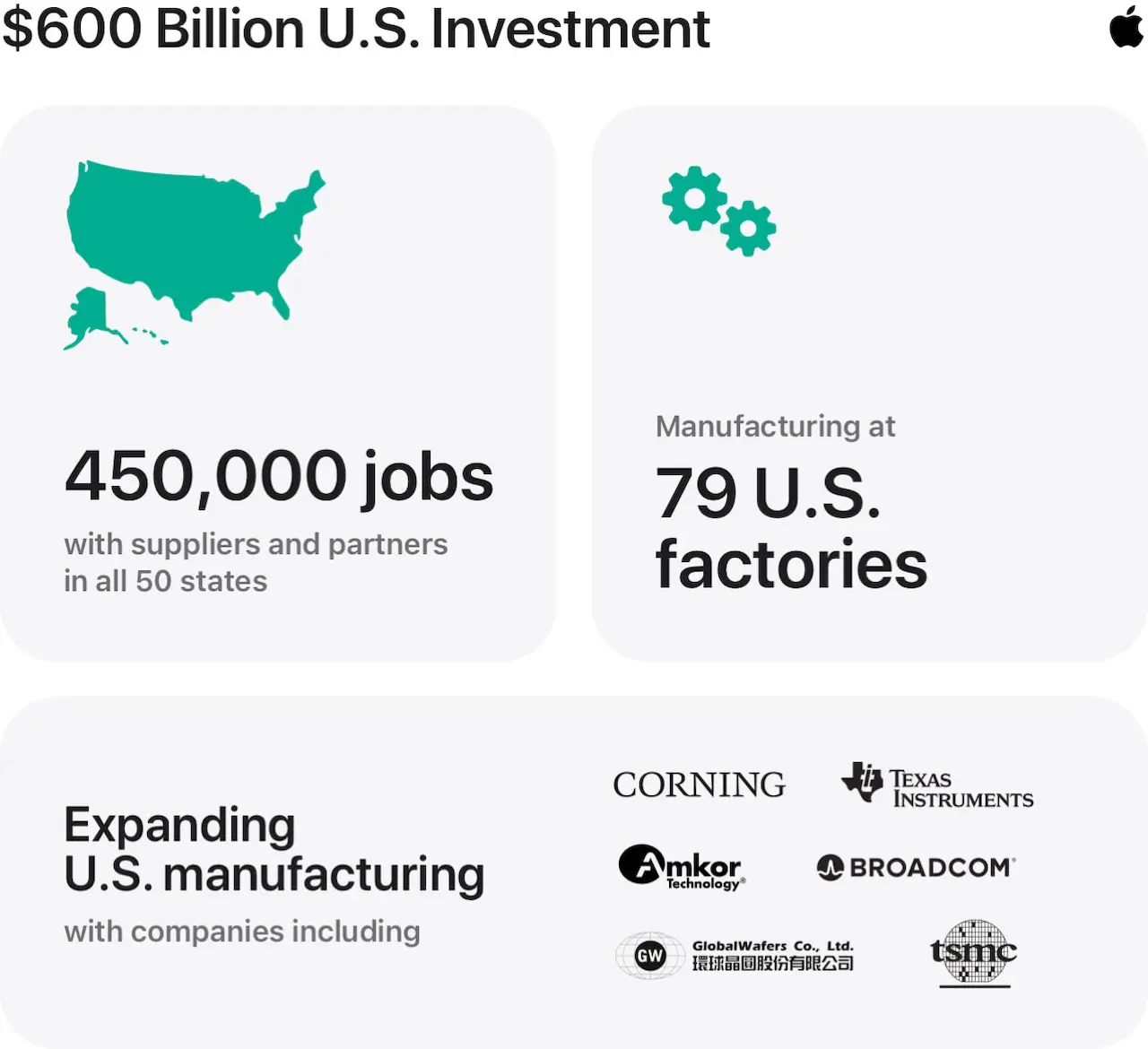

Apple has now committed to spending a total of $600b on US manufacturing over the next four years and will aim to employ another 20,000 Americans as part of its American Manufacturing Plan (AMP).

The deal was announced via a press conference featuring Apple CEO and President Donald Trump on Aug. 6. Investors seem to like the news as AAPL has climbed roughly 10% since the announcement.

It’s been a rough year for Apple as the company has to deal with stumbles in the AI arms race and the ever-present threat of tariffs (most of its manufacturing is currently in Asia).

iPhones will still be assembled offshore

Committing $600b to manufacturing in the USA is a significant investment, but it’s important to note that Apple will continue to assemble its devices – including the iPhone, which accounts for 50% of Apple’s revenue – in offshore locations such as China and Vietnam.

President Trump has repeatedly asked for the iPhone to be manufactured in the US but experts estimate a US-made iPhone would cost over $2,000.

While the device will not be assembled in the USA, every iPhone going forward will have at least some US-made components, according to Apple CEO Tim Cook.

In the conference, Cook explained: “For the first time ever, every single new iPhone and every single new Apple Watch sold anywhere in the world will contain cover glass made in Kentucky.”

An infographic that Apple provided as part of its recent conference on its American Manufacturing Plan.

Will Apple finally catch up in the AI race?

It’s been a trying year for Apple investors. APPL was down nearly 10% as of last week. The company was hit hard with tariff threats from President Trump and the stock bottomed out around $172 a share in early April.

A bigger issue, according to critics, is that Apple appears to be falling further behind in the AI arms race. Apple was already behind when it announced its own AI product, branded Apple Intelligence, in mid-2024.

Apple Intelligence stumbled out of the starting gates in fall of 2024 (some features have yet to be released) and many tech pundits believe it’s not in the same league as prominent LLMs like ChatGPT or Gemini.

It was apparently bad enough that Tim Cook held an all-hands on tech meeting earlier this summer where he admitted that Apple “must” figure out AI.

It’s not all bad, however, as the site is rumored to be looking to make a massive acquisition in the space. There is a rumor, reported by Bloomberg and other publications, that Apple is looking into acquiring software company Perplexity, which is a massive force in the AI space.

The rumored acquisition and the recent deal with President Trump seem to have buoyed the perception of the company. Stock in Apple is currently in the midst of its best rally of the year with a gain of over 10% on the week at the time of publication.

More By This Author:

These Two Dividend ETFs Are the Ultimate Hack For Consistent Yield

Can Disney Score Another Big Earnings Beat?

Will Gambling Stocks Feel The Impact Of Vegas’ Slow Summer?

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more