CLF: A Misunderstood Steel Stock That Offers Strong Profit Potential

Image Source: Unsplash

Cleveland-Cliffs Inc. (CLF) has a strong focus on maximizing return on invested capital and unlocking value for shareholders. We think CLF has been proactive with its Hot Briquetted Iron (HBI) facility, a project that generates strong returns on investment and improves CLF’s ESG metrics. CLF is a misunderstood story and we see CLF as the most compelling name in the industry.

Cleveland-Cliffs Inc.

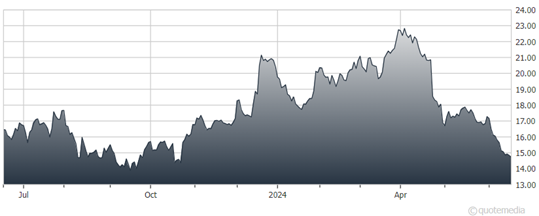

Our 12-month target of $24 values CLF shares at an EV/EBITDA of 6.5x our 2024 EBITDA estimate, a premium to CLF’s three-year average forward EV/EBITDA of 4.7x, but a discount to peers. CLF is insulated from the potential impact of higher costs for metallics, given its internally sourced iron ore pellets and HBI.

We think CLF is in a great position to restart a dividend (and continue to buy back shares), which we think would be a positive catalyst. Risks to our outlook include weaker economic conditions in North America (especially automotive OEM build rates or nonresidential construction), lower steel prices, and higher input costs.

Recommended Action: Buy CLF.

More By This Author:

Retail Sales, GDP, Production Show An Economy On The Right Track

RSP And SPY: Get Ready For A Mean Reversion Trade For The Ages

Energy: As Economic Backdrop Evolves, Consider This Promising Sector

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more