RSP And SPY: Get Ready For A Mean Reversion Trade For The Ages

Image Source: Pexels

The appetite for stocks has been off the charts -- especially mega-cap tech names. This has caused market breadth readings to plummet. But don’t fret, because now’s the time to get ready for a monster reversion trade for the ages. That will help the Invesco S&P 500 Equal Weight ETF (RSP), notes Lucas Downey, co-founder of Mapsignals.com.

Below we can see how the top stocks in the S&P 500, as tracked by the Invesco S&P 500 Top 50 ETF (XLG), have gained 22.5% in 2024. That easily beats the S&P 500 ETF Trust (SPY)'s jump of 15.7% and dramatically crushes the RSP's year-to-date performance of +5.1%.

Before you bail out on your underperforming stocks, have a look at the following pieces of evidence suggesting you should sit tight. And if you’re bold, start buying the beaten-down dogs.

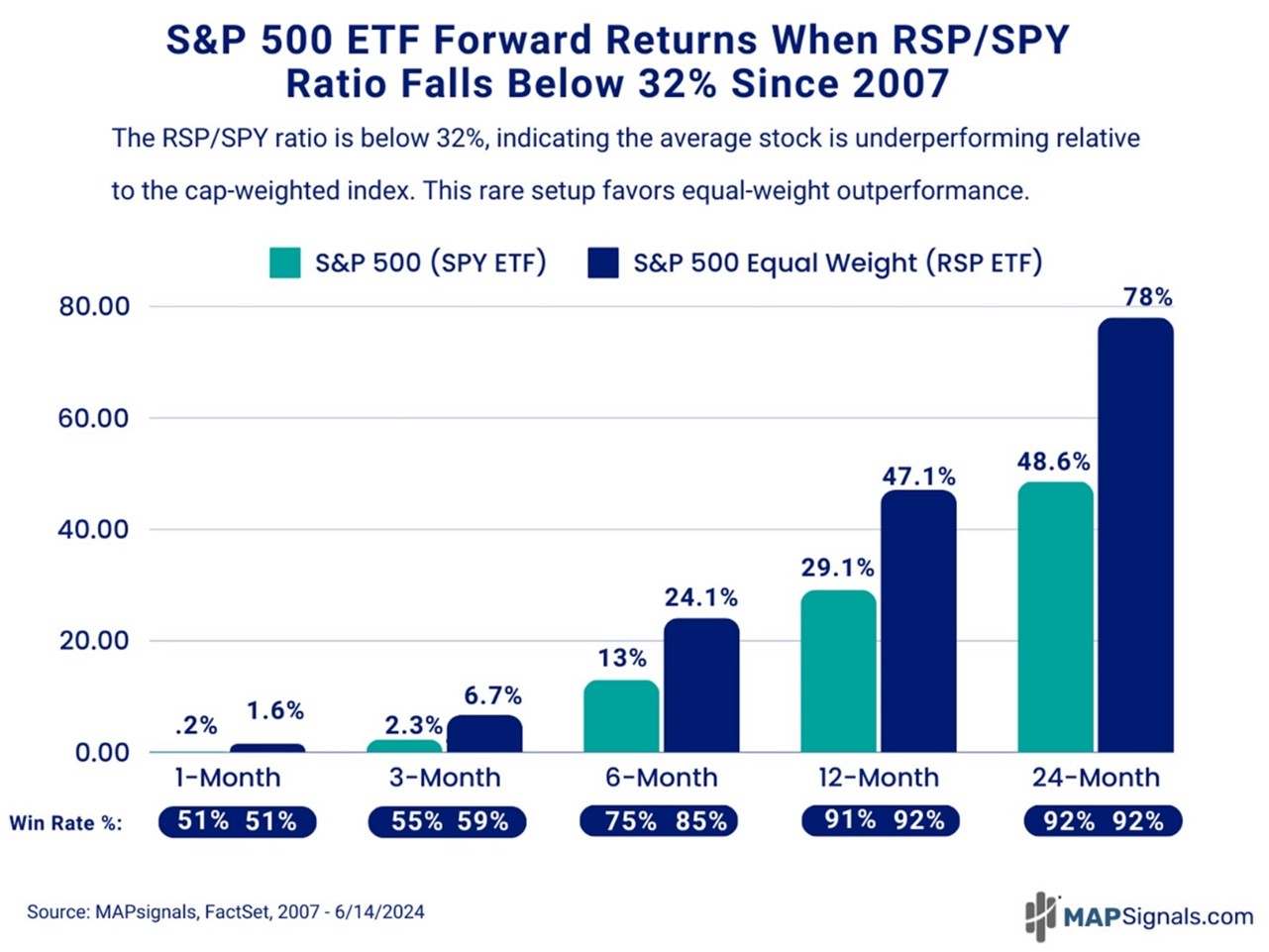

I went back and singled out all days when the RSP/SPY ratio fell below 32%. Basically, I needed to understand what we should expect for stocks going forward. That 32% threshold amounts to 201 trading dates that triggered during the Global Financial Crisis lows, the COVID-19 crash lows, and the relative lows seen recently.

Here’s what happened next: The SPY did just fine. But the RSP was spectacular. When the RSP/SPY ratio fell to 32% or lower since 2007:

- Six months later, the S&P 500 jumped 13% while the S&P 500 Equal Weight basket soared 24.1%

- 12 months later, we saw gains of 29.1% for SPY and 47.1% gains for RSP

- 24 months after, we saw SPY jump 48.6% and RSP catapult 78%

Here’s the bottom line: The stock market rally can keep going. Better yet, all stocks should begin to participate in the coming months -- and years. If history is a guide, we will be looking at a monster reversion trade where the equal weighted S&P will play catch up to the market bellwethers.

About the Author

Lucas Downey is the co-founder of MAPsignals research, which focuses on finding outlier stocks by following the big money. He is the instructor for options with Investopedia Academy and also posts videos often on his YouTube Channel, MapSignals.

More By This Author:

Energy: As Economic Backdrop Evolves, Consider This Promising SectorInflation: A Deeper Dive Into The CPI – And What It Means For Markets

Tech: Yes, The Best Players Are Scoring A Lot Of Points - And That's Normal

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more