Cenovus Vs. Enbridge: Is It Time To Step Away From Both Stocks?

Image: Bigstock

Key Takeaways

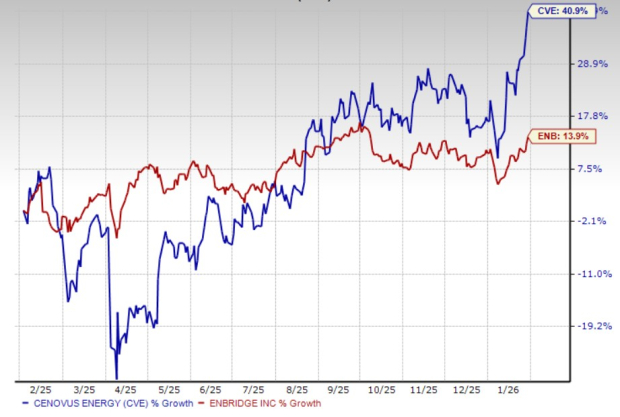

- Cenovus Energy's recent 40.9% stock rally beats Enbridge's 13.9%, but weak oil prices threaten Cenovus Energy's earnings outlook.

- Enbridge's fee-based model offers income stability, yet high debt levels raise financial risk concerns.

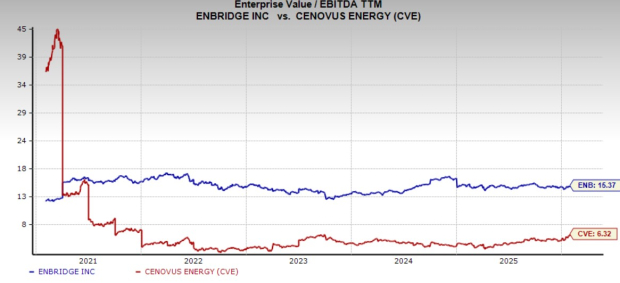

- Enbridge has been trading at 15.37X EV/EBITDA vs. Cenovus Energy's 6.32X, suggesting a valuation premium for stability.

In the energy space, Cenovus Energy Inc. (CVE - Free Report) and Enbridge Inc. (ENB - Free Report) are two major Canadian players with very contrasting business models. Over the past year, Cenovus Energy has rallied 40.9%, significantly outperforming Enbridge’s 13.9% gain. But does stronger price performance automatically make Cenovus the better stock? Let us examine the fundamentals of both companies to find out.

Image Source: Zacks Investment Research

Price performance alone does not fully capture a stock’s attractiveness, as it merely reflects investor sentiment across business cycles. To arrive at a sound investment conclusion, it is essential to evaluate fundamentals and the broader operating environment.

While upstream and integrated producers like Cenovus face greater exposure to commodity price swings and energy transition risks, pipeline companies such as Enbridge typically offer lower-risk profiles and steadier income streams, often appealing to stability-seeking investors.

Soft Oil Prices to Hurt Cenovus’ Upstream Business

According to OilPrice.com, West Texas Intermediate (“WTI”) crude has been hovering around $64 per barrel, well below the year-ago level. Adding to the pressure, the U.S. Energy Information Administration projects the average WTI price at $52.21 per barrel for 2026, suggesting a decline from the $65.40 registered in 2025.

Cenovus produces heavy and bitumen-blend crude from the Canadian oil sands, with realized prices closely tied to Western Canadian Select (“WCS”). WCS typically trades at a discount to WTI due to heavier quality and higher transportation costs. When WTI prices fall, WCS prices generally decline as well, and the impacts on Cenovus can be amplified if WCS differentials widen.

Lower crude prices pressure Cenovus’ upstream netbacks and cash flows, even if production volumes remain stable. As a result, sustained softness in oil prices poses a meaningful headwind to Cenovus’ earnings outlook.

Enbridge’s Business Model is Less Vulnerable to Commodity Prices

Unlike upstream-focused energy producers, Enbridge’s business is not highly sensitive to commodity price fluctuations. Enbridge is one of North America’s largest midstream energy companies, operating a vast infrastructure network. Enbridge transports 20% of the natural gas consumed in the United States.

The company generates stable, fee-based revenues from long-term contracts, limiting both commodity price and volume risks. Enbridge is also positioned to generate incremental cash flows from its CAD30-billion backlog of secured capital projects, spanning liquid pipelines, gas transmission, gas distribution, storage, and renewables, with in-service dates extending through 2029.

Approximately 98% of Enbridge’s EBITDA is supported by regulated or take-or-pay contracts, and more than 80% of its profits come from businesses with built-in inflation protection, allowing the company to raise tariffs or fees as costs rise. This structure helps protect earnings and dividends even in a high-inflation environment.

Despite the resilience of Enbridge’s business model, challenges remain. The company’s debt-to-capitalization ratio of 60.4% is higher than the industry average of 57.7%, and its debt-to-EBITDA ratio of 4.8X sits near the upper end of management’s target range. Elevated leverage increases sensitivity to prolonged high interest rates and may limit financial flexibility if growth opportunities slow.

Earnings Estimate Revisions

Earnings momentum also favors caution. Over the past week, Zacks Consensus Estimates for Cenovus’ 2025 and 2026 earnings have declined, reflecting growing concern over oil price weakness.

Image Source: Zacks Investment Research

Meanwhile, Enbridge’s estimates have remained unchanged, modestly favoring the pipeline operator from a near-term stability perspective.

Image Source: Zacks Investment Research

Valuation Comparison

From a valuation standpoint, investors appear willing to pay a premium for Enbridge’s stable midstream business model. Enbridge has been trading at a trailing 12-month EV/EBITDA of 15.37X, well above Cenovus’ 6.32X, indicating that much of Enbridge’s defensive appeal may already be priced in.

Image Source: Zacks Investment Research

Final Verdict: Avoid or Sell Both Stocks for Now

While Cenovus offers higher upside potential in a strong oil price environment, the recent soft crude outlook makes its upstream-heavy business model vulnerable. Enbridge, despite its stable cash flows, faces leverage-related risks and trades at a relatively elevated valuation.

As a result, risk-averse investors may want to avoid initiating positions in either stock at this time. Investors already holding Enbridge, with a Zacks Rank #4 (Sell) rating, or Cenovus Energy, carrying a Zacks Rank #5 (Strong Sell) rating, may consider trimming or exiting positions until fundamentals and macro conditions improve.

More By This Author:

2026 Volatility Playbook: NVIDIA, Barrick, Newmont & More In AI, Gold & Power

Buy Meta Stock After Strong Q4 Results & CapEx Hike?

These AI Cloud Stocks Are Starting To Soar Again Thanks To Nvidia: ANET, CRWV

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more