Buy Meta Stock After Strong Q4 Results & CapEx Hike?

Image Source: Pixabay

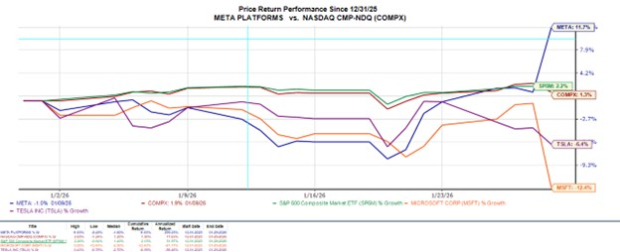

With quarterly results from the Mag 7 starting to roll in after market hours on Wednesday, Meta Platforms (META - Free Report) took the spotlight.

Overshadowing reports from Microsoft (MSFT - Free Report) and Tesla (TSLA - Free Report), Meta stood out with stronger revenue growth and a bigger earnings beat while offering better-than-expected guidance as well.

Although the social media leader announced a significant increase in its capital expenditures (CapEx), investors reacted positively as AI boosted Meta’s Q4 performance by improving ad targeting, driving higher engagement, and strengthening advertiser demand.

Robust growth in its family of social media apps (Facebook, Instagram, WhatsApp), higher ad impressions, and improved ad pricing all contributed to a standout quarter with Meta stock spiking as much as +10% in Thursday’s trading session.

Image Source: Zacks Investment Research

Meta’s Strong Q4 Results & CapEx Hike

Posting Q4 sales of $59.89 billion, Meta’s top line stretched nealry 24% from $48.38 billion in the prior year quarter and impressively topped estimates of $58.59 billion by 2%. On the bottom line, Meta’s Q4 EPS of $8.88 was up 11% from $8.02 per share a year ago and beat expectations of $8.21 by 8%.

Image Source: Zacks Investment Research

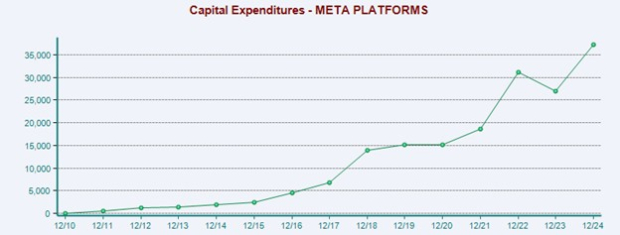

With AI being a primary contributor to Meta’s growth, the tech giant plans to boost its CapEx significantly in order to scale its AI infrastructure — including data centers, compute, and its “Meta Superintelligence Labs” — to support next-generation AI models and long-term platform growth.

Meta expects its CapEx to be between $115-$135 billion in 2026, up from the $72.22 billion the company spent last year and a more than 200% increase from $37.26 billion in 2024.

Image Source: Zacks Investment Research

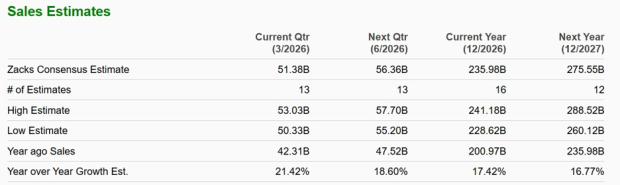

Meta’s Positive Revenue Guidance

Optimistically, Meta provided positive revenue guidance for Q1 2026, expecting quarterly sales in the range of $53.5-$56.5 billion and nicely above Wall Street’s expectations of $51.38 billion or 21% growth (Current Qtr below).

Image Source: Zacks Investment Research

Tracking Meta’s ROIC

Making Meta’s elevated CapEx less daunting is its intriguing return on invested capital (ROIC) of 27%, showing a keen ability to turn invested capital into profits.

As one of the clearest indicators of long-term shareholder value, the often admirable ROIC percentage is 20% or better, with the benchmark S&P 500’s average currently at 15%.

Image Source: Zacks Investment Research

The Cheapest P/E Valuation Among the Mag 7

What may be most intriguing to investors is that Meta is making the argument for being one of the most attractively priced high-growth tech stocks when considering P/E valuation.

Although Meta's stock has a lofty price tag of over $700, its 22X forward earnings multiple offers a discount to the benchmark and is the cheapest P/E valuation among the Mag 7, with the rest of these big tech peers at 30X or more, and Tesla having the high of 196X.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Following a strong Q4 report, Meta stock currently lands a Zacks Rank #3 (Hold). However, a buy rating could be on the way considering that the tech giant’s favorable guidance, valuation, and ROIC could offset any CapEx concerns.

Keeping this in mind, EPS revisions for FY26 and FY27 could begin to rise in the coming weeks. This would certainly serve as a further catalyst for more upside in Meta stock, especially with double-digit top and bottom line growth already being anticipated for the foreseeable future.

More By This Author:

These AI Cloud Stocks Are Starting To Soar Again Thanks To Nvidia: ANET, CRWVETFs To Watch As Gold Breaches The $5,200 Mark

2 Portfolio Worthy Value Stocks To Consider After Q4 Results: GM, IVZ

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more