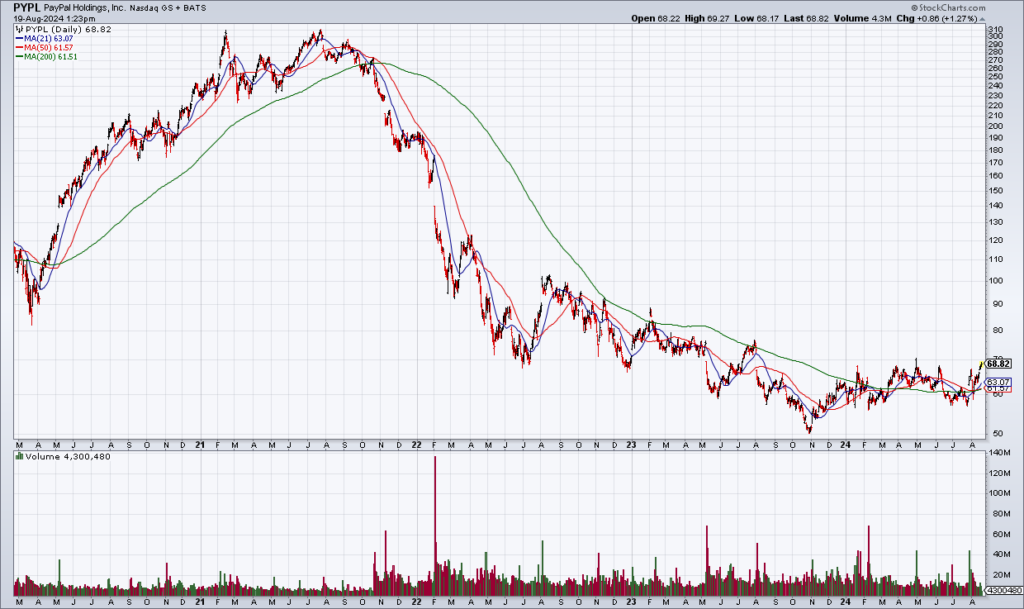

Can ZM Pull A PYPL?

(Click on image to enlarge)

As you can see above, the charts of PayPal (PYPL) and Zoom (ZM) look quite similar. Both stocks surged during the pandemic as their services became necessities when everyone was locked down – but have been destroyed and left for dead since. Both are deep-value stocks by any metric at this point. PYPL got a boost from its most recent earnings report and is +16% over the last month. Can ZM pull a PYPL?

Certainly, the stock is extremely cheap. ZM has about $23/share in cash and short-term securities on its balance sheet and no debt. So you get the business for $37. They are guiding current year Non-GAAP EPS to $4.99-$5.02. So the stock is trading at 7x current earnings after backing out the net cash and investments on its balance sheet. You won’t find a cheaper S&P stock. ZM management appears to understand how cheap their stock is and bought back 2.4 million shares for $150 million in 1Q24.

ZM had $570 million Free Cash Flow (FCF) in 1Q24 so they have plenty of money to do something like initiate a dividend or increase its share buyback. Any catalyst to get investors interested could get shares moving higher IMO. ZM reports 2Q24 earnings on Wednesday afternoon.

(Click on image to enlarge)

More By This Author:

I Won't Sell WMT Even Though It’s Overvalued And Overextended

July CPI Doesn’t Move The Needle, EAT Bites The Dust

HD Reports Weakening Sales But The Market Focuses On A September Rate Cut