Can Super Bowl Sunday Keep This Stock Hot?

Image: Bigstock

The Super Bowl is one of the most lucrative advertising events, with companies spending millions on commercial slots that last under just a minute. The average cost for a 30-second Super Bowl ad in 2024 was roughly $7 million, with brands using this opportunity to generate brand awareness, boost overall consumer engagement, and show off new products.

And for 2025, that price tag has gone up to roughly $8 million. Several companies, including DraftKings (DKNG - Free Report), could see a slight sales catalyst due to exposure to the event.

Let’s take a closer look.

DraftKings' Player Growth Remains Rock-Solid

The Super Bowl is the single biggest sports betting event in the U.S., with billions wagered on the event annually. There’s a clear path here for DraftKings’ top line to benefit from a small short-term bump if volumes are strong. Perhaps, it could also establish itself as the go-to platform for future wagers for the event, potentially providing longer-term growth.

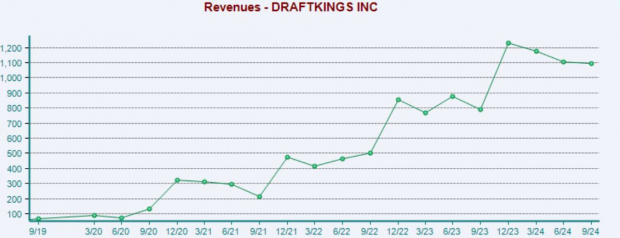

The company’s sales growth has remained notably strong over recent periods, primarily fueled by continued user growth. Impressively, sales have grown year-over-year by double-digit percentage rates in 15 consecutive periods.

Below is a chart illustrating DraftKings' revenue on a quarterly basis.

Image Source: Zacks Investment Research

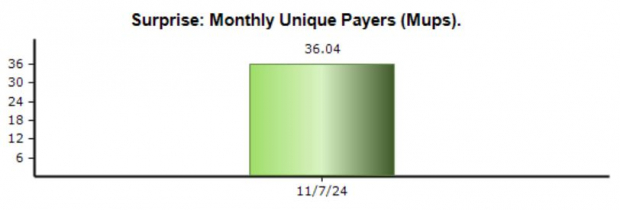

Concerning the above-mentioned user growth success, Monthly Unique Players (MUPs) reached 3.6 million throughout its latest period, jumping a sizable 55% year-over-year. Excluding its recent acquisition of Jackpot, MUPs were still up an impressive 27% year-over-year.

It’s critical to note here that further user growth is expected due to increasing adoption among states. Notably, DraftKings is live with mobile sports betting in 25 states (and D.C.), which collectively represent approximately 49% of the U.S. population.

Also notable, DraftKings exceeded our MUPs consensus estimate in its latest release by a fair margin.

Image Source: Zacks Investment Research

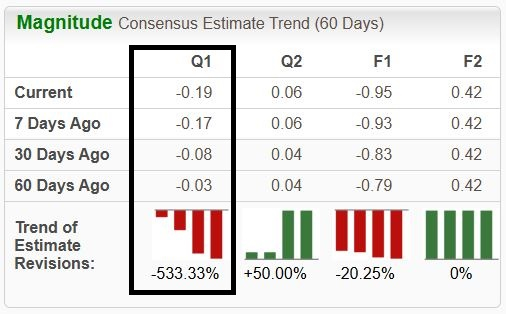

It’s worth noting that the earnings estimate revisions picture for DraftKings here doesn’t reflect much positivity, with the stock holding a Zacks Rank #3 (Hold) rating. As shown, analysts have slashed their EPS expectations for the upcoming quarterly release, which is expected on Feb. 13.

Image Source: Zacks Investment Research

Overall, investors shouldn’t see the Super Bowl as a catalyst for a short-term move upward for shares, though a strong showing concerning betting volumes would likely spark some short-term positivity. Instead, investors should view the event in the context of DraftKings spending capital to continue its user growth, establishing long-term top line expansion.

Bottom Line

It’s an undeniable fact that Americans love the Super Bowl, with the event being shown on TVs around the entire country. And with the rise of mobile sports betting platform providers like DraftKings (DKNG - Free Report), wagering has truly never been easier.

As mentioned, the Super Bowl is the most wagered U.S. event annually, and DraftKings looks to capitalize through higher betting volumes, continued customer growth, and increasing legality across jurisdictions.

More By This Author:

3 Stocks To Buy Following Blowout Quarterly Results

2 AI Stocks Investors Must Watch This Week

Amazon & Alphabet Earnings: Key Metrics To Watch

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more