2 AI Stocks Investors Must Watch This Week

Image Source: Pexels

We continue to wade through the 2024 Q4 cycle, which has been positive so far. Next week’s reporting docket is notably stacked, with major AI players Vertiv (VRT - Free Report) and Super Micro Computer (SMCI - Free Report) expected to report.

How do expectations stack up heading into their releases? Let’s take a closer look.

Vertiv

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services.

Earnings and sales expectations for the period to be reported haven’t budged much, with VRT forecasted to see 50% EPS growth on 15% higher sales. The company’s growth trajectory has been underpinned by red-hot demand for its services amid the AI infrastructure buildout.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Super Micro Computer

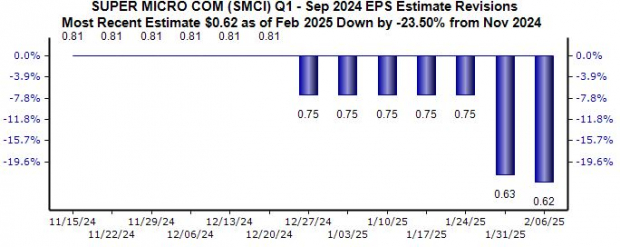

Super Micro Computer is a total IT solution Provider for AI, Cloud, Storage, and 5G/Edge services, fully explaining the buzz around the stock. EPS expectations for the upcoming release have nosedived over recent months, with the current $0.62 per share consensus estimate suggesting 10% growth.

Image Source: Zacks Investment Research

Revenue revisions have been taken lower as well, with forecasted sales of $5.8 billion down 5% over the same timeframe and suggesting 60% year-over-year growth. Like VRT, the company has seen significant top line expansion over recent periods.

Image Source: Zacks Investment Research

Bottom Line

We continue to wade through the 2024 Q4 earnings cycle, which continues to be positive. And next week, two big AI favorites – Super Micro Computer and Vertiv – are on the reporting docket.

Guidance will be key for both stocks’ reactions post-earnings.

More By This Author:

Amazon & Alphabet Earnings: Key Metrics To WatchApple & China Tariffs: A Closer Look

These Mag 7 Members Shattered Quarterly Records

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more