This ETF “continues to make lower lows”

Our recently published May Elliott Wave Financial Forecast has a special section titled “Bank Tremors Foreshadow Full Scale Quake” so look below to find out how to read the entire issue instantly, which includes Elliott Wave insights on major U.S. financial markets.

First, a reminder that the second, third, and fourth largest bank failures in U.S. history have all occurred in just the past few months.

They are First Republic, Silicon Valley Bank, and Signature Bank of New York. The failure of Washington Mutual in 2008 still ranks first.

And here’s an interesting factoid from the New York Post (May 1):

This year’s 3 bank failures held $532B in assets — more than all lenders that collapsed in the 2008 crisis

The current banking crisis may be far from over, as another headline suggests (USA Today, May 4):

US banking crisis: Close to 190 banks could collapse, according to study

As the article notes, that study found that 186 more banks could teeter on collapse if only half of their depositors withdrew their money.

The Financial Times in Britain also piped in on this topic and expressed concerns about way more than 186 banks (May 2):

Half of America’s banks are potentially insolvent — this is how a credit crunch begins

The bottom line with these banks is that they are suffering losses from bonds and debt securities. The downturn in commercial real estate has hit banks hard.

Curiously, back on March 21, U.S. Treasury Secretary Janet Yellen was giving assurances about the banking system (US News & World Report):

Yellen Tells Nation’s Bankers That the Crisis Is ‘Stabilizing’

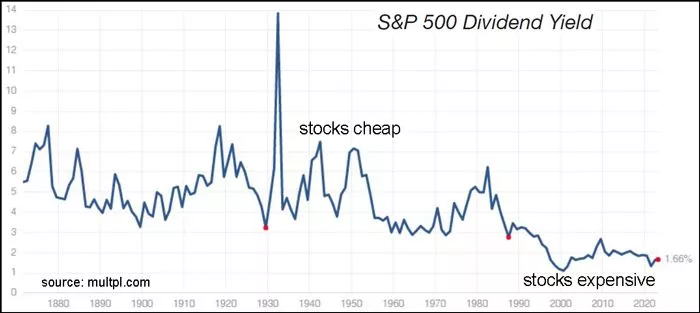

Our May Elliott Wave Financial Forecast begged to differ as it showed this chart and said:

The SPDR S&P Regional Banking ETF (KRE) continues to make lower lows since Secretary Yellen’s pronouncements. The ETF is down 48% since peaking on January 14, 2022, several days after the top in the Dow and S&P 500.

Since that chart and commentary were published, San Francisco-based PacWest Bancorp is another bank which has also cratered in price.

Getting back to what was mentioned about that special section in the May Elliott Wave Financial Forecast titled “Bank Tremors Foreshadow Full Scale Quake,” follow the link below to learn how you can get instant access.

Could Your Bank Be the Next to “Go Down for the Count”?

We’re not even in an official recession and the banking crisis is gaining steam.

Imagine the scenario if the entire economy slumps. Or worse, goes into a full-scale crisis.

More By This Author:

Optimism Pessimism In The Financial Markets

How To Buy Sell Or Hold?

U.S. Dollar King Of Currencies Rule Over The Markets

Get the insights that you need about U.S. banking and the economy. Plus, get Elliott wave analysis of U.S. stocks, bonds, gold, silver, the U.S., and more. Go

more

Get the insights that you need about U.S. banking and the economy. Plus, get Elliott wave analysis of U.S. stocks, bonds, gold, silver, the U.S., and more. Go Here to Learn More

Disclosure: Financial Markets Risk Warning

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

All information on this website is for educational purposes. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibility for your actions, trades, profit or loss, and agree to hold Invest2Success and any authorized distributors of this information harmless in any and all ways.

All rights reserved. The use of this website constitutes acceptance of our user agreement.

Financial Products Services Disclosure

Invest2Success is partnered with and advertises promotes other companies finanical products and services, as well as our own. As such, Invest2Success receives advertising promotion compensation from these other companies in doing so. Invest2Success believes the products services of our own and other compaines listed on our site and blog are very unique and can be beneficial to investors traders because they meet our quality guidelines for good investing trading methods which investors traders can use to help improve their financial education knowledge and investing trading results. We do not warrant and are not liable for any claims or testimonies made by these other compaines products and services. Review each product and service carefully before purchasing and using. The purchase, use, and results of any of the products services on our website and blog is sole responsibilty of the user.

less

How did you like this article? Let us know so we can better customize your reading experience.