Cal-Maine Foods: Why We Are Avoiding The Egg Giant

Cal-Maine Foods (Nasdaq:CALM) has just reported its earnings and we will discuss the results and outlook for the name in this column. We saw a recent run up in the name, but we have stood by a sell rating that we recently assigned back in December. We believed a round of speculative buying had driven the stock higher, but significant challenges remained in the egg market. With these challenging market conditions, Cal-Maine is in a tight spot. In this column, we discuss recent performance of the name, and our take on the stock.

Revenues rise

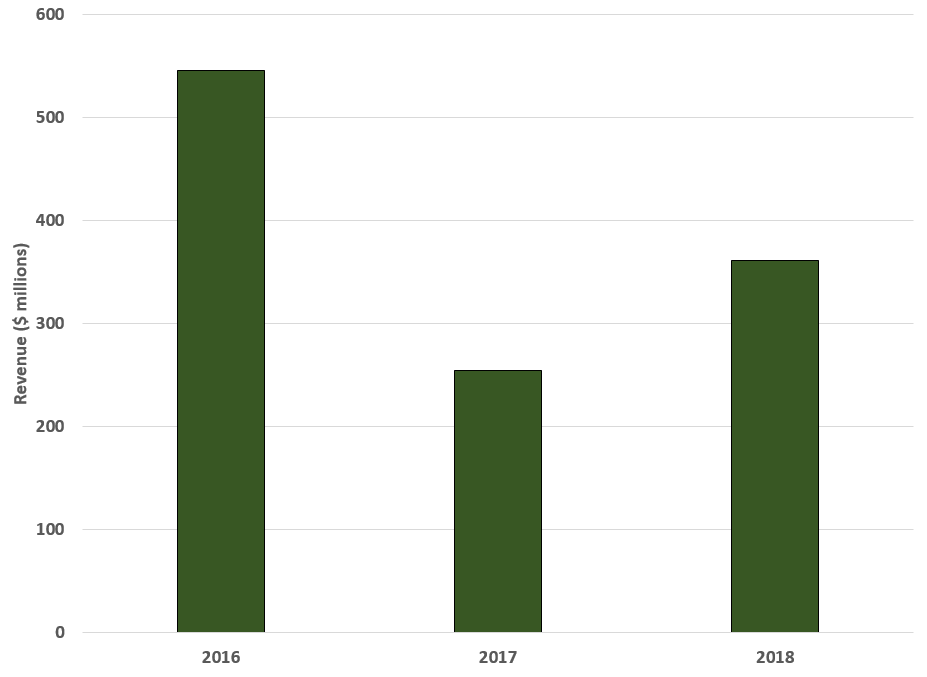

Revenues have been pressured from their highs back in 2016, but came back on strong this year versus Q2 2017:

Source: SEC Filings

The turnaround is seen in the chart. Net sales in the present Q2 2018 were $361.2 million, rising 42.4% from last year. While these revenues are still down markedly from two years ago, they did rise thanks to higher volumes and better pricing.

They were impacted by sales mix. Sales of specialty eggs dipped to 32.3% of total revenues from 45.8% last year. This was a direct result of changes in pricing, as volumes of specialty egg sales were actually higher this year, and represented 22.6% of volume (compared to 22.4% last year).

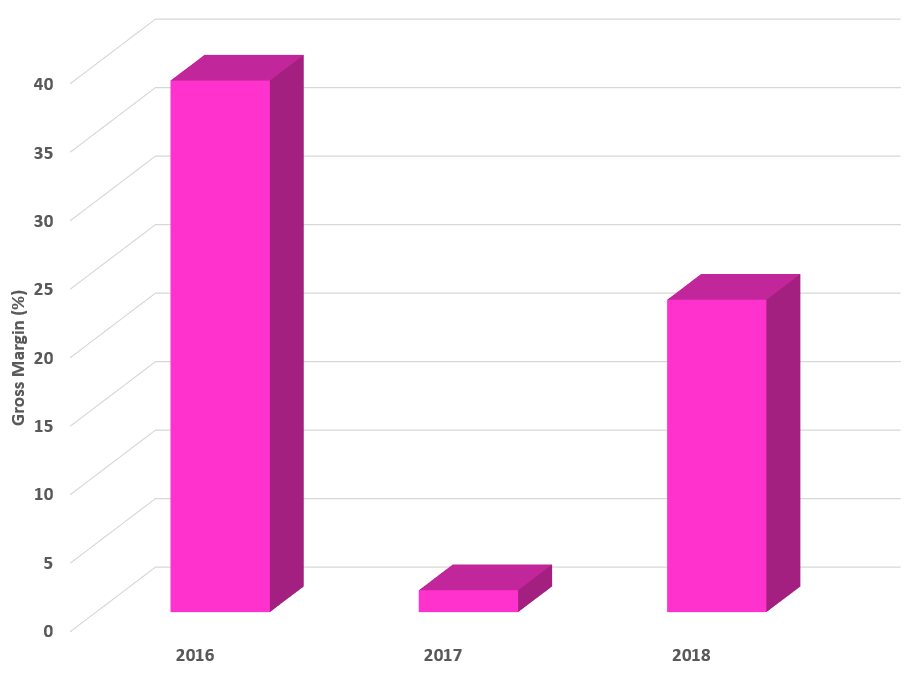

Margins see a benefit

We believe that gross margins are an important metric for companies where selling and expense costs are often out of their hands, such as commodity plays like Cal-Maine. With sales rising and feed costs declining this quarter, gross margins expanded:

Source: SEC Filings

Earnings improved

Profits matter. Factoring in rising sales and overall expenses, net income saw a boost versus last year, but it was below our expectations for $0.64 per share. Cal-Maine swung to a profit of $26.6 million, or $0.55 per share on an adjusted basis. This represents a turnaround from last quarter where the company saw a big loss of $16.0 million.

Looking ahead to 2018

This year’s USDA harvest estimates suggest that the company should have an ample supply of its primary feed ingredients for the year. This is a benefit as feed costs are a major expense for the company. With the USDA estimates, this means that feed costs will likely remain contained.

Therefore, if egg prices rise further, margins will expand and earnings will improve. The demand side of the equation is strong, but supply remains ample for eggs, keeping pricing down. Therefore, something must happen to materially impact egg supply. Right now, there is still no catalyst that we can identify.

Based on current pricing trends, we see 2018 revenues coming in at $1.38 to $1.45 billion. Factoring in the current trajectory of expenses, we foresee earnings hitting $2.10-$2.40. This could change in the spring based on feed/supply costs or material changes in egg prices. Overall, we believe shares are still too expensive here, and recommend you stay out of the stock.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more