Buy The Surge In First Solar Stock Before It's Too Late?

Image Source: Unsplash

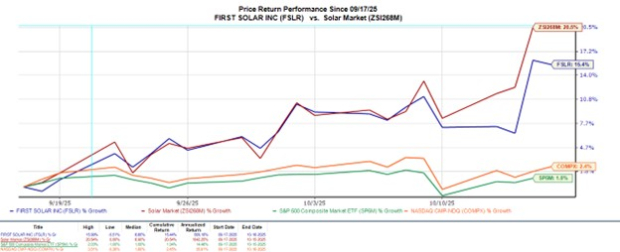

The excitement for First Solar’s (FSLR - Free Report) massive earnings potential is back in effect, with the solar industry leader being boosted by a powerful mix of policy support, analyst upgrades, and strong business fundamentals.

Being a prime beneficiary of the Inflation Reduction Act, which has an emphasis on incentivizing and investing in clean energy and climate initiatives, more long-term visibility demand is on the horizon amid increased government funding for renewable energy.

This comes as First Solar’s U.S. production facilities are reportedly sold out through 2028, with the company specializing in cadmium telluride (CdTe) thin-film solar modules that offer superior performance compared to traditional silicon panels.

As a reminder that the all-time high for First Solar stock is over $300 a share, FSLR has spiked +10% so far this month and is now up nearly +40% year to date.

Recently hitting a fresh 52-week peak of $248, this certainly begs the question of whether it's time to buy the surge in FSLR before it gets more expensive or if there will still be better buying opportunities ahead.

Image Source: Zacks Investment Research

FSLR Reports On October 30

Propelling FSLR is that First Solar is expected to post strong Q3 results on Thursday, October 30. Zacks' projections call for First Solar’s Q3 sales to be up an eye-popping 74% to $1.54 billion compared to $887.67 million in the prior year quarter.

Taking advantage of this impressive top line expansion, First Solar’s earnings are expected to climb 46% to $4.24 per share versus EPS of $2.91 in Q3 2024.

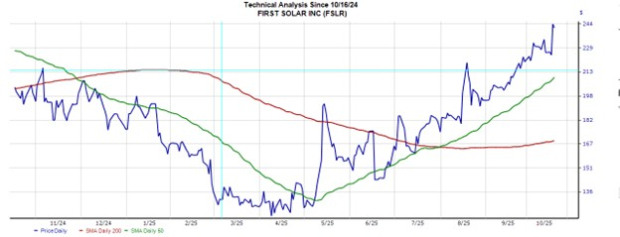

FSLR Technical Analysis

With investors being lured by foreseeable expectations of high double-digit top and bottom line growth in fiscal 2025 and FY26, FSLR has been on a tear since breaking out above its 50-day and 200-day SMAs in July.

Previously, at the end of last year, the drop in First Solar’s 50-day SMA (green line) below the 200-day SMA (red line) led to an extended downtrend in FSLR before the reemergence of several catalysts, including the clarification of what ended up being favorable policy changes regarding updated rules for clean energy tax credits and federal incentives.

First Solar’s 50-day and 200-day SMA support levels are currently at roughly $169 and $210 a share, respectively.

Image Source: Zacks Investment Research

First Solar’s Attractive P/E Valuation

At current levels, FSLR still trades at a reasonable 16X forward earnings multiple despite such an extensive rally in recent months.

From a historical perspective, First Solar stock not only offers a nice discount to the benchmark S&P 500 and many of its solar peers but also trades more than 20% from its decade-long median of 21X, with an extreme high of over 1,500X during this period.

Image Source: Zacks Investment Research

FSLR Price Target & Analyst Upgrades

Blowing past its current Average Zacks Price Target of $231.17, several analysts have recently upgraded their price targets for First Solar stock to over $260.

This includes analysts at BMO Capital (BMO - Free Report), Jefferies Financial Group (JEF - Free Report), and JPMorgan (JPM - Free Report), with Citigroup (C - Free Report) currently having the street high price target of $300.

Image Source: Zacks Investment Research

What the Zacks Rank Suggests

Most influential to Zacks' proprietary ranking system is the trend of earnings estimate revisions (EPS), with FSLR currently landing a Zacks Rank #3 (Hold). Over the last quarter, EPS revisions for First Solar are still positive but have dipped in the last week for FY25 and FY26.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Although it’s very enticing to chase the rally, the technical analysis of FSLR also shows how this stock can be very volatile and influenced by these trading indicators. It’s understandable how FOMO could be setting in, but the possibility of better buying opportunities is not off the table, even with new emerging catalysts such as the use of solar energy to support AI infrastructure.

More By This Author:

Buy 3 Tech Stocks On The Dip To Strengthen Your Portfolio In Q4

Buy This Top Investment Bank Stock As Q3 Results Approach: STT

BlackRock & Goldman Sachs Beat Q3 Expectations And Post Record AUM

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more