BlackRock & Goldman Sachs Beat Q3 Expectations And Post Record AUM

Image Source: Pexels

As two of the most prominent asset managers, BlackRock (BLK - Free Report) and Goldman Sachs (GS - Free Report) helped highlight Tuesday’s Q3 earnings lineup after exceeding their quarterly expectations and hitting records in assets under management (AUM).

Notably, both firms are benefiting from strong inflows across asset classes and strategic positioning in high-growth areas like passive investing and digital finance.

BlackRock shares were nicely up over +3% in today’s trading session, with BLK extending to year-to-date gains of +18% while Goldman Sachs stock dipped 2% on what appears to be some profit taking as GS is still up an impressive +37% YTD.

Image Source: Zacks Investment Research

BlackRock & Goldman Sachs Q3 Results

Posting Q3 sales of $6.5 billion, BlackRock’s top line expanded 25% from $5.19 billion in the prior year quarter and topped estimates of $6.24 billion. BlackRock’s Q3 earnings were up nearly 1% to $11.55 per share, beating EPS expectations of $11.19 by 3%.

Pivoting to Goldman Sachs, Q3 sales of $15.18 billion stretched 19% from $12.69 billion a year ago and noticeably exceeded estimates of $14.14 billion by 7%. More impressive, Goldman Sachs' Q3 EPS climbed nearly 46% to $12.25 compared to $8.40 per share in the comparative quarter and beat expectations of $11.11 by 10%.

BlackRock & Goldman Sachs Record AUM

Remaining the largest global asset manager, BlackRock’s AUM spiked 17% year over year to a record $13.5 trillion.

Placing among the top 10 largest asset managers globally, Goldman Sachs' AUM also hit a new peak of $3.45 trillion, rising 11% YoY.

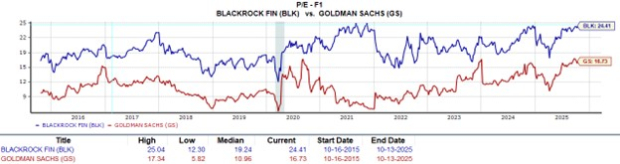

BLK & GS Valuation Comparison

Goldman Sachs' valuation stands out at 16X forward earnings. In this regard, GS trades at a distinct discount to the benchmark S&P 500’s 25X forward earnings multiple, with BlackRock at 24X.

GS also trades near the preferred level of less than 2X forward sales, with BLK at 8X and trading at a premium to the S&P 500’s 5X.

Image Source: Zacks Investment Research

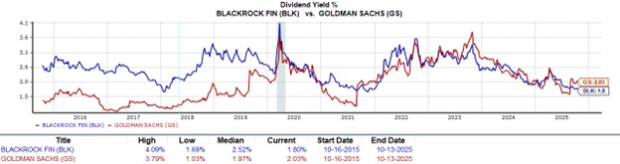

BLK & GS Dividend Comparison

Offering respectable dividends, Goldman Sachs' current yield of 2.03% edges BlackRock’s 1.8%. These yields top the S&P 500’s 1.11% average, although BlackRock’s slightly trails the broader Zacks financial sector’s 1.89%.

Image Source: Zacks Investment Research

Should Investors Buy BLK or GS Stock?

Despite having the advantage in AUM, BlackRock stock pales in comparison to Goldman Sachs in many metrics. However, both of these prominent finance stocks have proven to be viable investments in the portfolio, and for now, they land a Zacks Rank #3 (Hold), respectively.

That said, a buy rating could certainly be on the way for Goldman Sachs, as earnings estimate revisions are likely to rise in the coming weeks, given its impressive Q3 EPS beat.

More By This Author:

Buy The Surge In Taiwan Semiconductor Stock As Q3 Results Approach?3 Hot Tech Stocks To Buy On The Dip: CRWD, MU, WDC

3 Medical Service Industry Stocks Poised To Counter Workforce Issues

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more