Bullish Dreams Should Be Tempered By History

January brought gains across most asset classes, especially for the junkiest debt, equities, and crypto-Ponzis.

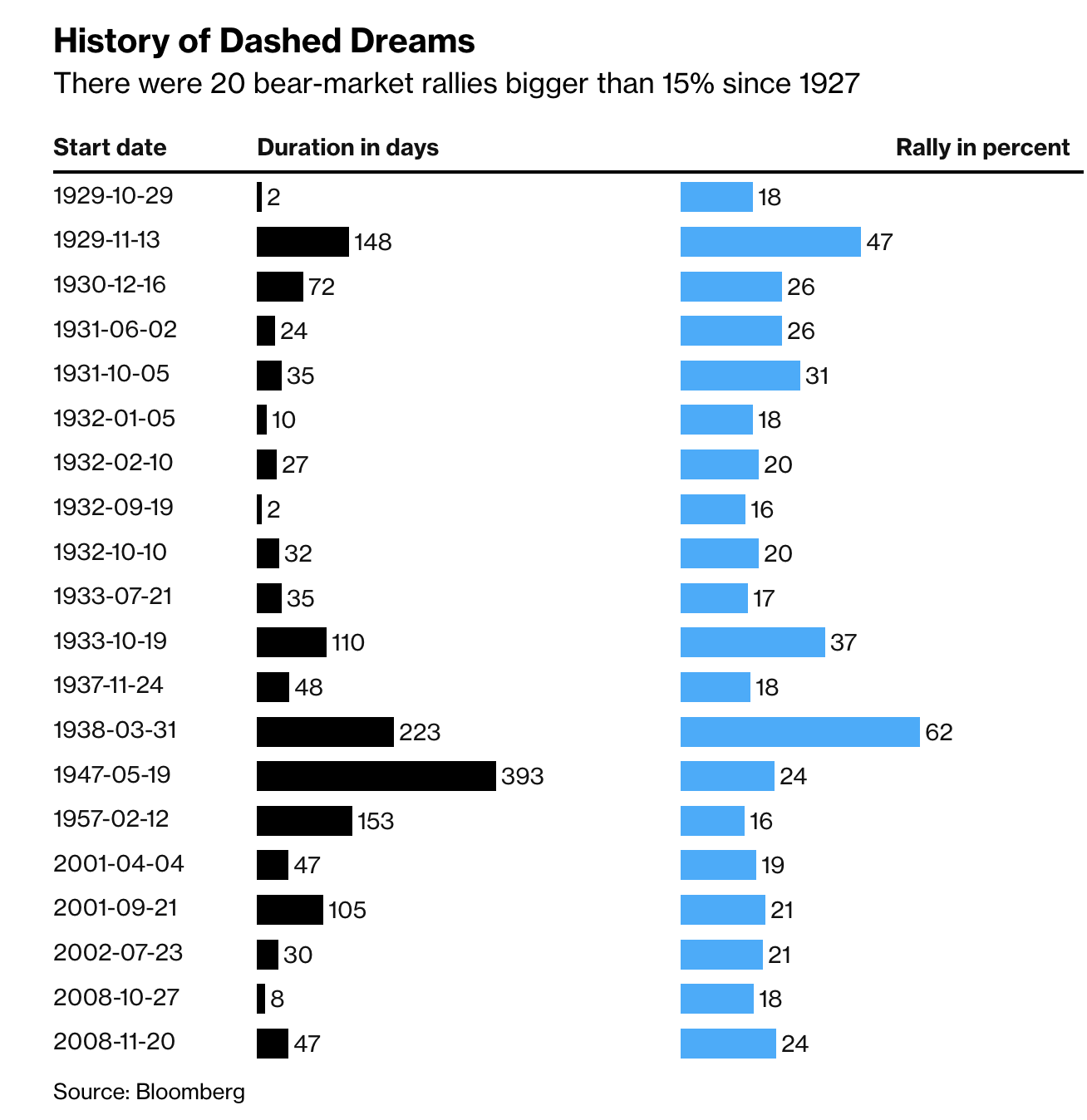

The bulls are chomping at the bit to convince us that the 2022 loss cycle is now over. However, it bears noting that big rebounds have been a regularly recurring feature within bear markets since time began.

The Bloomberg chart below summarizes the 20 S&P 15%+ rallies within larger downtrends from 1929 to 2008. Buy and holders should beware.

(Click on image to enlarge)

There has also never been a bear market low that occurred before the US Fed paused a tightening cycle. In every case, stocks fell for months after the first cut. Today, the US Fed is still in tightening mode via rate hike plans and ongoing Quantitative Tapering.

More By This Author:

Irrationally Exuberant January Comes To A Close

Tightening Will Continue To Bite Through 2023/2024

Equities Don’t Bottom When Yield Curves Are Inverted

So, we should consider an active bear market hidden into rebounds of an bull market. The quantitative tapering and the interest rise just put pressure on the market prices. Great article Danielle.