Bull Of The Day: The Kroger Co.

The Kroger Co. (KR - Free Report) sports the highly coveted Zacks Rank #1 (Strong Buy) and resides within the Zacks Retail – Supermarkets Industry.

Kroger has undergone an extensive makeover, not only regarding products but also in terms of how consumers prefer shopping for groceries.

Founded in 1883, the long-time retailer operates approximately 2,700 retail stores under its various banners and divisions in 35 states.

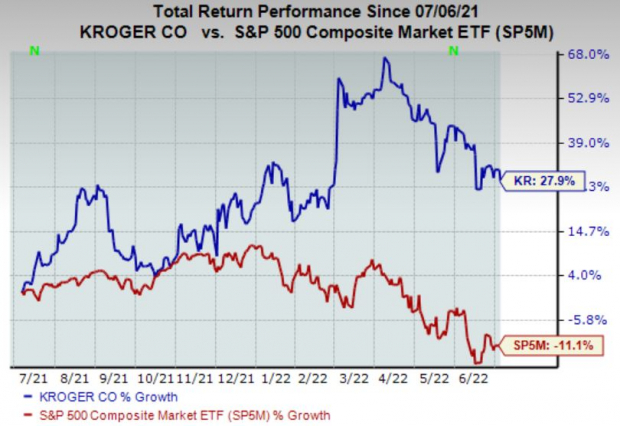

Share Performance

Kroger shares have been a bright spot in an otherwise dim market throughout 2022, increasing nearly 5% in value and easily outperforming the S&P 500’s decline of almost 20%.

Image Source: Zacks Investment Research

Upon widening the time frame to encompass a year’s worth of price action, the story remains the same – Kroger shares have enjoyed a stellar run, increasing nearly 30% in value and extensively outperforming the S&P 500 in this time frame as well.

Image Source: Zacks Investment Research

The company’s share performance is inspiring – many companies have witnessed deep double-digit valuation slashes throughout 2022.

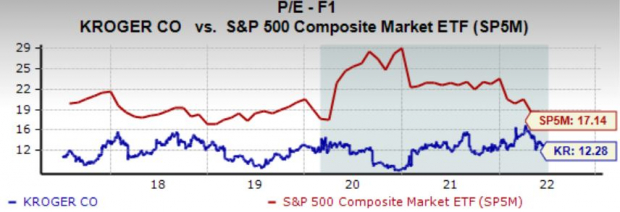

Quarterly Performance & Valuation

Kroger has been on a blazing-hot earnings streak, exceeding bottom-line expectations in ten consecutive quarters dating back to early 2020. In its latest quarter, in the face of adverse business conditions, the company beat earnings expectations by a substantial 13% and reported quarterly EPS of $1.45.

Furthermore, the average EPS surprise has been a strong 20% over its last four quarters.

In addition to strong quarterly performance, the grocery retailer sports attractive valuation levels. Its current forward earnings multiple resides at 12.3X, marginally below its five-year median value of 12.6X and nowhere near highs earlier this year of 16.4X.

Additionally, the value represents an enticing 28% discount relative to the S&P 500’s forward earnings multiple of 17.1X.

Image Source: Zacks Investment Research

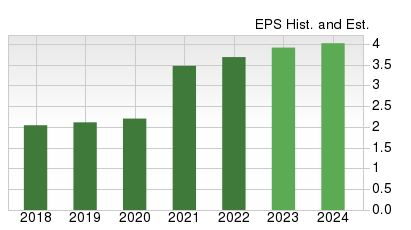

Growth Estimates

Analysts have primarily revised their earnings outlook positively over the last 60 days. For the upcoming quarter, the $0.81 per share estimate reflects a respectable 1.3% growth in earnings from the year-ago quarter.

Furthermore, the $3.91 per share estimate for the current fiscal year represents a sizable 6.3% expansion in the bottom-line year-over-year.

Image Source: Zacks Investment Research

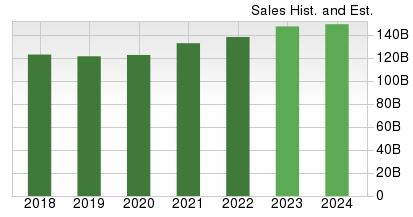

Quarterly revenue is forecasted to climb to $34 billion for the upcoming quarter, a substantial 7.3% increase compared to year-ago quarterly sales of $31.7 billion.

Pivoting to current fiscal year sales, the grocery retailer is penciled in to rake in a mighty $147 billion, a notable 6.7% increase in the top-line year-over-year.

Image Source: Zacks Investment Research

Dividends

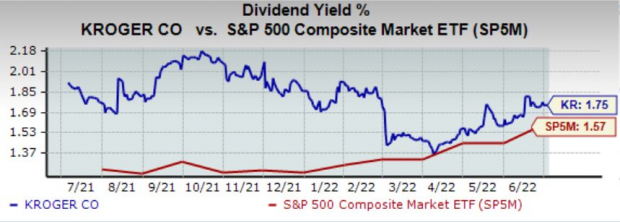

For investors who like to get paid, good news – Kroger has that covered with its annual dividend with a yield of 1.7% and a payout ratio sitting sustainably at 21% of earnings.

Impressively, the company has increased its dividend six times over the last five years, with a five-year annualized dividend growth rate of a double-digit 13%.

Additionally, the yield is notably higher than that of the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

One of the best ways investors can find expected winners within the market is by utilizing the Zacks Rank – one of the most potent market tools out there. A portfolio consisting of Zacks Rank #1 (Strong Buy) stocks have beaten the market in 26 of the last 31 years with an average annual return of 25%.

Additionally, the top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Kroger would be an excellent bet for investors looking to add a solid stock to their portfolios, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

Bull Of The Day: Myers Industries, Inc.

Why Dow Inc. Could Beat Earnings Estimates Again

5 ETFs That Gained Double Digits In Q2

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more