Bull Of The Day: Myers Industries, Inc.

Myers Industries (MYE - Free Report), a Zacks Rank #1 (Strong Buy), has surged more than 250% since the March 2020 bottom after dropping to roughly $6/share during the pandemic-induced market plunge. A very low percentage of companies complete the journey from penny stock to mid-double digits. These companies all experience remarkable growth in terms of both revenue and earnings, and MYE is no exception. The stock is currently up over 15% this year even as the general market hovers in the bear market territory.

In a sign of strength, MYE recently hit a 52-week high before experiencing a mild pullback during the last month. This has created a great buying opportunity for the stock as it continues to benefit from increased demand for its products. The company’s longevity and continued stock price ascent speak to management’s ability to adapt to the ever-changing market landscape.

One of the ways we can determine which stocks are outperforming the market is to identify leading sectors and industry groups. The Zacks Rubber – Plastics industry is currently ranked in the top 8% out of approximately 250 industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

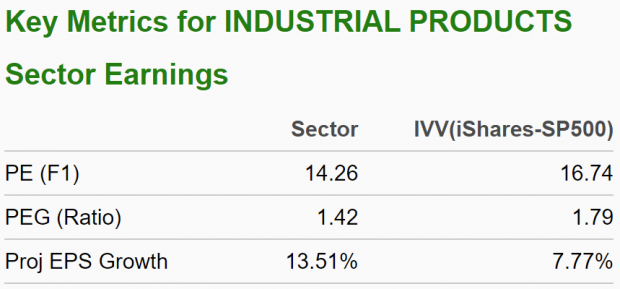

Quantitative research studies suggest approximately half of a stock’s future price appreciation is due to its industry grouping. Investing in stocks within leading industry groups can provide a constant ‘tailwind’ to our investing success. This industry group is part of the Zacks Industrial Products sector, which ranks in the top 32% out of 16 Zacks Ranked Sectors. Also, note the favorable characteristics of this sector below:

Image Source: Zacks Investment Research

Let’s take a closer look at this company within a powerful industry and sector combination.

Company Description

Myers Industries is a global manufacturer of polymer products for the agricultural, automotive, and industrial commercial and consumer markets. MYE is also the largest wholesale distributor of tools and supplies for the tire service industry.

The manufacturing company offers tire repair materials and custom rubber products, along with providing equipment for under-vehicle service for heavy trucks and off-road vehicles. Myers Industries was founded in 1933 and is headquartered in Akron, OH.

Earnings Trends and Future Estimates

MYE has surpassed earnings estimates in 2 of the past 4 quarters. The company most recently reported Q1 EPS back in May of $0.50 per share, a 78.57% surprise over the $0.28/share consensus estimate. This compares favorably to the $0.22/share reported in the same quarter in the prior year. Net sales for the first quarter of $225.49 million also beat estimates by 10.42%.

Myers Industries has delivered a trailing four-quarter average earnings surprise of 20.11%. Analysts have raised their full-year EPS projections by 26.56% in the past 60 days. The Zacks Consensus Estimate now stands at $1.62, reflecting a 67% growth rate relative to last year. Sales are anticipated to rise 14.66% to $873.05 million.

Charting the Course

MYE has risen from $6.47/share back in March 2020 to $22.71 at the time of this writing. Only stocks that are in extremely powerful uptrends are able to make this type of price move. The stock has continued its winning ways this year while the market has been in correction mode. This is the kind of stock we want to include in our portfolio – one that is trending well and experiencing positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 50 and 200-day moving averages (as evidenced by the blue and red lines, respectively) are both sloping up. The stock is making a series of higher highs and is showing relative strength versus the market. With both strong fundamentals and technicals, MYE has been of the pandemic’s biggest beneficiaries.

Other Factors to Consider

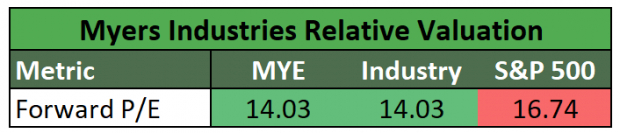

Despite the impressive performance, MYE’s valuation remains attractive:

Image Source: Zacks Investment Research

In addition, MYE pays a $0.54 dividend, which translates to a 2.38% yield.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. And as we know, Myers Industries has seen a steady batch of positive revisions as of late. As long as this trend remains intact (and MYE continues to post earnings beats), the stock should continue its bullish run this year.

Bottom Line

Buoyed by an undervalued and leading industry group, it’s not difficult to see why MYE is a compelling investment. A history of positive earnings surprises along with a strong technical trend certainly warrants a closer look at this top-rated stock.

Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, make sure to put MYE on your shortlist.

More By This Author:

Why Dow Inc. Could Beat Earnings Estimates Again5 ETFs That Gained Double Digits In Q2

3 Highly Ranked Stocks With Robust Dividend Yields Perfect For Income Investors

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more