Bull Of The Day: Shake Shack

Shake Shack (SHAK - Free Report), the fast-food hamburger and milkshake chain is on a tear this year, and it looks like the bull run may have just begun. Shake Shack boasts a compelling trade setup with top Zacks Ranks, convincing technical chart patterns, and improving business fundamentals.

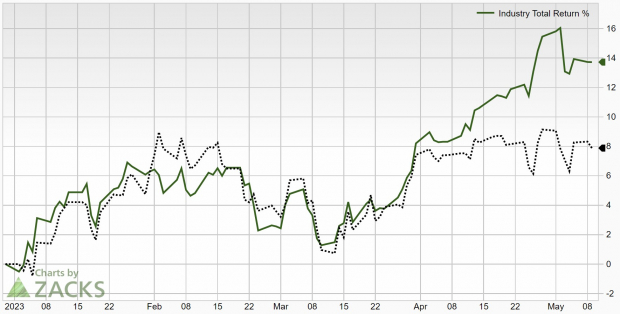

SHAK currently scores a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. It has also benefited from the recent strength of the Retail – Restaurant industry, which is currently in the top 18% of the Zacks Industry Rank, outperforming the broad market YTD.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Company Description

Shake Shack serves elevated versions of American classic foods, with high-quality ingredients. It is primarily known for its burgers, chicken sandwiches, hand-spun milkshakes, and house-made lemonade. The first Shake Shack location opened in 2004 in New York City and has grown to approximately 460 locations today. The company operates 436 restaurants, including 254 domestic company-operated locations and 33 domestic-licensed locations. Additionally, there are 149 international-licensed restaurants. SHAK also operates an impressive mobile app through which diners can order meals before arriving at the restaurant.

Q1 Earnings

Last week, Shake Shack reported Q1 earnings, and results came in better than expected. Earnings for the quarter were -$0.01 per share, beating estimates of -$0.09 per share. Sales for the quarter came in at $253 million, up 24.5% YoY and beating analysts’ estimates of $246 million.

SHAK was also able to improve several key business metrics. Same-store sales were up 10.3%, led by higher menu prices and double-digit traffic growth. This increase brings average weekly sales to $73,000. Additionally, operating margins have increased 310 basis points in the last year, bringing them up to 18.3%.

The company opened six new domestic, company-operated locations and seven new licensed restaurants including locations in Mexico and China.

Investors were clearly happy with the earnings beat as shares rallied tremendously following the report. Shares are up 20% following the earnings report, and SHAK stock is now up 60% YTD.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shake Shack has grown at an impressive pace over the past decade. Sales have climbed nearly 10x from just $110 million in 2014 to over $950 million today.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Setup

Shake Shack stock just broke out of an extremely compelling chart pattern. After drawing in investors, and building out a year-long base, SHAK has broken out of a bull flag consolidation.

Although the technical setup has already been completed, the close at the top of the range, followed by another weekly gap up is a bullish signal. From a technical perspective, SHAK is a convincing investment, and any pullbacks are good buying opportunities.

(Click on image to enlarge)

Image Source: TradingView

Valuation

Shake Shack is trading at a trailing twelve-month Price to EBITDA ratio of 34x, which is below its five-year median of 35x, and well above the industry average of 15x. It should be noted that SHAK has traded at a significant premium to the industry for the entirety of its time as a public company.

When compared directly to a competitor of a similar caliber SHAK’s valuation makes more sense. Chipotle Mexican Grill (CMG - Free Report), which is also a Zacks Rank #1 (Strong Buy) stock has a very comparable valuation. Trading at 34x TTM Price to EBITDA, CMG is right in line with SHAK. Both provide innovative, high-quality offerings and are some of the fastest-growing companies in their respective sector.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Shake Shack has a lot going for it today. With improving business economics, growing same-store sales, increased traffic, improving earnings estimates, and strong technical momentum SHAK is a worthy consideration for any investor’s portfolio.

More By This Author:

Twilio Q1 Earnings Beat, Shares Plunge on Weak View

Airbnb, Inc. Surpasses Q1 Earnings and Revenue Estimates

3 Small-Cap Blend Mutual Funds For Outstanding Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more