Bull Of The Day: Exxon Mobil

Image Source: Pixabay

Exxon Mobil (XOM - Free Report) is one of the leaders in the hottest sector of 2022: energy. This Zacks Rank #1 (Strong Buy) is busting out to new 5-year highs when almost everyone else is breaking down.

ExxonMobil is one of the largest energy companies in the world. It explores, produces, refines, and owns service stations around the world. But it's also one of the largest chemical companies as well.

In the 2000s, ExxonMobil was one of the largest companies in the world. Will it regain its crown during this commodities cycle?

Earnings Coming on Oct 28, 2022

On Oct 28, ExxonMobil will report third-quarter earnings. It has beaten 3 out of the last 4 quarters but has had a nice streak during the pandemic.

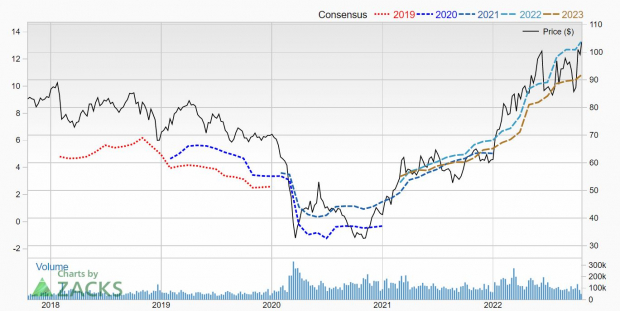

Analysts remain bullish with oil and natural gas prices remaining elevated. The Zacks Consensus Estimate is looking for $3.60 in the quarter with 4 estimates revised higher in the last 30 days but just 2 lowered during that time.

Image Source: Zacks Investment Research

Big Earnings Growth in 2022

With other companies cutting guidance or seeing declining earnings, ExxonMobil is sitting pretty in 2022.

Earnings are expected to rise 146.7% year-over-year to $13.27 from just $5.38 last year. Analysts have gotten more bullish over the last 90 days, with earnings jumping to $13.27 from $11.95 in that time.

Analysts are conservative about next year, however, currently seeing earnings softening by 18.6% to $10.81. However, it's still too early to have any insights into commodity prices in 2023, which are the main driver of earnings.

But you can see what it looks like on the price and consensus chart. 2022 earnings have taken off, and 2023 have too, but just not quite as bullish, for now.

Image Source: Zacks Investment Research

Dividend All-Star

ExxonMobil has long been a favorite of income investors as it has paid a dividend for decades. ExxonMobil says on its website that payments to shareholders have grown at an average annual rate of 6% over the last 39 years.

That's a nice added bonus for shareholders as the stock has been challenged during some of that time period.

Despite shares being up 69.9% this year and breaking out to a new 5-year high, over that 5-years, shares are up just 25%. For comparison purposes, the S&P 500 was up 43% during that same time period.

ExxonMobil's dividend is currently yielding 3.4%.

Shares are Dirt Cheap

Even with shares at new 5-year highs, earnings are soaring so the shares are still cheap.

It trades with a forward P/E of 7.8. The S&P 500 is trading at 17x.

ExxonMobil also has a PEG Ratio of just 0.3. A PEG under 1.0 usually indicates a company has both value and growth, which is a powerful combination.

For investors looking to get into oil stocks, ExxonMobil is one of the leaders and one to keep on your shortlist.

More By This Author:

The Most Popular, And Fun, ETFs Of 2022

5 Big Bank Earnings Charts To Kick Off Earnings Season

Bull of the Day: Chico's FAS

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more