Bull Of The Day: BP

After leading the way most of the year, energy stocks have taken a breather. I see several large names down over 20% from their early June highs. It makes some sense, given the fact that crude oil prices are well off the highs as well. However, this latest pullback could actually be a fantastic buying opportunity. As prices have come down on these stocks, earnings continue to rise. That sort of divergence between the price and earnings could mean huge profits lie ahead for investors.

Today’s Bull of the Day is one of these energy stocks that has come down off the highs. It’s Zacks Rank #1 (Strong Buy) BP (BP - Free Report). BP p.l.c. engages in the energy business worldwide. It operates through Gas & Low Carbon Energy, Oil Production & Operations, Customers & Products, and Rosneft segments. It produces and trades in natural gas; offers biofuels; operates onshore and offshore wind power, and solar power generating facilities; and provides de-carbonization solutions and services, such as hydrogen and carbon capture and storage.

The reason for the favorable Zacks Rank is four analysts have increased their earnings estimates for the current year and next year. The bullish behavior has pushed up our Zacks Consensus Estimates for the current year from $5.66 to $7.48 while next year is up from $5.09 to $5.85. That means that the current PE for BP sits all the way down at 3.72x earnings. Compare that to an industry average of 6.3x and the broad market’s 17.31x.

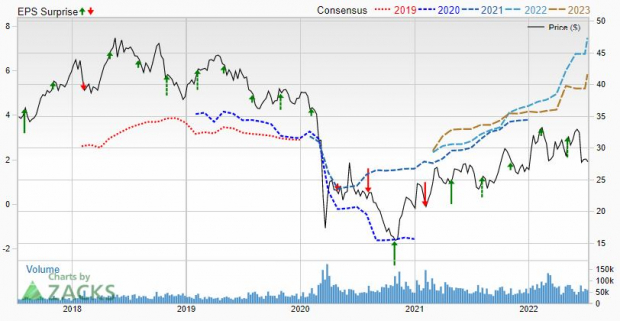

Image Source: Zacks Investment Research

A quick look at the Price, Consensus, and EPS Surprise Chart reveals the divergence between the stock’s price and earnings. Earnings are much higher than they were during 2019 when BP shares were trading in the mid-$40s. Think about that. Earnings are higher and the stock price is significantly lower.

Not only does BP have a strong underlying earnings trend, but it also pays a very healthy dividend. At its current price of $27.84, BP yields 4.64%. That means that long-term investors get paid to wait for the price to catch up with earnings.

More By This Author:

Airline Stock Roundup: Pay Hike Likely For American Airlines Pilots, Gol Linhas' June Traffic & More

3 Large-Cap Stocks Up More Than 20% Year-To-Date

Bear Of The Day: Activision Blizzard

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more