Airline Stock Roundup: Pay Hike Likely For American Airlines Pilots, Gol Linhas' June Traffic & More

Image: Shutterstock

With labor problems hurting the U.S. airline industry, there was an encouraging update from American Airlines’ (AAL- Free Report) CEO Robert Isom. Per the new proposal made to the Allied Pilots Association, the union representing the pilots, pilot pay is likely to be boosted 17% by 2024's end.

European carrier Ryanair Holdings (RYAAY - Free Report) also received impressive tidings on the labor front when it reached a pay-related agreement with the British Airline Pilots’ Association (BALPA).

Latin American carrier Gol Linhas’ (GOL - Free Report) June traffic, measured in revenue passenger kilometers, declined 5.5% from the May reading, reflecting the slowdown in air-travel demand in the country. In the latest update on the takeover saga of Spirit Airlines (SAVE - Free Report), management delayed its shareholders’ vote on the buyout offer put forward by Frontier Group Holdings (ULCC - Free Report) by a week to July 15.

Recap of the Latest Top Stories

Per the proposal put forward by AAL’s CEO, pilots will be eligible for a pay hike of 6% on commencement of the contract followed by 5% raises at the start of 2023 and 2024. Moreover, if the deal gets ratified by Sept. 30, 2022, there will be other lucrative incentives like retroactive pay.

The new offer is being reviewed by the union. American Airlines currently carries a Zacks Rank #3 (Hold). Updates on labor deals at other U.S.-based carriers were mentioned in the previous week’s writeup.

At Ryanair, the labor deal will accelerate pay restoration of pilots and ensure pay hikes post restoration through 2026. The restoration of pay is certainly necessary, as RYAAY intends to expand capacity as much as 115% of the pre-coronavirus levels in the current year itself to meet the demand swell.

Per Ryanair’s people director Darrell Hughes, “While 100% of our pilots across our European network are covered by 2020 Emergency Agreements, we continue to work with our pilots and their unions on new deals, similar to this one concluded with BALPA, and have successfully re-negotiated improved long-term agreements with 70% of our pilots, running until 2026 or 2027 as we prioritize pay restoration.”

Naturally, for this capacity expansion, it is imperative to keep RYAAY’s group of pilots satisfied. The pay increments apart, pilots at RYAAY become eligible for other benefits.

At Gol Linhas, consolidated capacity, measured in available seat kilometers, expanded 68.6% year-over-year in June, much higher than the traffic increase of 54%. As a result of capacity expansion outweighing traffic growth, the load factor (% of seats filled by passengers) declined 7.2 percentage points to 76.7%. The domestic operations accounted for most of the data as international operations are still minimal.

In the first half of the year, consolidated load factor decreased 2.5 percentage points year-over-year to 79.3% with capacity expansion (73.2%) outweighing traffic growth (67.9%).

To continue talks with Frontier and another bidder, JetBlue Airways (JBLU - Free Report), Spirit Airlines postponed its shareholders’ vote, which was scheduled for today. Management at SAVE stated that the shareholders of record as of the close of trading on May 6, 2022, are eligible to vote at the special meeting.

Both JetBlue and Frontier are aiming to acquire Spirit Airlines to expand their network and take advantage of the continued improvement in air-travel demand. The takeover battle comes at a time when the airline industry is struggling with staffing and aircraft shortages.

Performance

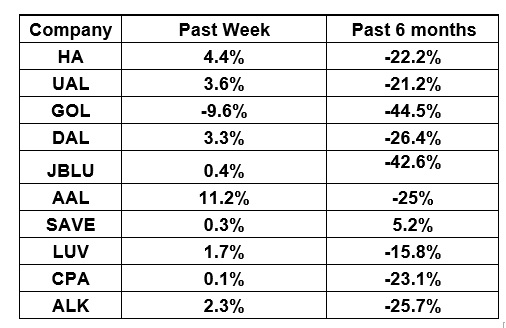

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that almost all airline stocks have traded in the green over the past five trading days. The NYSE ARCA Airline Index has increased 1.3% to $56.46. Over the past six months, the NYSE ARCA Airline Index has plummeted 32.5%.

What's Next in the Airline Space?

Investors will await further updates on the ongoing takeover tussle surrounding Spirit Airlines in the coming days.

More By This Author:

3 Large-Cap Stocks Up More Than 20% Year-To-Date

Bear Of The Day: Activision Blizzard

Bull Of The Day: The Kroger Co.