Bull Market In A Bear Stock

Build-A-Bear's Big Wednesday

Shares of Build-A-Bear Workshop (BBW) closed up nearly 27% on Wednesday, in the wake of a blockbuster Q3: revenues of $95.1 million, up 27.4% from Q3 2020, and a surprise profit of 38 cents per share (consensus estimates had been for a loss of 17 cents). On top of that, the company announced a special $1.25 per share dividend and a share buyback plan.

Taryn Elliott/Pexels

Who Was Bullish On BBW Before Wednesday?

Build-A-Bear wasn't the most obvious play earlier this year. Stores where children build their own teddy bears? Who knew this is where parents would flock with their children once the lockdowns were lifted, but fear of contagion was still rife?

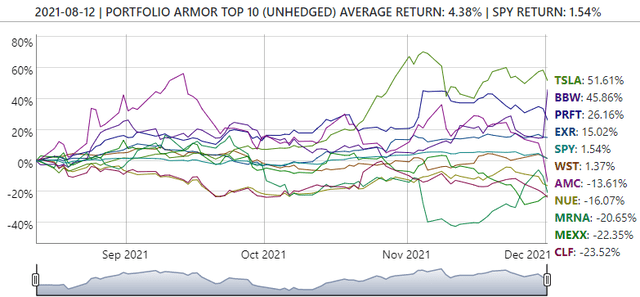

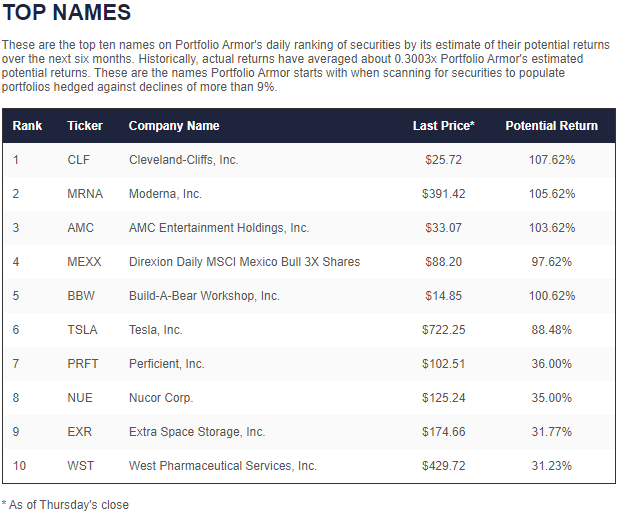

Our system didn't know that, but its gauge of options market sentiment was bullish enough on Build-A-Bear in August to put the stock in its top ten. As regular readers know, our system analyzes every security with options traded on it in the U.S. every day the market is open, and it estimates potential returns for them over the next six months. It uses that data to populate its daily top ten ranking and also hedged portfolios constructed for users. These were our top ten names on August 12th.

Screen capture via Portfolio Armor on 8/12/2021.

Here's how that top ten had performed as of Wednesday's close.

Build-A-Bear was our second best performer from that cohort, up 45.86%, behind only Tesla (TSLA), which was up 51.61%. Overall, our top names were up a modest 4.38% on average, while SPY was up 1.54% over the same time frame.

Does It Make Sense To Buy BBW Now?

Our system wasn't particularly bullish on it after Wednesday's close, estimating a low single digit return for it over the next six months. Two other stocks from that August 12th top ten did appear on our December 1st top ten though, Tesla and Moderna (MRNA). Considering that Moderna is down by more than a fifth since it appeared in our top ten in August, bargain hunters might want to consider the COVID vaccine maker here. As always, we suggest hedging if you're going to buy Moderna or any of our top names. That way, your downside will be strictly limited in case we end up being wrong, or the market goes against us.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more