British American Tobacco: Big Dividend On Sale

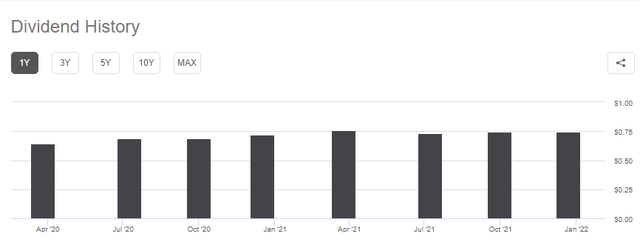

Both heavy traders and value investors should like this one. Buy British American Tobacco (BTI) End of article. We believe shares are a buy. The stocks of tobacco names ebb and flow. We have most often owned (PM) and (MO), but we are liking BTI at these levels, especially with the tanking of the stock with the market weak of late, as well as rates on the ten-year rising which tends to TEMPORARILY hurt dividend-paying stocks. This is an opportunity to scoop a value name and collect a paycheck. Take a look at the chart:

Source: BAD BEAT Investing

This sets up for a solid investment, but can also be traded. I am not even going to recommend a stop loss on this. I think you buy it here and add every 50 cent drop.

Target 1: $34.75.

Add in 50 cent blocks to $31.75 it if falls that far and hold.

Traders should hold for $37.50 then take off.

Value investors might want to stick around and collect the SAFE dividend that is yielding 8.5%.

Let me be clear. If you put $10,000 into this stock all right now, you will be paid $850 a year in dividends. Ratchet it up to $30,000, a significant investment, and the $2550 a year paycheck isn't that bad.

Now, if you are smart and add the dips, you will get a better yield.

I just bought 1,000 shares today at 2:30. I will buy 500 more every 50 cent block. I am in this trade, which I am planning to hold either for $37.50 in short term, or as a beautiful dividend payer. IN EITHER CASE, IT IS ON SALE.

You can also SELL PUTS. Or you can buy shares and write calls against them for EXTRA INCOME!

Discussion

The company is in good shape. I think most notably they have been branching out with acquisitions in recent years. That hurt the balance sheet for a while. They are looking to branch out and reshape the company.

Source: Company presentation

Following the acquisition of Reynolds, the net debt of the company soared. Between 2016 and 2017 net debt per share increased by 166% and over the last decade this increased by 297%.

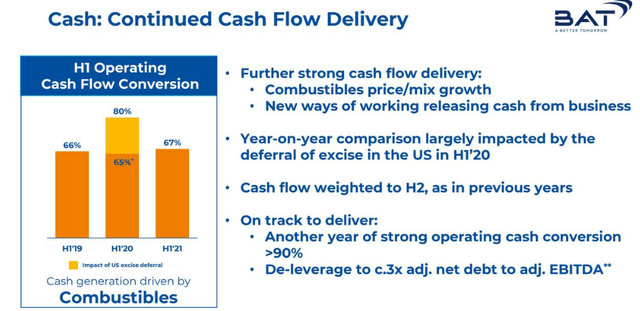

Management said that they are planning to deleverage the balance sheet targeting an adjusted net bed to adjusted EBITDA of 3x by year-end.

This is something that we are closely watching as we consider the deleveraging process an important process to unlock value for shareholders. We think it happens.

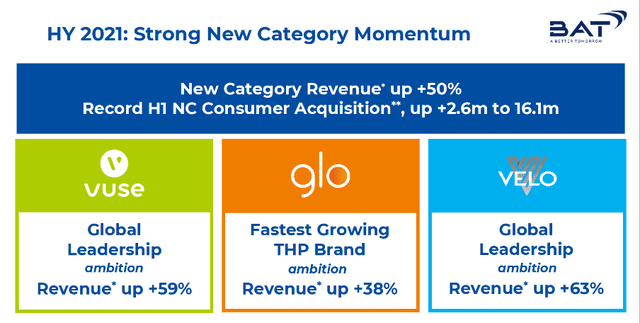

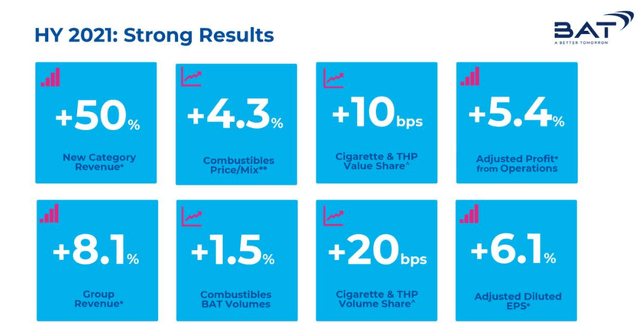

Look at BTI’s new categories performance. Looking at the H1 results it is clear that BTI's momentum is accelerating around the new category products. They are WINNING.

Source: Company presentation (linked above)

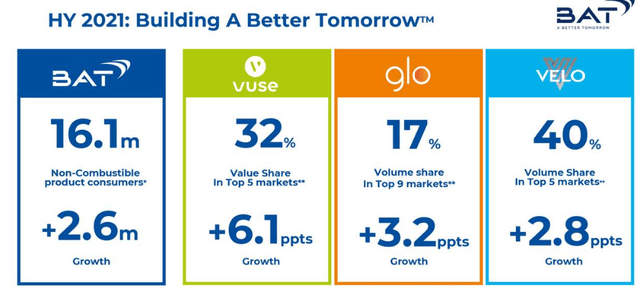

The key here is that the team is currently focused on acquiring customers and building the company’s brands around the new category of non-combustible products and it appears that they are doing a good job.

BTI operates under three brands Vuse for vapor products; Velo for modern oral products and glo for tobacco heating products. As we can see from the diagram above all three brands had significant growth. This growth in less risky products in combination with a subscription-based model will lead to high margins and brand loyalty in customers.

Source: Company presentation (linked above)

Now, look. There is concern with judicial rulings and regulators regarding products from other companies. That is a risk and must be watched. But ut is all priced in. The company is killing it.

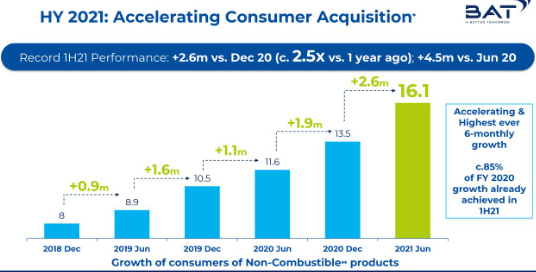

BTI had 16.1 million non-combustible customers reported in H1 2021 (and the highest ever 6-month growth reported) and we expect this to continue to grow.

Source: Company presentation (linked above)

As I mentioned Phillip Morris and Altria to sell cant sell IQOS products in the U.S. due to patent infringement. But that is good for BTI since it has the rights. This will only lead to accelerated growth for BTI, even if the ban does not last for long.

We see non-combustible products that are subscription-based as lasting.

Look in the first half of 2021 new category revenue increased by 50% and we do expect this growth momentum to continue acting as a growing platform for BTI.

So what about the most recent quarter? It was a good beat. Here are highlights.

- Revenue of £12.18B (+8.1% Y/Y) beats by £40M.

- Adjusted operating profit £5.24B, estimate £5.25B.

Source: Company presentation (linked above)

- Operating margin 40.3%.

- Operating cashflow conversion of 67% (30 June 2020: 80%), reflecting phasing of excise payments in U.S. in 2020.The company is on track for FY 2021 guidance:

- Global tobacco industry volume now expected to be down c.-1.5% (from c.-3%), driven by strong EM recovery.

- Constant currency revenue growth above 5% and continued strong progress towards £5B New Categories revenue in 2025.

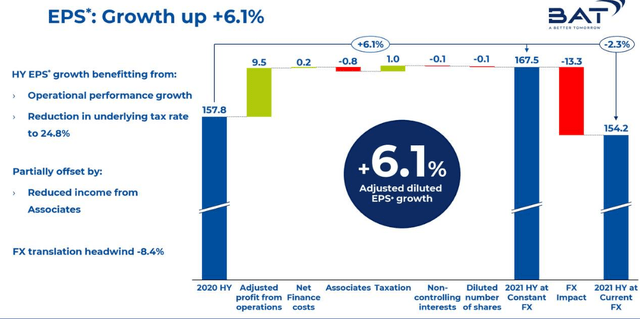

- Mid-single figure constant currency adjusted EPS growth.

- Operating cashflow conversion in excess of 90%, Adjusted Net debt/Adjusted EBITDA around three times.

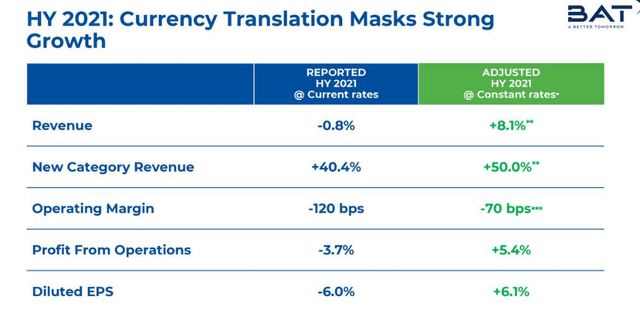

Weighed down slightly by Q1, the half-year mark shows interesting growth when we control for rates.

Source: Company presentation (linked above)

Look at these incredible growth metrics. And it is not like people stopped their tobacco and nicotine habits during COVID. In fact evidence points strongly to the idea that such activities increased.

Source: Company presentation (linked above)

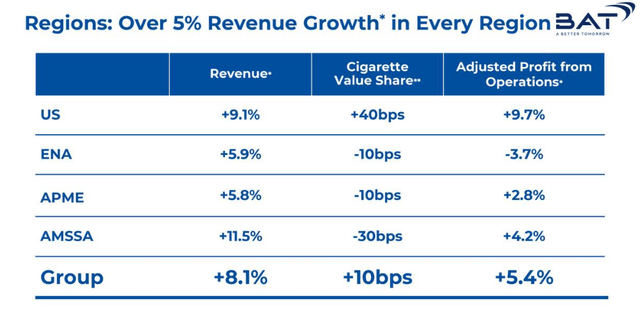

Regional growth is also ever-present, in big part due to new product offerings from the company

Source: Company presentation (linked above)

So what about looking ahead?

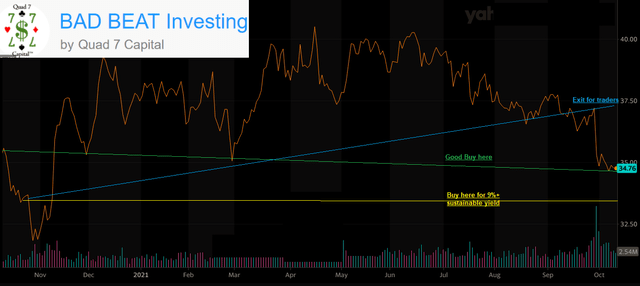

Well, first there is some solid value here with shares under $35 each. Love it.

Source: BAD BEAT Investing

These are amazing numbers. I was shocked to see some of them, but sales like this are rare in the space. Jump on it, and buy the dip. The Seeking Alpha Quant measures are good here too:

We also like the cash flow story here. Cash looks good moving forward with the company on track to de-lever its balance sheet. H2 cash is always strong.

Source: Company slides (linked above)

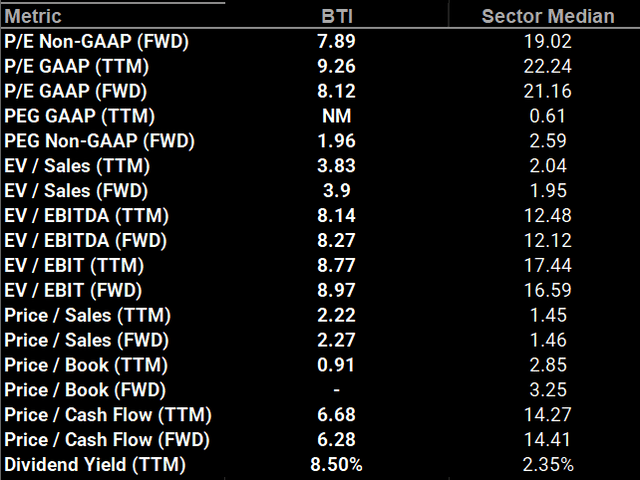

The dividend is stellar

BTI offers a starting forward dividend yield of 8.5% ($2.93 per share) with a current payout ratio of 67%. Compared to MO and PM, BTI offers the highest dividend yield and lowest payout ratio

Let us repeat. You get paid a LOT of yield, with a LOWER payout ratio to ones we have owned a lot in the past (PM and MO).

Source: Seeking Alpha

There is room for growth as well.

Take home

The stock is rarely this cheap on a valuation basis. Under $35 is a gift. If it gets down to $32-$33 that is crazy exceptional value. This dividend is safe. You will be paid handsomely.

Buy some. And add if the market continues to send it lower.

You will be very happy in months to come on this one.

A true value investment.

And...if you so choose, can be traded.

I did not realize this was still even a business area, now that the tobacco stink has dropped so much. So thanks for an educational and interesting presentation/article.