Blue Chips That Fell Behind

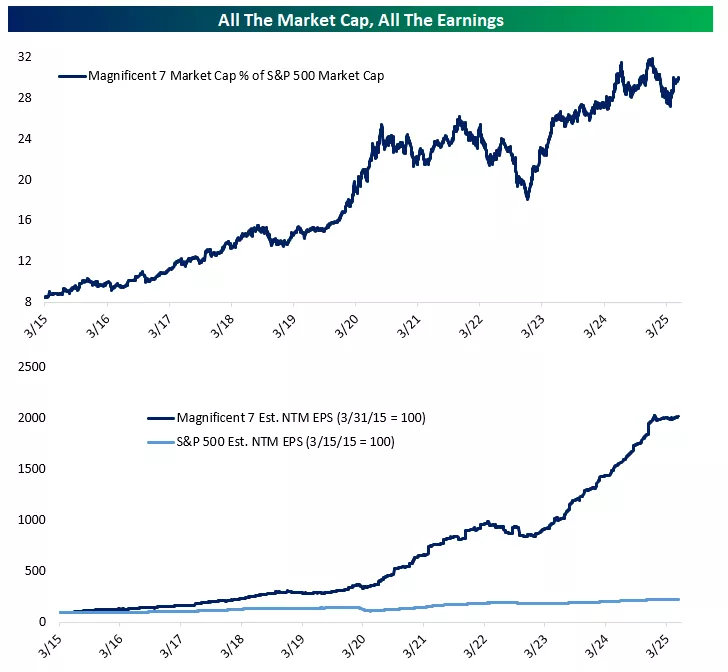

The US equity market remains astoundingly top heavy. As shown below, the Magnificent 7 are not quite at a record share of large cap market capitalization, but they're still quite close at 29.8% as-of today. Typically, narrow breadth like this where a few stocks hold up the whole market is a bad sign, but this iteration is quite different from historical examples because these stocks are growing earnings so rapidly compared to the market as a whole. Over the last 10 years, estimated next 12 month EPS for the S&P 500 has risen by about 125%. For the Magnificent 7, it's up 1900%. In other words, these monster growth companies are holding up the market not just through their prices but also their earnings.

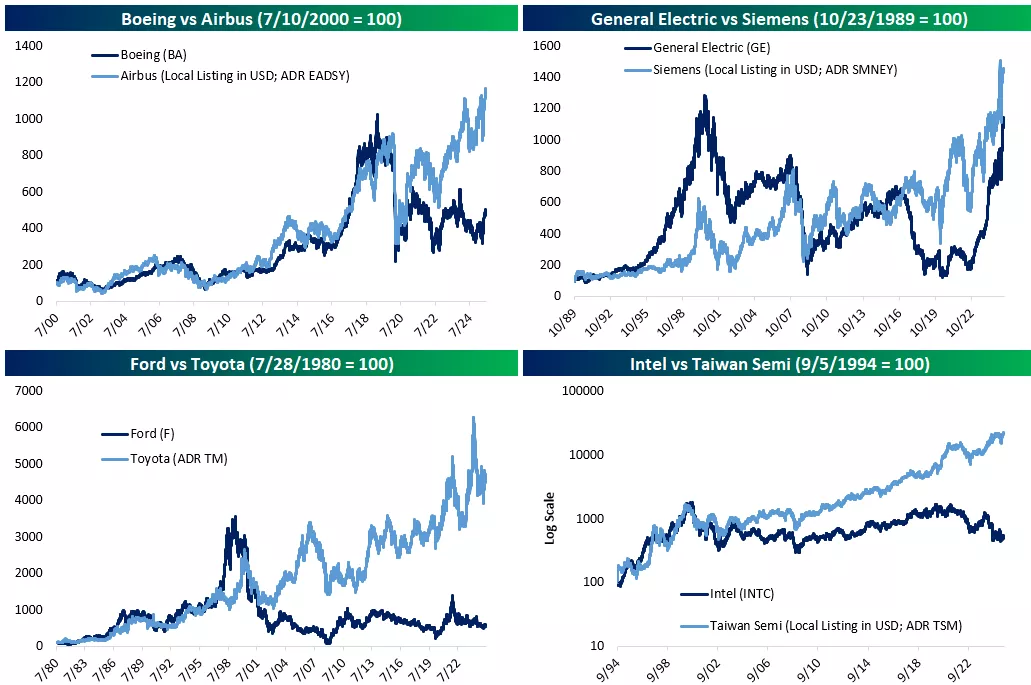

That can mask some surprisingly painful dynamics though. In the charts below we show four different US blue chip stocks that have historically been exemplars of American innovation and productive capacity. In each case, we compare them to a foreign stock with a similar history. As shown, these US blue chips have started to fall behind. Long before Boeing (BA) had to contend with the Air India crash that was a focus of headlines this morning and has shares down about 4% as-of this writing, it was already getting trounced by Airbus (ADR EADSY). Those stocks traded very similarly from 2000 through 2020, but have since diverged wildly as the American airliner OEM has fallen behind its European peer. General Electric (GE) is no longer a giant industrial conglomerate having spun off or sold dozens of businesses. It's now just an aircraft engine manufacturer, and while performance has been spectacular since 2022, over the long run it has clearly diverged from the performance of its German conglomerate peer Siemens (ADR SMNEY). A similar divergence dating back over 20 years is also visible for auto OEM Ford (F) and Japanese competitor Toyota (ADR TM). The worst divergence is at the cutting edge, with chip company Intel (INTC) diverging dramatically from the foundry business of Taiwan Semi (ADR TSM), which used to trade almost exactly the same as INTC.(Click image to enlarge.)

Of course these are just select examples, but we think they're instructive illustrations of how the massive earnings growth and price appreciation of the big "tech" stocks (not all are specifically Information Technology sector members) has hidden a lot of weakness in the US equity market under the hood. On the one hand, investors that own a broad index of stocks can protect themselves from this sort of dispersion by owning everything. That gives them a hedge: they get the benefits of what Austrian economist Joseph Schumpeter called "creative destruction" without assuming all strong performers go the way of the dodo. On the other, this dynamic illustrates the risks to the market from any long-term erosion of innovation. The blue chip winners of today will very likely become the laggards described above eventually, and without new dynamic companies to replace them, the US equity market (and maybe economy) will look much less attractive.

More By This Author:

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more