BlackBerry Is Sizzling

After reporting FQ3 earnings BlackBerry BBRY is sizzling. The company delivered revenue of $548 million and eps of -0.17. Revenue was up 12% sequentially and exceeded the $489 million analysts were expecting. Below is my take on the quarter:

Software And Services Was Impressive

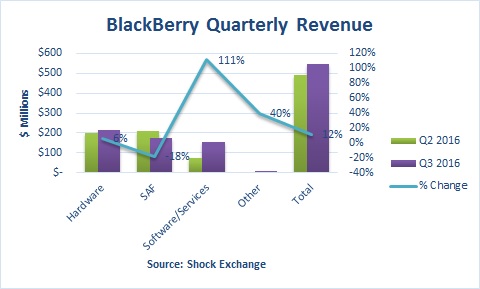

Total revenue was up 12% sequentially, while software and services more than doubled.

The story for BlackBerry over the past several quarters has been to find a way to offset SAF run-off. While SAF declined by $38 million (18% Q/Q), Software and services revenue more than doubled by $81 million to $154 million; of that, $53 million was from IP licensing, $81 million was organic, and about $20 million was from M&A activities.

Management expects Good Technology revenue of $160 over the next 12 months -- more than double the quarterly run-rate from M&A activities. The company's increase in gross margin from 38% last quarter to 43% this quarter was likely the result of the traction in software and services. Once the Good deal is integrated, I expect BlackBerry to potentially exceed the 40% margins management has targeted.

Priv Sizzled

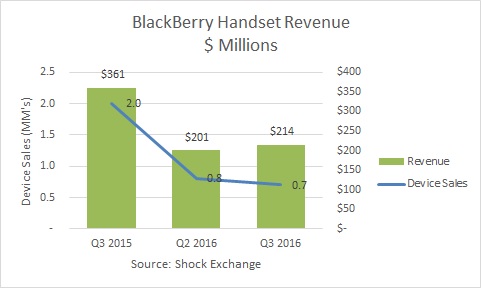

The company recognized revenue on 0.7 million devices, versus 0.8 million in the previous quarter. Average sales price ($306/unit) was up 22% versus $251 last quarter.

This is the first quarter since FQ2 2015 that hardware saw a sequential increase in revenue. Though management declined to give actual sales figures, I find it hard to believe that the improvement was not driven by the BlackBerry Priv.

The Priv is priced at $699 for an unlocked version, which could help account for the pick up in asp. By the end of FQ4 the Priv will be available in 31 countries, up from four this quarter. In channeling Nike's (NYSE:NKE) Jordan Brand marketing strategy, BlackBerry may be able to create the frenzied demand necessary to maintain the Priv's initial sizzle, and its premium price. Management anticipates sequential revenue growth for FQ4 and depending on the Priv's success, a potential for the hardware segment to finally break even.

Disclosure: I am long BBRY

Blackberry would be the major market upset if it is able to jump back in to the cellphone market in 2016. I believe it is the under-loved underdog that many people would love to see do well again. It lost a tremendous market share to Apple by not remaining competitive but I do see the potential if it gets it right. In terms of analyst opinions, the jury is out and not convinced that the stock will bounce back. Out of 29 analysts this month, the breakdown is as follows: Strong buy: 2, Buy: 1, Hold: 15, Underperform: 11, Sell: 0