Biggest Losers Bounce The Most

The near-term closing low for major US equity indices occurred back on January 27th. Since then, the average stock in the Russell 1,000 is up just under 7% through Friday morning. You can see the low made in the charts below of select ETFs like SPY, QQQ, and ARKK.

(Click on image to enlarge)

What we’ve seen since the January 27th low is a rip higher in the stocks that had been hit the hardest on a year-to-date basis up to that point. On January 27th, the bottom 10% of stocks in the Russell 1,000 in terms of YTD performance were already down an average of 33.3% on the year! As shown below, this decile of stocks has seen an average bounce back of 14.8% since January 27th. Conversely, the decile of stocks that had held up the best YTD through January 27th are up an average of 4.9% since 1/27.

(Click on image to enlarge)

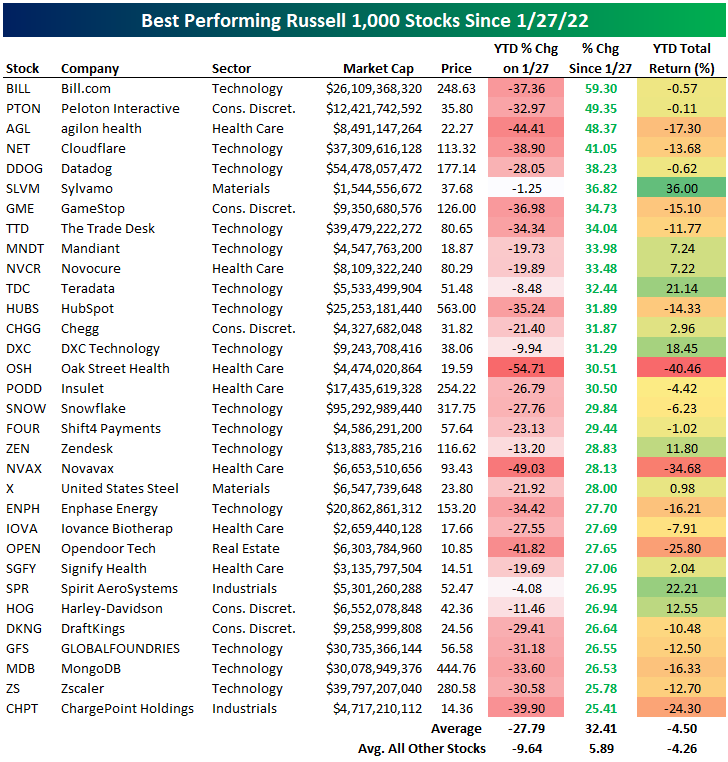

Below is a list of the 32 stocks in the Russell 1,000 that have rallied 25% or more since the January 27th close just over two weeks ago. At the top of the list is Bill.com (BILL) with a gain of 59.3%. Three other stocks have risen more than 40% — Peloton (PTON), agilon health (AGL), and Cloudflare (NET), while another 12 have risen more than 30%. Other notable stocks on the list include GameStop (GME), Chegg (CHGG), Snowflake (SNOW), Zendesk (ZEN), US Steel (X), Enphase Energy (ENPH), Harley-Davidson (HOG), DraftKings (DKNG), and ChargePoint (CHPT).

(Click on image to enlarge)

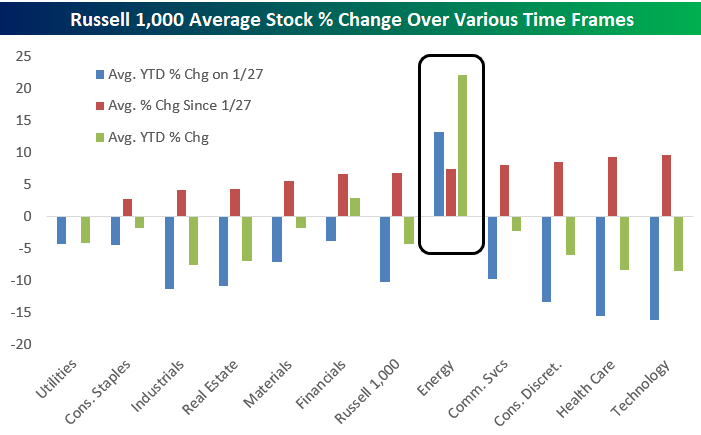

Below we show the average performance of Russell 1,000 stocks by sector over three different time frames: YTD through 1/27, since 1/27, and YTD through today. Technology stocks were down the most YTD on 1/27, they’ve bounced back the most since 1/27, and they’re still down the most YTD of any sector. The biggest standout is Energy, where the average stock is up over each of the three-time frames. Year-to-date, the average Energy sector stock is now up more than 22%. Financials is the only other sector that has seen the average stock post gains on a year-to-date basis.

Like these charts? See more stock market research from Bespoke by starting a two-week trial to Bespoke Premium ...

more