Beyond Meat Brings Home The Bacon

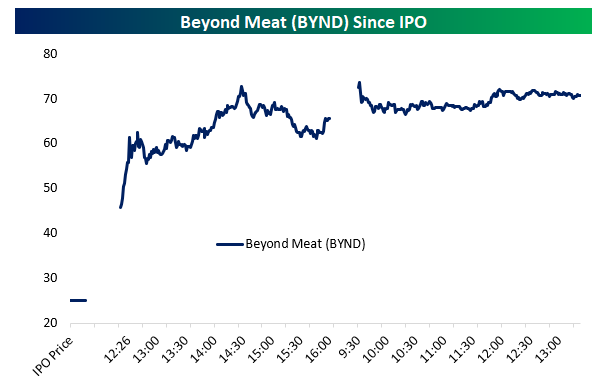

Yesterday Beyond Meat (BYND) IPO’d at $25/share, valuing the business at about $1.5bn versus trailing 12-month revenues of less than $70mm. The company has been operating in VC-funded private markets for a long time, developing meat alternatives appealing to the health conscious, climate-concerned, and animal welfare-oriented consumer base that wants “meat” without some of its negative externalities. While the pricing of the IPO sounds aggressive, price action since has been extreme. The stock has surged more than 180% from its IPO price, trading in the low-$70 range and holding opening day gains as-of this writing.

(Click on image to enlarge)

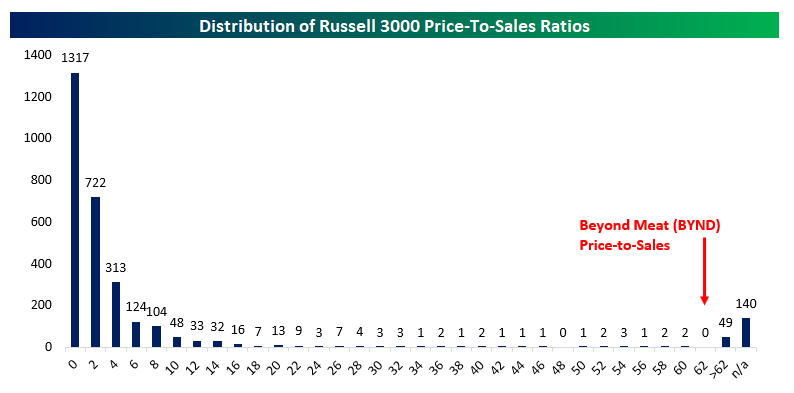

The nose-bleed 60.9x price-to-sales ratio BYND now carries sounds absolutely ridiculous, but there are actually 49 companies in the Russell 3000 with a more aggressive valuation and another 140 for which data is not available. Obviously, BYND’s valuation relative to its sales is extremely aggressive, but given its long history in the private markets, describing it as an extremely high-growth company isn’t without precedent among currently listed stocks in the US.

(Click on image to enlarge)

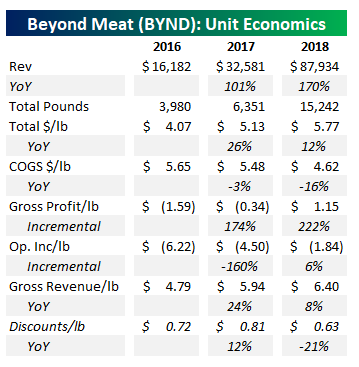

While it’s hard to get excited about a stock that has so much optimism priced in already, we should note that BYND’s economics don’t actually look as bad as some other IPOs and businesses we have come across. This is a real business, with real demand, what appears to be pricing power, and potential to grow very profitably. In the table below, we show annual data from Beyond Meat’s S1. Revenue has more than doubled the last two years, with the volume of meat substitute products rising by almost 5x in two years. As the company has scaled up its product offering, it has raised prices from an average net of $4.07 per pound to more than $5.70 per pound. At the same time, it has reduced discounting from 81 cents per pound in 2017 to 63 cents per pound this year.

On top of raised prices, the company has been able to reduce the cost of goods sold per pound, falling from $5.65 in 2016 to $4.62 today (down 16% YoY). Those positive economies of scale suggest that strong revenue growth will feed through to increasing profit margins. So far, that’s what’s happened: for each pound sold in 2016, BYND lost $1.59 on a gross basis, but gross profits rose by $1.74 for each additional pound sold in 2017 and by $2.22 cents per pound from 2017 to 2018. That’s led to gross profits of $1.15 per pound in 2018, and operating losses of $1.84 per pound in 2018. While the company used to lose money on each additional pond ($1.60 from 2016 to 2017), incremental pounds sold generated 6 cents of operating income per pound from 2017 to 2018. Assuming the company can keep up sales momentum and reduce costs across that higher volume, profitability is very attainable.

(Click on image to enlarge)

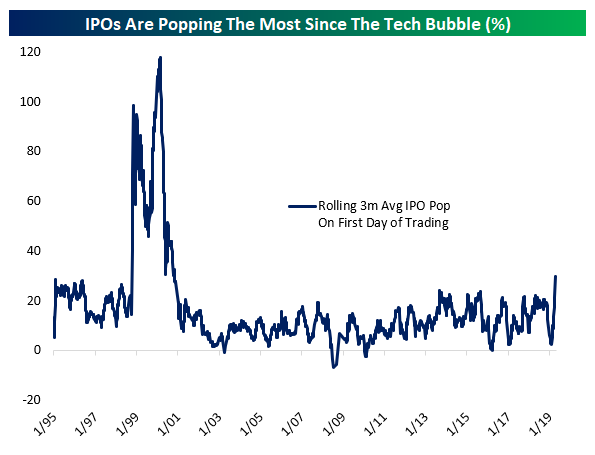

One last point on the BYND IPO: it’s part of a boom in average gain on the first day of trading. In the chart below we show the rolling three-month average gain from IPO price to the first close since 1995. The tech bubble really stands out on this chart! The average IPO went from a ~20% pop in the late 1990s to more than doubling! After 2001, pops returned to a much more normal 10-20% range, with some brief drops into negative territory during 2008, 2010, and 2016. With the most recent round of IPOs, though, we’ve seen the return of high average pops, and the current rolling three-month average has shot up to nearly 30%. That’s the highest since the tech bubble and highest for any period other than the tech bubble since 1995. So far, we’ve been pretty skeptical of claims that we’re in the same sort of period of market excess as the tech bubble (see “Best and Worst Performing IPOs” from April 23rd, link). This is one indicator, though, that points to the current IPO market being a little too hot. Other indicators, as discussed in that prior post, aren’t sending the same signal…for now, at least.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Premium to access our interactive earnings database and much ...

more