Best Performers Since 3/14 Pivot

Early last week, the US equity market pivoted, gaining 1%+ for four consecutive days between last Tuesday and last Friday (3/15-3/18). Sentiment has shifted amongst the investing community for the time being. For now, it seems that the market may have largely priced in some of the most hawkish Fed tightening scenarios. Remember, we already saw huge drops of 50%, 60%, 70%, even 80%+ in many of the most interest-rate sensitive growth stocks before the Fed even lifted off of 0%. How much further were investors expecting them to go?

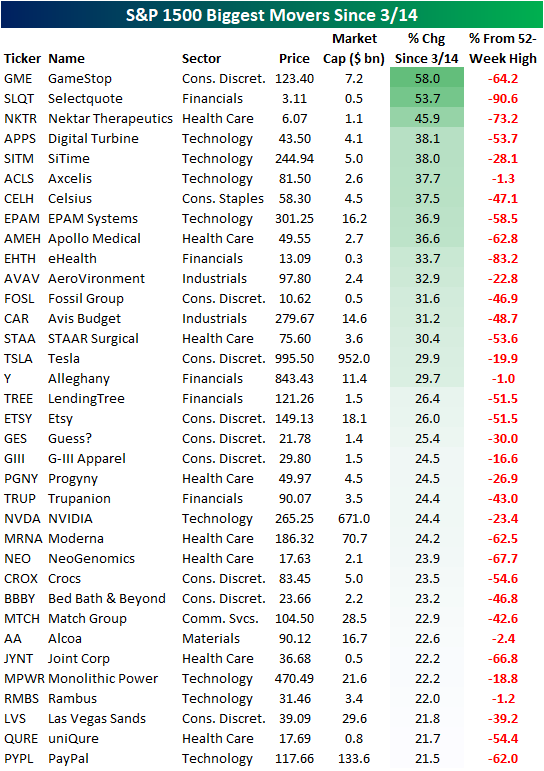

Since the 3/14 pivot, certain members of the S&P 1500 have already gained over 20% but still remain well off of 52-week highs. Of the top 35 performers since last Monday, the average stock is still 43.4% off of its 52-week highs (median: 47.1%). Although there is much recovery room left for many of these high-flyers, this is a move in the right direction. The top-performing stock since the 3/14 close is GameStop (GME), which has moved 58.0% higher on the back of a 30.9% move today. This may imply that investors have increased their risk appetite, or that retail investors viewed the dip as a buying opportunity, which would likely apply to the broader market from a retail perspective. Selectquote (SLQT) and Nektar Therapeutics (NKTR) rank immediately below GME, gaining 53.7% and 45.9% respectively. Both of these stocks are operating at a loss on the bottom line, which tells us that the risk-on trade has performed strongly over the last week. Other noteworthy names on the list include Tesla (TSLA), Avis Budget (CAR), Etsy (ETSY), NVIDIA (NVDA), and PayPal (PYPL).

Breaking this down further, the sectors that help up strongly in the face of a downturn earlier this year have performed the worst since the 3/14 pivot. Utilities and Energy members of the S&P 1500 have only gained 0.6% and 2.6% on average, respectively, since last Monday. On the other hand, Consumer Discretionary, Health Care, and Technology members of the S&P 1500 have gained 7.8%, 8.1%, and 10.6% on average, respectively. Based on the data below, the sectors most off their highs have rallied the most aggressively since the pivot, while the sector leaders from pre-3/14 have lagged.