Best And Worst Performers Since The COVID Crash Low

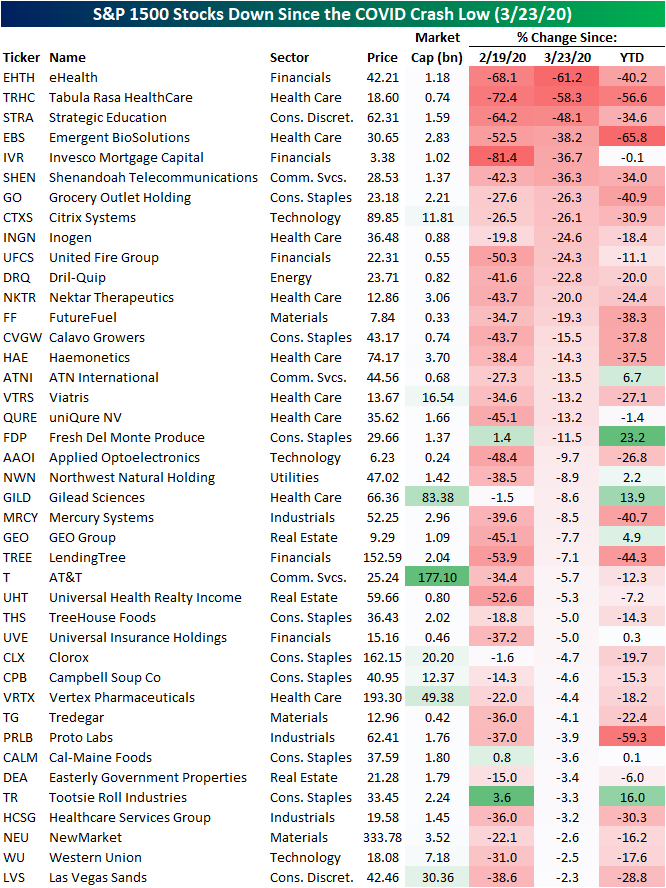

The major indices have consistently been hitting new record highs over the past few days with the S&P 500 having now more than doubled off the COVID Crash low on March 23, 2020. As for individual stocks, there are currently only nine S&P 500 stocks that are below their levels from March 23, 2020, and expanding the universe to the S&P 1500 which includes small and mid-caps, there are currently 41 stocks that are below their levels from that date. Obviously, March 23, 2020, may not coincide with a particularly high or low point on these individual stocks’ charts, but declines since then would be quite painful to handle given that the broad market has more than doubled over the same time frame.

As shown below, eHealth (EHTH) currently is the biggest decliner versus March 23, 2020 levels having fallen over 60% with a large share of that decline occurring this year. The only other stock that has been more than cut in half since the bear market low is Tabula Rasa HealthCare (STRA). TRHC has been declining since the spring, but a large share of that decline is actually occurring today after it reported an EPS and sales miss in addition to lowered guidance on earnings last night. Today, the stock has fallen nearly 50% in reaction to those weak earnings. There are a handful of stocks on this list that are up on a year-to-date basis with Fresh Del Monte Produce (FDP), Tootsie Roll Industries (TR), and Gilead Sciences (GILD) the only ones that are up double digits. While below their levels from the bear market low, TR and FDP are also two of the only stocks that are simultaneously above levels from February 19, 2020, which marked the last high prior to the start of the COVID Crash bear market.

As for the stocks that have gained the most since the COVID Crash low on 3/23/20, meme mania darling GameStop (GME) still tops the list having rallied 5,492%. That is twice the rally of the next best performer, SM Energy (SM). As for the rest of the top performers since the bear market low, there are another 15 that have gained over 1,000%. One of those is a member of the trillion-dollar market cap club: Tesla (TSLA). Another one of these top performers, Tupperware Brands (TUP), is also one of the only stocks that is actually lower on a year-to-date basis, and those declines are significant at a 43.81% loss.TUP got below $2/share at its lows during the COVID Crash, but then surged back into the mid-$30s in late 2020. It has since moved back down into the teens.