Beaten Down Blue Chips

While major US equity indices are now back to all-time highs, not everything has been working in the market lately, especially the list of stocks we're going to share with you today.

The S&P 100 is made up of the largest publicly-traded stocks in the US, and while the mega-caps like Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) have been driving this blue-chip index higher, there are other names in the index that have been left behind over the last few years.

Below we're going to go through the eleven stocks in the S&P 100 that are down at least 20% over each of the last 2 years and the last 3 years. Let's get started...

Charter Communications (CHTR)

Description: Broadband connectivity company and cable operator serving more than 32 million customers in 41 states through its Spectrum brand.

Sector: Communication Services

Market Cap: $64 billion

Dividend Yield: None

Next Year Est. P/E Ratio: 9.9

2-Year % Change: -34.1%

3-Year % Change: -43.1%

Disney (DIS)

Description: American multinational mass media and entertainment conglomerate.

Sector: Communication Services

Market Cap: $171 billion

Dividend Yield: 0.64%

Next Year Est. P/E Ratio: 17.9

2-Year % Change: -30.6%

3-Year % Change: -44.9%

General Motors (GM)

Description: American multinational automotive manufacturing company.

Sector: Consumer Discretionary

Market Cap: $47.5 billion

Dividend Yield: 1.04%

Next Year Est. P/E Ratio: 4.56

2-Year % Change: -32.3%

3-Year % Change: -34.2%

3M (MMM)

Description: American multinational conglomerate operating in the fields of industry, worker safety, healthcare, and consumer goods.

Sector: Industrials

Market Cap: $51.5 billion

Dividend Yield: 6.44%

Next Year Est. P/E Ratio: 9.24

2-Year % Change: -46.3%

3-Year % Change: -45.3%

NextEra Energy (NEE)

Description: American energy company with about 58 GW of generating capacity, revenues of over $18 billion in 2020, and about 14,900 employees throughout the US and Canada.

Sector: Utilities

Market Cap: $115.4 billion

Dividend Yield: 3.28%

Next Year Est. P/E Ratio: 15.7

2-Year % Change: -23.4%

3-Year % Change: -33.8%

Nike (NKE)

Description: American athletic footwear and apparel corporation.

Sector: Consumer Discretionary

Market Cap: $152.7 billion

Dividend Yield: 1.47%

Next Year Est. P/E Ratio: 23.6

2-Year % Change: -30.5%

3-Year % Change: -26.5%

Pfizer (PFE)

Description: American multinational pharmaceutical and biotechnology corporation.

Sector: Health Care

Market Cap: $160.0 billion

Dividend Yield: 5.93%

Next Year Est. P/E Ratio: 12.1

2-Year % Change: -47.3%

3-Year % Change: -25.8%

PayPal (PYPL)

Description: American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers; it serves as an electronic alternative to traditional paper methods such as checks and money orders.

Sector: Financials

Market Cap: $67.9 billion

Dividend Yield: None

Next Year Est. P/E Ratio: 11.25

2-Year % Change: -59.9%

3-Year % Change: -74.4%

Target (TGT)

Description: American retail corporation that operates a chain of department stores.

Sector: Consumer Staples

Market Cap: $64.3 billion

Dividend Yield: 3.16%

Next Year Est. P/E Ratio: 15.37

2-Year % Change: -35.2%

3-Year % Change: -26.8%

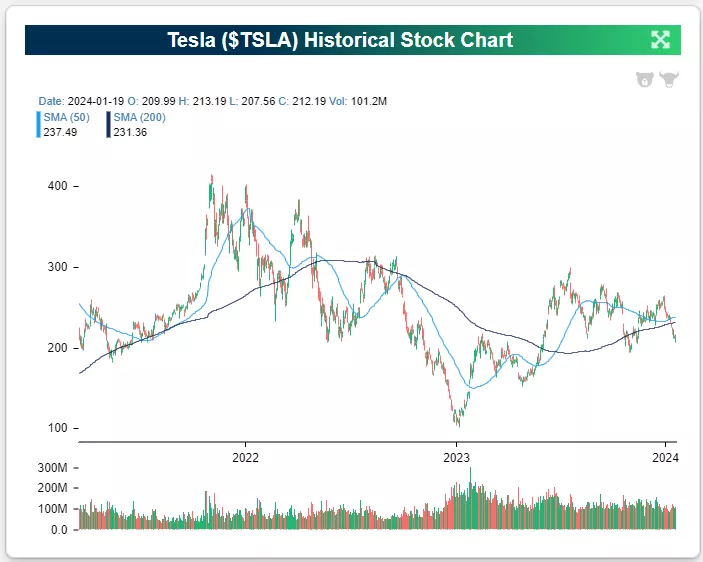

Tesla (TSLA)

Description: American multinational EV automotive and clean energy company.

Sector: Consumer Discretionary

Market Cap: $660.7 billion

Dividend Yield: None

Next Year Est. P/E Ratio: 38.9

2-Year % Change: -32.1%

3-Year % Change: -29.2%

Verizon (VZ)

Description: American multinational telecommunications conglomerate.

Sector: Communication Services

Market Cap: $173.5 billion

Dividend Yield: 6.44%

Next Year Est. P/E Ratio: 8.93

2-Year % Change: -22%

3-Year % Change: -29.3%

Below is a table listing each of the eleven beaten-down blue chips we've highlighted above. As shown, the average stock on this list has a market cap of $157 billion with a 3.55% dividend yield and an estimated next-year P/E ratio of 15.2x. It's also down an average of 35% over the last two years and 37% over the last three years. Given that these are all established, well-known large-cap companies, we think they're certainly worth at least a closer look here given how extended some of the other areas of the market are right now.

More By This Author:

Sliding Down On The Market Cap Ladder

Nonstop Nasdaq

Stocks And Politics

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more