Bear Of The Day: Meta Platforms, Inc.

Image Source: Pixabay

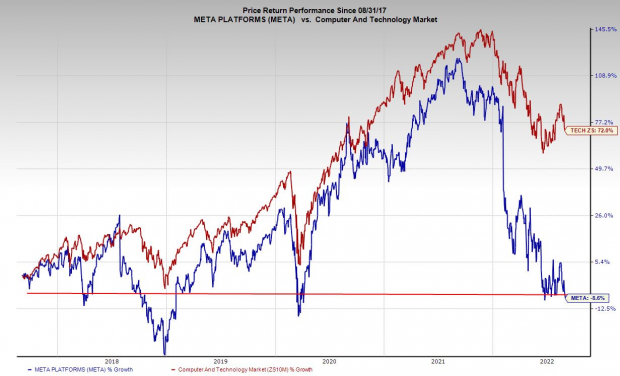

Mark Zuckerberg’s company has been on a wild ride since it decided to change its name from Facebook to Meta Platforms, Inc. (META - Free Report) last year.

Things have not gone well for Meta in 2022, and its outlook turned a lot worse after it reported its second-quarter results at the end of July.

Identity Crisis?

Zuckerberg announced last October that his social media company which owns Facebook, Instagram, WhatsApp, and more would soon be known as Meta Platforms. The firm is currently pouring billions of dollars and tons of resources into the metaverse, betting that people will eventually live some of their lives in a new digital world via avatars.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The metaverse reality is still years off and it might not ever come to fruition. In the here and now, Meta’s traditional social media apps are being negatively impacted by Apple’s (AAPL - Free Report) privacy changes that require apps to ask users whether they want to be tracked.

Meta said when it reported its Q4 FY21 results that Apple’s tracking changes could cost it $10 billion in lost sales in 2022 alone. Apple’s changes have impacted Snap and countless others. Things haven’t improved much since then as advertisers also pull back on spending across the digital economy amid an economic slowdown.

Most recently, the parent company of Facebook and Instagram reported its first-ever decline in revenue, with sales down around 1%. The company also fell short of our EPS estimate and provided downbeat guidance.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

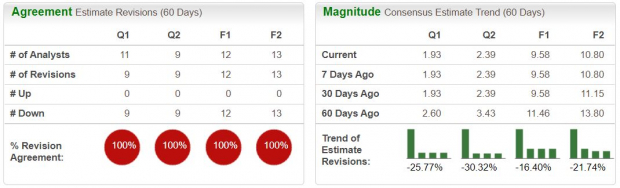

The nearby chart showcases how far Meta’s FY22 and FY23 consensus EPS estimates have fallen, down 16% and 22%, respectively. Meta’s downward earnings revisions help it land a Zacks Rank #5 (Strong Sell) right now.

Zacks estimates call for Meta’s revenue to dip 1.3% in 2022, with it projected to post 11% higher sales in 2023. But its days of 20% or more sales growth might be over, at least for now. Meanwhile, its adjusted earnings are projected to fall by 30% this year and only climb 13% in FY23 to come in well short of its FY21 levels.

Meta is still a strong company with 2022 sales set to top $115 billion in a down year. Meta also boasts an impressive balance sheet and reaches billions of people a day via its various platforms.

Still, investors might want to stay away from Meta for the moment because Wall Street is dumping it amid all of the digital ad fears, TikTok competition worries, and its big bets on the metaverse.

More By This Author:

Bear Of The Day: Garmin Ltd.

Is Netflix A Value Stock Ahead Of Earnings?

Bull Of The Day: Sysco Corporation

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more