Bear Of The Day: Cal-Maine Foods, Inc

Cal-Maine Foods (CALM) produces, packages, and distributes shell eggs. The company offers specialty shell eggs such as nutritionally enhanced, cage free, organic, and brown eggs under recognized brand names including Egg-Land’s Best, Land O’ Lakes, Farmhouse Eggs, and 4-Grain. CALM markets and sells its products to national and regional grocery store chains, club stores, independent supermarkets, and foodservice distributors. Cal-Maine Foods was founded in 1957 and is based in Ridgeland, MS.

The Zacks Rundown

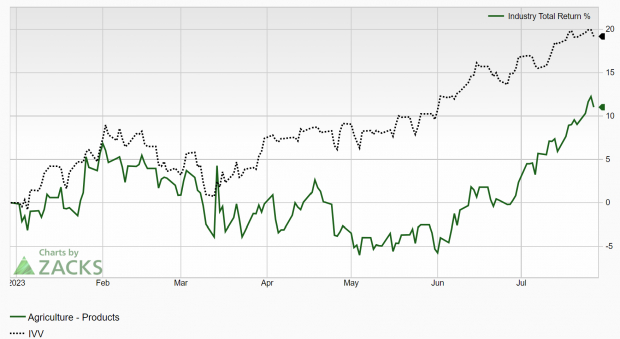

CALM, a Zacks Rank #5 (Strong Sell), is a component of the Zacks Agriculture – Products industry group, which ranks in the bottom 10% out of more than 250 Zacks Ranked Industries. As such, we expect this industry group as a whole to underperform the market over the next 3 to 6 months, just as it has throughout this year:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Candidates in the bottom tiers of industries can often be solid potential short candidates. While individual stocks have the ability to outperform even when included in a poorly-performing industry group, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much more difficult.

The odds are stacked against CALM, and the stock is agreeing with this notion. CALM shares experienced a climax top in December of last year and have been in a price downtrend ever since. The share price is hitting a series of lower lows and represents a compelling short opportunity as the stock continues to lag the major market indexes.

Deteriorating Outlook

Cal-Maine Foods has been on the receiving end of negative earnings estimate revisions as of late. For the current quarter (fiscal Q1), the Zacks Consensus EPS Estimate sits at a loss of -$0.01/share, reflecting a -100.39% decline relative to the same quarter last year.

For the current fiscal year, analysts have also revised their EPS estimates downward by 13.93% in the past 60 days. The Zacks Consensus Estimate is now $4.20/share, translating to negative growth of -72.94%. Falling earnings estimates are a huge red flag and need to be respected. Negative growth year-over-year is the type of trend that bears like to see.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Trend

As illustrated below, CALM stock is in a sustained downtrend. Notice how the stock has plunged below both the 50-day and 200-day moving averages signaled by the blue and red lines, respectively. The 50-day moving average has recently acted as resistance and shares are currently testing that level. The stock is making a series of lower lows, with no respite from the selling in sight. Also note how both moving averages have rolled over and are sloping down – another good sign for the bears.

(Click on image to enlarge)

Image Source: StockCharts

While not the most accurate indicator, CALM stock has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. CALM would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. The stock has fallen nearly 10% this year alone, widely underperforming the major indices.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to hit new highs anytime soon. The fact that CALM is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns. Falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear of CALM shares until the situation shows major signs of improvement.

More By This Author:

These 3 Quarterly Releases Positively Shocked The Market

Low-Volatility ETFs InFocus

2 Intriguing Tech Stocks To Consider As Earnings Approach

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more