Bear Of The Day: Avis Budget Group, Inc.

Avis Budget Group, Inc.’s (CAR) earnings outlook has tumbled in 2024 and its most recent/most accurate EPS estimates came in well below its already beaten-down consensus.

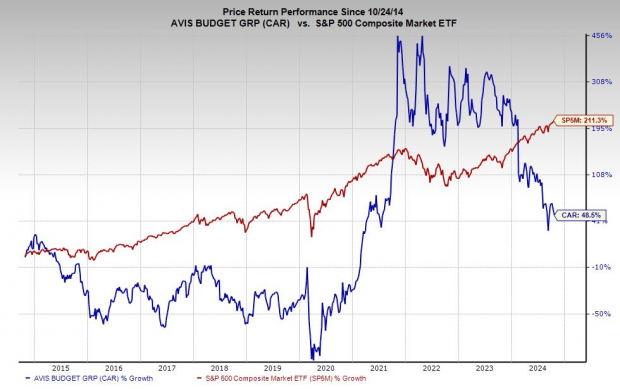

The car rental titan’s stock has tumbled 60% in the last two years and it doesn’t look like investors should attempt to buy into Avis Budget just yet.

Avis Budget Stock 101

Avis Budget boasts roughly 10,250 rental locations in around 180 countries under its Avis and Budget brands. Avis Budget directly operates most of its car rental locations in North America, Europe, and Australasia. Outside of those regions, Avis Budget works primarily through licensees.

(Click on image to enlarge)

Image Source: Zacks Investment Research

On top of its core Avis and Budget segments, CAR’s Zipcar brand is one of the largest car-sharing companies in the world.

The vehicle rental space is an extremely competitive industry, marked by intense price and service competition. Avis Budget's primary competitors include Enterprise Holdings, Inc. (Enterprise, National, and Alamo brands), Hertz Global Holdings, Inc. (HTZ) (Hertz, Dollar, and Thrifty brands), and many others.

The company’s total expenses jumped 20.8% YoY in 2023, and Zacks estimates call for expenses to climb by 15.6% in 2024. Avis Budget’s expenses have surged on the back of high fleet costs, with Per-Unit Fleet Costs per Month up 104% YoY to in the first six months of 2024 (up 131% in its Americas region).

(Click on image to enlarge)

Image Source: Zacks Investment Research

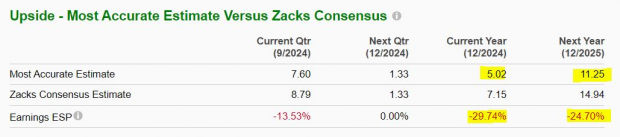

Avis Budget missed our adjusted Q2 earnings per share estimate by 84% YoY.

Zacks estimates call for CAR’s adjusted EPS to fall by 83% YoY from $42.08 a share last year to $7.15 per share in 2024. CAR’s adjusted earnings already dropped 26% in 2023 and its most accurate/recent EPS estimate for FY24 came in 30% below consensus—$5.02 a share vs $7.15.

Stay Away from CAR Stock?

On top of that, Avis Budget’s most accurate/recent EPS estimate for FY25 is 25% below consensus. Avis Budget’s downward earnings revisions help it earn a Zacks Rank #5 (Strong Sell) right now.

Avis Budget stock has tumbled 60% in the past two years, helping it give up a large chunk of its massive post-Covid selloff gains. CAR trades miles below its 200-week moving average, and Avis Budget is back below its 50-day following a recent pop.

Investors might want to stay away from Avis Budget stock until it proves that its earnings outlook isn’t going to keep fading.

More By This Author:

3 Growth Tech Stocks To Buy And Hold: VRT, SPOT, APPF

Bull of the Day: Willdan Group, Inc.

Under-The-Radar Stocks To Buy To Profit From This Wall Street Megatrend

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more