Bear Of The Day: Archer Daniels Midland

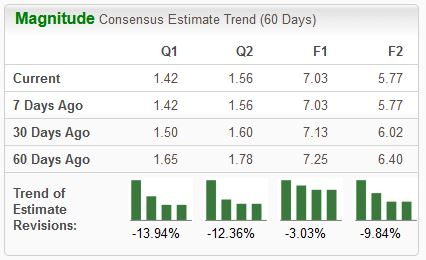

Archer Daniels Midland (ADM) is one of the leading producers of food and beverage ingredients as well as goods made from various agricultural products. Analysts have lowered their earnings expectations over the last several months, pushing the stock into a Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, the company resides in the Zacks Agriculture – Operations industry, which is currently ranked in the bottom 4% of all Zacks industries (242/250). Let’s take a closer look at how the agriculture giant currently stacks up.

Archer Daniels Midland

ADM shares have had a rough showing over the last year, losing more than 30% in value and widely underperforming relative to the general market. News of the company suspending its CFO over accounting practices near the end of January caused shares to nosedive, as we can see highlighted below.

It was the biggest one-day drop for the stock (-24%) since all the way back in 1929.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares have seen modest buying pressure since, up a slight 2.5%. Nonetheless, the unfavorable coverage has certainly weighed heavily on investors’ sentiment and will remain a hurdle for the company to clear.

Bottom Line

Negative earnings estimate revisions from analysts and a recent suspension of its CFO paint a challenging picture for the company’s shares in the near term.

Archer Daniels Midland is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

More By This Author:

Bull Of The Day: The Progressive Corp

5 Consumer Staple Stocks To Buy Amid Ongoing Market Volatility

3 Stocks To Watch From The Prospering Computer Industry

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook ...

more