Bull Of The Day: The Progressive Corp

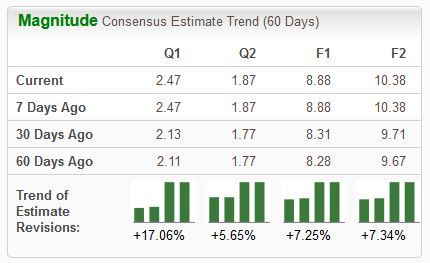

The Progressive Corp, (PGR), a current Zacks Rank #1 (Strong Buy), is a massive American insurance company. Analysts have taken their expectations higher across the board.

Image Source: Zacks Investment Research

In addition to favorable earnings estimate revisions, the company resides within the Zacks Insurance – Property & Casualty industry, currently ranked in the top 20% of all Zacks industries. Let’s take a deeper look at the company.

Progressive

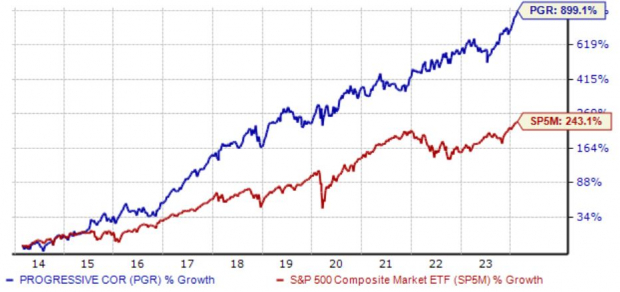

Right off the bat, it’s worth noting that Progressive shares have been monster performers in general over the last decade, delivering a remarkable 25% annualized return vs. the S&P 500’s 13.1%. Shares got a solid boost following its latest set of quarterly results.

(Click on image to enlarge)

Image Source: Zacks Investment Research

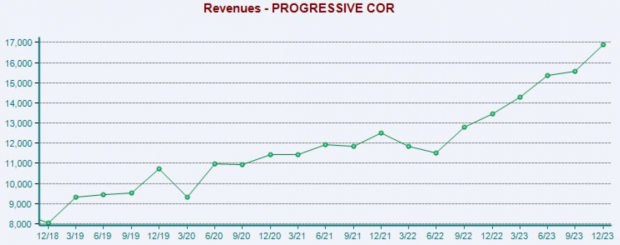

Concerning the above-mentioned quarter, PGR exceeded the Zacks Consensus EPS estimate by 24% and posted a 3% revenue beat, reflecting growth rates of 97% and 23%, respectively. Drilling a bit deeper, Progressive saw total Policies in Force grow 9% from the year-ago period, reflecting continued business momentum.

The company’s top line performance has been strong, with revenues enjoying a recent acceleration.

(Click on image to enlarge)

Image Source: Zacks Investment Research

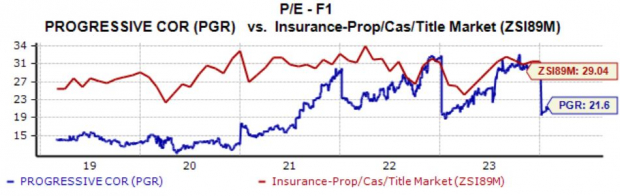

In addition, shares aren’t overly stretched regarding valuation given the company’s growth, with the current 21.6X forward earnings multiple (F1) comparing favorably to the Zacks industry average of 29.0X. PGR is forecasted to enjoy 45% earnings growth on 15% higher sales in its current year (FY24), with FY25 expectations alluding to an additional 17% bump in earnings paired with a 12% revenue boost.

The stock carries a Style Score of ‘A’ for Growth and a Style Score of ‘D’ for Value.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Income-focused investors could also be attracted to PGR shares, currently yielding a respectable 0.4% annually paired with a sustainable payout ratio sitting at 6% of its earnings.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

The Progressive Corp. (PGR) would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

5 Consumer Staple Stocks To Buy Amid Ongoing Market Volatility

3 Stocks To Watch From The Prospering Computer Industry

Don't Overlook These Low-Risk High-Dividend Yielding Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more