Be Mindful Of Potential Sell-Off As Market Is Too Expensive Now

Wall Street is anticipating a "Santa Claus Rally" during the final trading days of the year and the first two days of the new year. Historically, the S&P 500 has shown an average gain of 1.3% since 1969. However, the absence of such a rally is seen as a potential indicator of poor stock performance, often preceding bear markets or times when stocks can be purchased at lower prices later in the year.

Failure of the Santa Claus Rally has been associated with flat years and bear markets. The term was originally coined by Yale Hirsch, the Stock Trader’s Almanac founder, who famously stated, "If Santa Claus should fail to call, bears may come to Broad and Wall."

Despite the current leg up in stocks, we still express caution and believe that the current breakout might be a setup for a classic bull trap rather than the start of a larger breakout campaign. Factors contributing to this cautious outlook include low volatility, oversold levels in yields, and divergences within indicator work.

Looking into the new year with a reversal and a negative surprise in the first quarter, we expect the S&P 500 to trade at 4,300, around 8% lower than the recent closing level. The market’s pricing of as many as six rate cuts from the Fed next year was a bit off, as we don’t think there’s a particularly meaningful slowdown in the U.S.

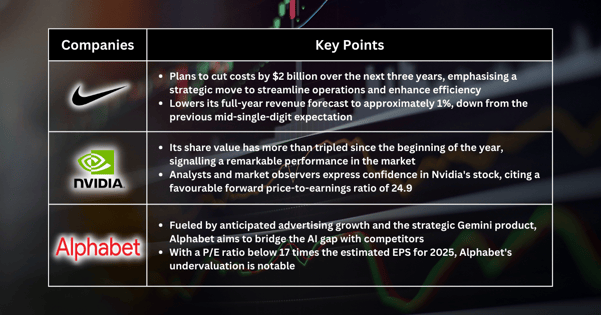

Nike: Headwind ahead as sales slow (NKE)

Nike unveiled plans to cut costs by about $2 billion over the next three years as it lowered its sales outlook. It now expects full-year reported revenue to grow approximately 1%, compared to a prior outlook of up mid-single digits. In the current quarter, which includes the second half of the holiday shopping season, Nike expects reported revenue to be slightly negative as it laps tough prior-year comparisons and sales to be up low single digits in the fourth quarter.

The new negative outlook reflects increased macro headwinds, particularly in Greater China and EMEA, based on recent digital traffic softness and higher marketplace promotions, life cycle management of key product franchises, and a stronger U.S. dollar that has negatively impacted second-half reported revenue versus 90 days ago.

Nvidia: still attractive for the new year (NVDA)

Nvidia has experienced an impressive surge in its share value, more than tripling since the beginning of the year. Despite the notable surge, analysts and market observers maintain that there is still considerable value to uncover in Nvidia's stock.

One key metric supporting the optimistic outlook is the chipmaker's forward price-to-earnings ratio, which stands at 24.9. This ratio indicates the market's expectations for future earnings growth, and a relatively moderate P/E suggests that investors are willing to pay a reasonable price for anticipated future earnings.

As the new year approaches, Nvidia continues to capture the favor of analysts—confidence in the company's future performance within the competitive semiconductor industry. Furthermore, NVDA is still the best way to play AI, emphasizing Nvidia's strategic position in the burgeoning field of artificial intelligence. Despite Nvidia's remarkable stock performance throughout the year, the forward P/E ratio and analysts' optimistic forecasts suggest that the company remains well-positioned for further growth.

Alphabet: Undervalued (GOOG)

We favor Alphabet, the parent company of Google, driven by an anticipated improvement in advertising growth and the positive impact of Alphabet's Gemini product, which is expected to help the company close the AI gap with its competitors.

One key factor contributing to the positive outlook is the perception that Alphabet is currently experiencing weaker sentiment and is less widely owned than other mega-cap stocks. The analyst highlights an undemanding valuation for Alphabet, with a P/E ratio below 17 times the estimated EPS for 2025, pegged at $8.03.

The undemanding valuation becomes particularly noteworthy as it is juxtaposed against the potential for robust growth in advertising and the strategic positioning of Alphabet's Gemini product.

While acknowledging the potential for antitrust resistance, we are confident that any challenges Alphabet may face in this regard will be less burdensome than initially feared. This indicates a belief that Alphabet can navigate regulatory hurdles and continue its growth trajectory, potentially alleviating concerns that have weighed on the stock.

More By This Author:

Tech Stocks Surge As Fed Signals Three Rate Cuts In 2024

Market Bull Run May Pause as Fed’s Powell May Make a Big Mistake

Survey Shows Stock Sentiment Weakening, But AI Race Could Be The Opportunity

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more