Survey Shows Stock Sentiment Weakening, But AI Race Could Be The Opportunity

Investors have been focused on jobs data as initial jobless claims reported on Thursday were 220,000 while continuing claims came in at 1.861 million.

The market is clinging to each data point to see if the economy can continue with this Goldilocks scenario where the labor market cools just enough to take pressure off wages but not tip the market into a recession.

Let us look at the market sentiment. The percentage of individual investors who are pessimistic over the six-month outlook for stocks jumped to 27.4% in the latest survey from the American Association of Individual Investors (AAII), up from 19.6% last week — which had marked the fewest bears since January 2018.

The ranks of bullish investors dipped to 47.3% in the latest week, the first time they’d fallen in five weeks, and down from 48.8% last week — which had marked the greatest number of optimists only since last August. Bulls, on average, are at 37.5%. Optimists have been above this average for the past five weeks and six out of the past nine weeks.

The AAII characterized the latest sentiment readings as returning “to their respective typical ranges.”

Tech stocks rallied sharply this week, with Alphabet advancing more than 5% after the company announced its Gemini AI model. AMD popped nearly 10% a day after the semiconductor company announced its newest AI chip – and Meta and Microsoft said they would use it.

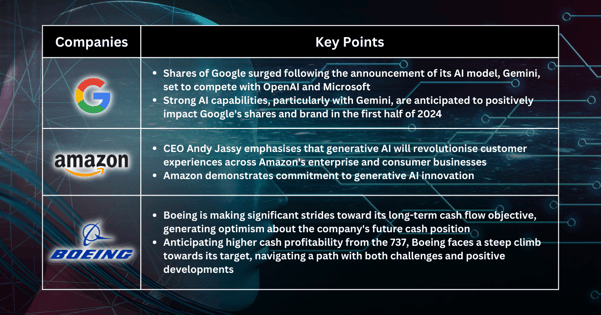

Google: New AI Model Is A Game Changer? (GOOG)

Shares of Google jumped after the company announced that its latest artificial intelligence model, Gemini, will compete with products from OpenAI and Microsoft.

Alphabet has been under pressure from concerns over Google’s AI capabilities this year, so a well-branded, competitive model could have upsides for its consumer search activity and Cloud enterprise sales.

We think Google has strong AI capabilities, and data suggesting that Google has best-in-class, proprietary AI capabilities can be positive for the shares in 1H 24.

Amazon: Generative AI will change every customer experience (AMZN)

Amazon CEO Andy Jassy said generative artificial intelligence will change the customer experience in the company’s enterprise and discretionary consumer business.

He said Generative AI is going to change every customer experience, and it is going to make it much more accessible for everyday developers, and even business users, to use.

Amazon Web Services announced in June it would invest $100 million in a center to help companies use generative AI. In late November, the company launched a new chatbot called Q, its latest effort to keep up with rival tech giants Microsoft and Google in the productivity software field.

Boeing: Traveling demand and its cashflow position may push prices higher (BA)

Boeing is progressing well toward its long-term cash flow goal. It is crucial to be optimistic about the company's future cash situation in a high-interest-rate environment.

Out-year cash profitability should be considerably higher as some headwinds reverse, so we buy into the idea that 737 can contribute meaningfully to its revenue growth; however, it is a steep climb from today’s 737 profitability to Boeing’s target, and the path will likely include ups and downs.

More By This Author:

FOMC Meeting Looms Large Following Strong NFP PerformanceGold Prices Surpass $2,100, Signaling Prolonged Upside In 2024

Stock Momentum Persists Amid Overwhelming Expectations For Fed Rate Cut

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more