Bank Earnings Looming: What Can Investors Expect?

Image Source: Pexels

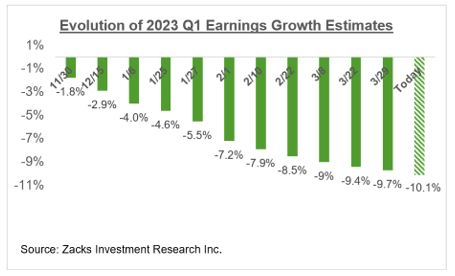

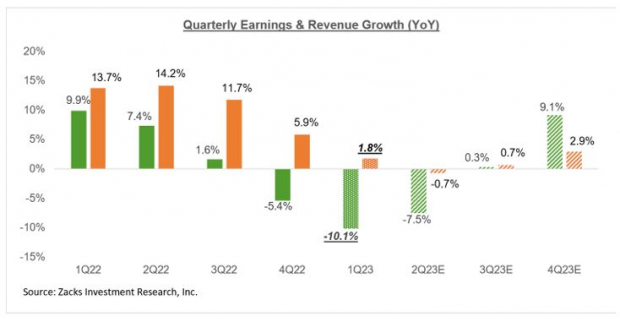

For 2023 Q1, S&P 500 earnings are expected to decline -10.1% from the same period last year on +1.8% higher revenues.

As has been the case in recent quarters, estimates for 2023 Q1 have been steadily coming down, as the chart below shows.

Image Source: Zacks Investment Research

Please note that the magnitude of cuts to Q1 estimates is relatively modest compared to what we saw in the comparable periods for the preceding two quarters. That said, estimates have come down across the board for most sectors.

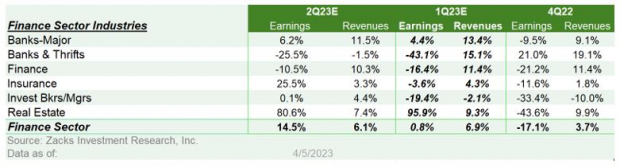

The Finance sector, which dominates the initial phase of each reporting cycle, enjoyed modest upward revisions to estimates in the first two months of the quarter, but estimates started to come down as the regional banking crisis took hold following the Silicon Valley Bank episode.

The Finance sector as a whole is expected to show +0.8% earnings growth in Q1 on +6.9% higher revenues, which would follow the -17.1% earnings decline on +3.7% higher revenues in 2022 Q4.

The Major Banks industry, which includes JPMorgan (JPM - Free Report) and Citigroup (C - Free Report) that will kick-start the Q1 reporting cycle for the group on April 14th, is expected to bring in +4.4% more earnings in the period on +13.5% higher revenues. The table below shows the Q1 earnings and revenue expectations for the Finance sector’s constituent industries.

Image Source: Zacks Investment Research

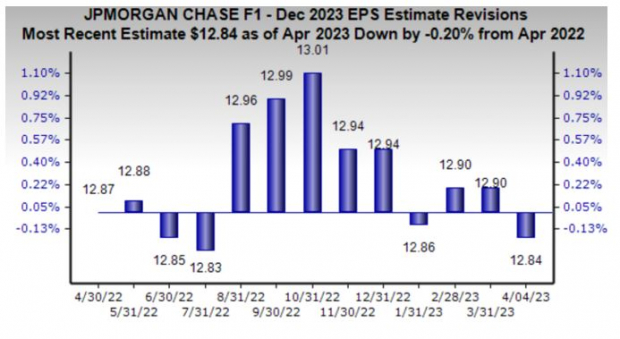

Q1 Earnings estimates for JPMorgan and Citigroup haven’t changed much, with the current $3.43 EPS estimate down a hair from $3.44 on March 17th but up from $3.42 on January 13th. The current JPM estimate for full-year 2023 has modestly come down, as the chart below shows.

Image Source: Zacks Investment Research

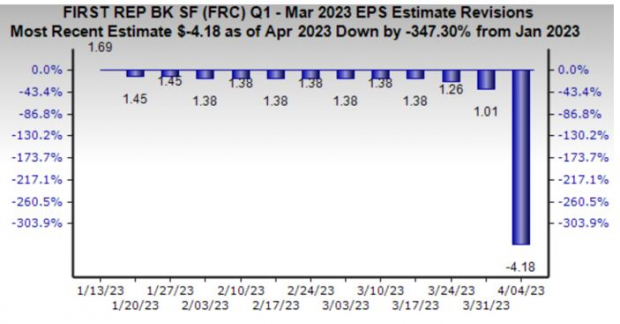

While Q1 EPS estimates for JPMorgan and Citigroup haven’t moved much, the same for First Republic (FRC Quick QuoteFRC - Free Report) have literally fallen off a cliff, as the chart below shows.

Image Source: Zacks Investment Research

The First Republic example is by no means representative of the broader regional banks space, but it does go on to show that the profitability picture for parts of the regional banks industry has really taken a hit in the wake of the Silicon Valley development.

The big money-center banks like JPMorgan and Citigroup will enjoy strong net-interest income growth as a result of growing loan portfolios and expanded margins. But those gains will mostly get offset by weakness in investment banking and other fee activities. Credit quality still remains favorable by historical standards, though delinquencies are bound to increase as the economic cycle turns down. Some of that will show up in provisions for loan losses in these quarterly reports, as it did in the preceding quarterly reporting cycle.

The Earnings Big Picture

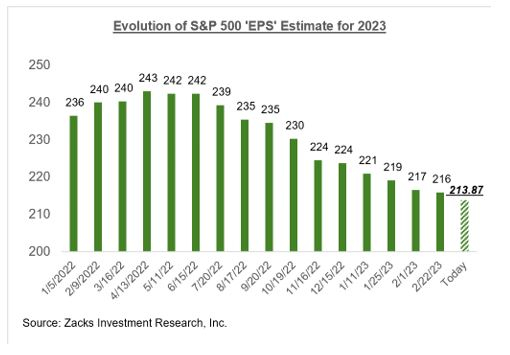

The chart below shows the evolution of aggregate earnings estimates for 2023 since the start of 2022.

Image Source: Zacks Investment Research

As noted earlier, the current aggregate earnings total for the index approximates to an index ‘EPS’ of $213.78, down from $242.98 in mid-April, 2022.

The chart below tracks these index ‘EPS’ values since the start of 2022. Please note that these ‘EPS’ values are imputed approximations and have been previously published on the dates listed in the chart below.

Image Source: Zacks Investment Research

The chart below provides a big-picture view of earnings on a quarterly basis. The growth rate for Q4 is on a blended basis, where the actual reports that have come out are combined with estimates for the still-to-come companies.

Image Source: Zacks Investment Research

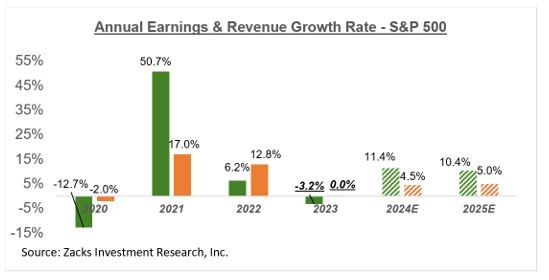

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As mentioned earlier, 2023 aggregate earnings estimates on an ex-Energy basis are already down by more than -14% since mid-April 2022. Perhaps we see a bit more downward adjustments to estimates over the coming weeks after more companies report quarterly results and provide guidance. But we have nevertheless already covered some ground in taking estimates to a fair or appropriate level.

This is particularly so if whatever economic downturn lies ahead proves to be more of the garden variety rather than the last two such events. Recency bias forces us to use the last two economic downturns, which were also among the nastiest in recent history, as our reference points. But we need to be cautious against that natural tendency as the economy’s foundations at present remain unusually strong.

More By This Author:

Breaking Down Upcoming Bank Earnings

Analyzing The Evolving Q1 Earnings Landscape

Analyzing Banking Woes And The Shifting Earnings Landscape

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more