Banco De Chile - Great South Of The Border Investment

Summary

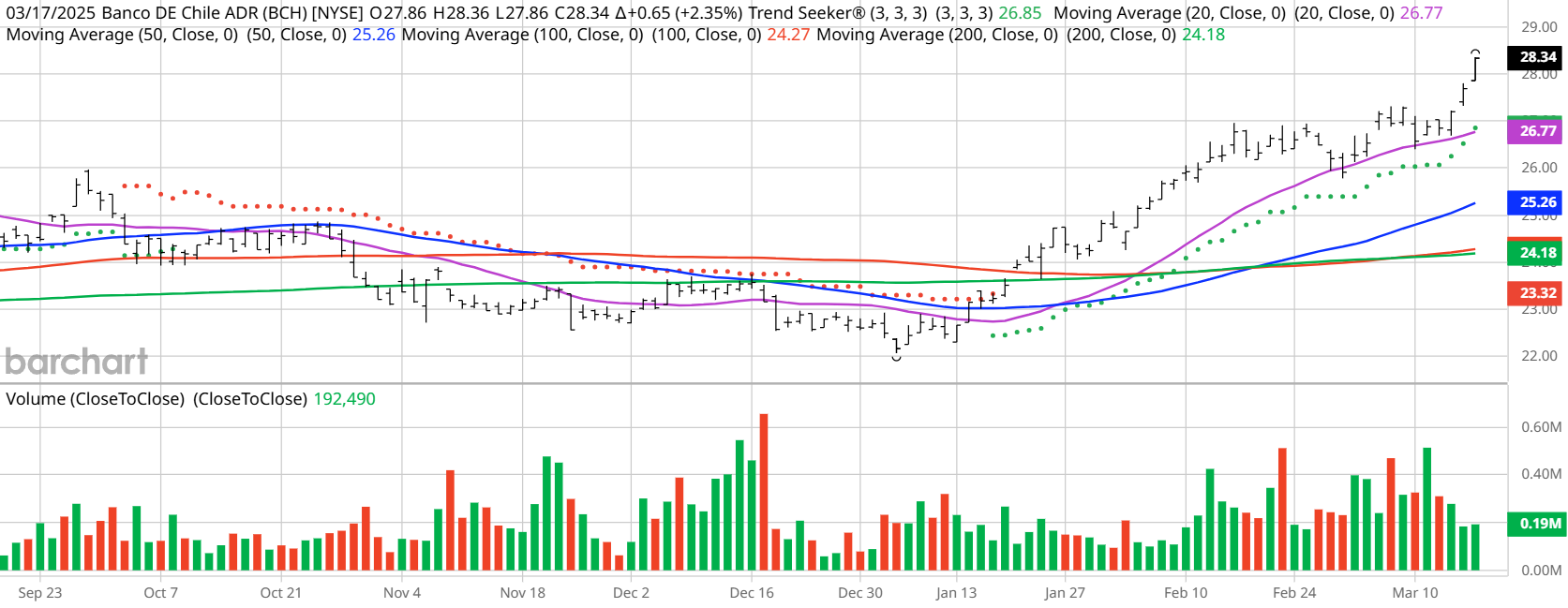

- Banco de Chile has shown strong technical indicators, including a 20.60% gain since the Trend Seeker buy signal on 1/17 and a 21.16% gain over the past year.

- The bank operates in Retail, Wholesale, Treasury, and Subsidiaries segments, offering a wide range of financial services in Chile, with a market cap of $13.99 billion.

- Barchart's technical indicators show 100% buy signals, with BCH trading above its 20, 50, and 100-day moving averages, and a Relative Strength Index of 71.84%.

- Analysts have mixed opinions with 2 strong buys, 7 holds, and 1 sell; MorningStar deems it fairly valued, highlighting its profitability and low cost of funds.

The Chart of the Day belongs to the Banco de Chile (BCH). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 1/17 the stock gained 20.60%.

BCH Price vs Daily Moving Averages:

(Click on image to enlarge)

BCH (Barchart)

Banco de Chile, together with its subsidiaries, operates as a commercial bank that offers banking services in Chile. It operates in four segments: Retail, Wholesale, Treasury, and Subsidiaries. The Retail banking segment offers checking and demand deposit accounts; debit and credit cards; lines of credit; home mortgage, consumer, commercial, and general purpose mortgage loans; financial leases; factoring services; mutual fund management and stock brokerage; foreign trade; payments and collections; insurance brokerage; time deposits; savings instruments; and foreign currency services through the network of branches operating under the Banco de Chile and Banco Edwards brands. The Wholesale banking segment offers short- and long-term commercial loans; working capital loans; lines of credit; corporate credit cards; foreign trade and foreign currency services; factoring services; leasing; long-term syndicated loans; investment banking services; payment services; collection services and connections to international fund transfer networks; checking accounts and deposit products; fund administration; treasury and investment management; derivative contracts; and insurance brokerage services. The Treasury segment offers foreign currency trading, forwards, interest rate swaps, repurchase agreements, and investment products based on bonds, mortgage bonds, and deposits; manages currency, interest rate, term mismatches; fixed income; foreign exchange; and derivative instruments; and issues short and long-term senior bonds, and long-term subordinated bonds in Chile or abroad. The Subsidiaries segment offers equities and fixed income brokerage and currency exchange services; life and general insurance, as well as individual and group policies; investment banking services; and payment solutions. Banco de Chile was founded in 1893 and is headquartered in Santiago, Chile. Banco de Chile is a subsidiary of LQ Inversiones Financieras S.A.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 36.56+ Weighted Alpha

- 21.16% gain in the last year

- .39 - 60 month Beta

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 5.86% in the last month

- Relative Strength Index 71.84%

- Technical support level at $28.10

- Recently traded at $28.34 with 50 day moving average of $25.26

Fundamental Factors:

- Market Cap $13.99 billion

- P/E 10.84

- Dividend yield 4.46%

- Revenue expected to increase by 5.31% next year

- Earnings estimated to increase an additional 4.10% next year

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 2 strong buy, 7 holdand 1 sell opinion on the stock with price targets between $21 and $30

- MorningStar thinks the stock is fairly valued and comments:" Banco de Chile's reputation and long history in Chile have allowed it to attract a large pool of noninterest-bearing deposits, giving it a lower cost of funds than most of its rivals. This funding advantage has contributed to the bank's impressive profitability, historically delivering returns on equity in the mid- to high teens. "

- There are 326 investors following the stock on Motley fool and 276 think it will beat the market and 50 think it won't

- 1,950 investors monitor the stock on Seeking Alpha

More By This Author:

Beware Of FOMO

Gilead Sciences - Leader In HIV Medicines

Benitec - Another Biopharma Rocket

Disclosure: On the date of publication, Jim Van Meerten did not have (either directly or ...

more