Baidu: Oversold And Undervalued, Buy The Dip

Baidu (BIDU) is amongst a handful of highly dominant technology companies in China. Like other Chinese internet juggernauts, Baidu has gone through a rocky time in recent months. The company's stock crashed by 50% during the Q1 Chinese stock meltdown, and prices remain under pressure still. However, despite some negative headlines circling above Chinese companies, Baidu remains on my strong buy list. The company is cheap, has strong growth prospects, is developing its secondary businesses, is likely to continue to produce robust earnings, and should illustrate strong share price appreciation in the future.

Why The Declines

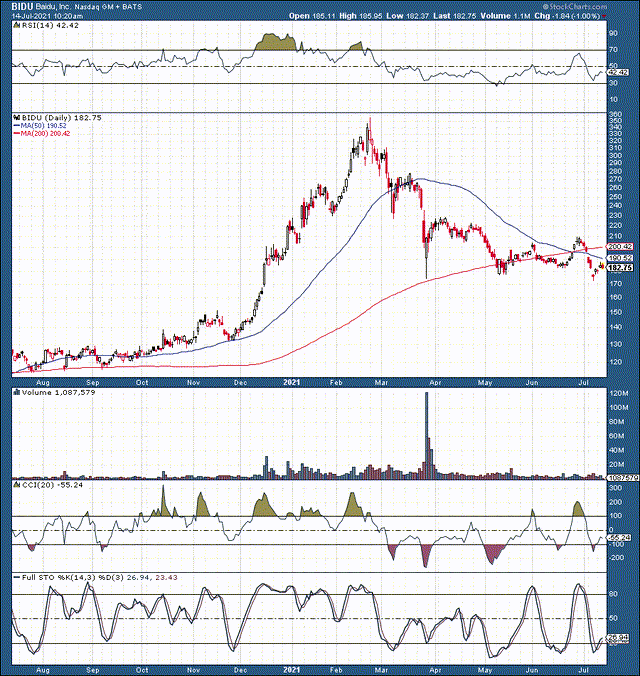

Source: StockCharts.com

One might wonder if Baidu is so great, why the extraordinary declines in the first place? Well, a combination of factors, a perfect storm if you will lead to the stock's sharp selloff. First, shares became remarkably overbought on a technical basis. Baidu nearly tripled inside of a 3-month time frame. Such parabolic price action is rarely sustainable on an intermediate or long-term basis. Second, around the same time that shares were peaking, scares about the Chinese Communist Party ("CCP") crackdown on big tech began to surface. Then news about increased U.S. regulation regarding Chinese companies came out. Alibaba's (BABA) fine and the Ant Group controversy also received a lot of attention around this time. And, of course, the infamous hedge fund meltdown included Baidu and several other prominent Chinese names.

The Takeaway

Quite a few factors collided and lead to one of the most significant declines in Baidu's history. However, this does not mean that Baidu is any worse than it was several months ago. Conversely, Baidu appears more vital than ever, and the issues responsible for plaguing the company's stock price could turn out to be transitory. After all, according to the Holding Foreign Companies Accountable Act, Baidu would have to not comply with U.S. auditing standards for three years in a row before the delisting process occurs. There doesn't appear to be a reason to doubt Baidu's ability to comply, and we're talking about three years here. Also, I don't see any evidence implying that The Chinese state controls Baidu. On the contrary, the CCP is in the process of conducting investigations into big internet tech firms.

What Makes Baidu Unique

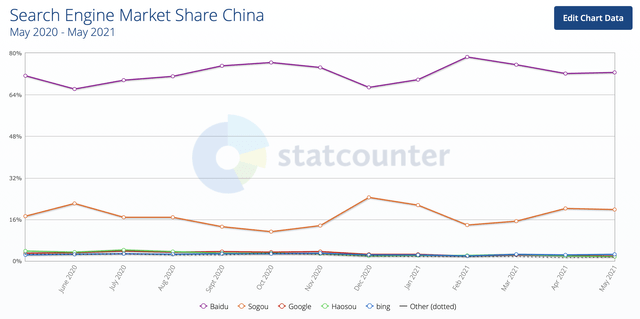

Several factors make Baidu very unique. Baidu is essentially the Google of China, with a commanding search market share of over 70%.

Source: statcounter.com

We see a steady, dominant market position here for Baidu. The company derived roughly 64% of its revenues from online marketing operations in Q1 2021. Revenues from Baidu's core segment came in at approximately $2.76 billion and increased by over 27% on a YoY basis. We see substantial growth in this area of Baidu's business despite the company's market share staying at around the same percentage. This dynamic implies that we can expect further revenue increases as more people come online in China, the country's middle class continues to expand, and advertising budgets continue to grow.

iQIYI (IQ) is another element that makes Baidu very special. Baidu launched iQIYI back in 2010. While it spun off iQIYI in an IPO back in 2018, it retained a majority stake in the company, and in 2020 Baidu generated roughly 28% of its revenues from its iQIYI unit.

Source: facebook.com

So, What is iQIYI? iQIYI is essentially China's equivalent of Netflix (NFLX). iQIYI is a popular video viewing platform with around 500 million monthly active users and $5 billion in annual revenues. Yet, the company's market value is only about $10.4 billion right now, extremely cheap for a unit that is growing revenues at a double-digit pace and is significantly increasing EPS.

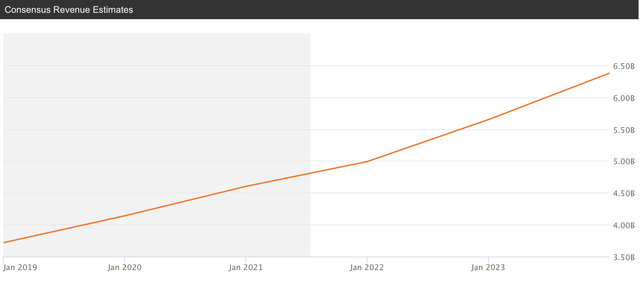

Source: seekingalpha.com

iQIYI should hit about $6.4 billion in revenues in 2023. This increase is about a 13% gain on a YoY basis. Relative to the company's current market cap of $10.4 billion, this is merely 1.6 times sales, remarkably cheap for a market-leading enterprise with a significant growth runway ahead.

Developments in AI

In addition to its leading market positions in search, streaming, and other areas, Baidu is also a global leader in artificial intelligence ("AI"). Baidu is teaming up with China's state-owned BAIC group to build 1,000 driverless cars in the next three years. Baidu plans to change the way people think of travel by putting driverless taxis out on China's streets. With over 1.4 billion Chinese, a driverless taxi market would likely bring enormous revenues for the company. Additionally, Baidu's other AI initiatives should turn into steady revenue streams and profit-generating channels over time.

Valuation Perspective

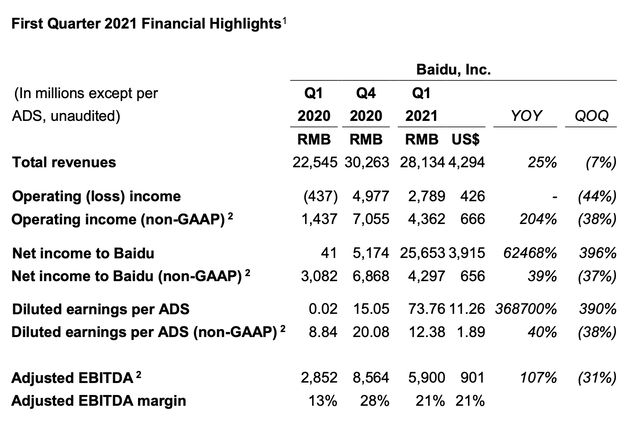

Last quarter (Q1 2021), Baidu's total revenues were $4.294 billion, a 25% YoY increase. The company's operating income grew by 204%, its net income increased by 39%, and EPS expanded by 40% on a YoY basis.

Source: ir.baidu.com

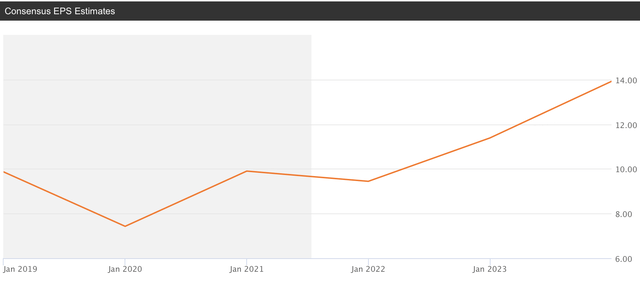

We see very healthy growth for Baidu's businesses, and the company's substantial growth should continue. Baidu trades at only 16 times forward (2022's) consensus EPS estimates. This valuation is remarkably cheap for a market-leading company about to grow YoY revenues by 15%.

Source: seekingalpha.com

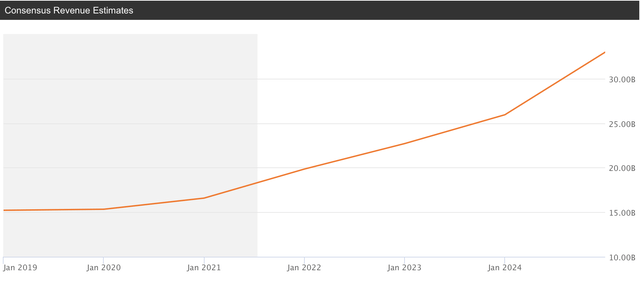

Furthermore, we see that Baidu will likely earn about $14 in EPS in 2023. By this estimate, Baidu is trading at just 13 times 2023 consensus EPS figures. However, it is what comes after 2023 that is intriguing.

Source: seekingalpha.com

Analysts expect a 27% increase in revenues in 2024. If we apply a similar rise to Baidu's EPS estimates, we arrive at an EPS figure close to $18, putting Baidu's 2024 valuation at just 10 times EPS estimates. In comparison, Alphabet (GOOG) (GOOGL) trades at nearly 30 times next year's EPS estimates and at 20 times 2024's expected EPS results. Google's valuation is essentially twice as expensive as Baidu, which makes Baidu's shares look extremely attractive right now.

The Bottom Line

Baidu recently faced and successfully weathered several challenges, including domestic scrutiny of big tech names, a U.S. hedge fund meltdown, U.S. regulatory concerns, and other factors. Now the negative headlines are back, and it's all about possible delisting now. While The SEC's recently adopted Holding Foreign Companies Accountable Act sounds serious, no evidence suggests Baidu won't comply with regulators. Furthermore, Baidu would need to fail compliance for three years before getting delisted. Three years is a long time, and I see no reason why Baidu wouldn't comply in one year, never mind three. Also, China remains a crucial trading partner for the U.S., and a worsening relationship is in no one's interest. Therefore, the negative headlines could fade soon, and once the clouds of uncertainty pass, a clear vision of Baidu's significant value will emerge. Objectively, the stock can quickly move to about $360 (100% gain) once the uncertainty factors are alleviated or removed from the investing equation.

Just in Case, What if?

In the rare case that the probability of a U.S. exchange delisting Baidu goes up substantially, the share price will likely take an additional hit. However, Baidu is at 16 times forward earnings, so much of the risk is already priced in. Moreover, if you're worried about holding Baidu ADRs, you can buy the stock on the Hong Kong stock exchange. I don't view a BIDU delisting in the U.S. as a high probability occurrence, but if it does happen, the company's business is not likely to be impacted. Therefore, in any case, the company's stock price should stabilize, recover, and move substantially higher in the intermediate and longer-term.

Disclosure: I/we have a beneficial long position in the shares of BIDU, BABA, GOOG either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses ...

more