"Avoid The Stock": Goldman Says Apple's Recent Stock Performance Is "Unsustainable"

With Tesla's earnings now over, the talking heads at CNBC will be making an instant pivot to talking about the country's other favorite, widely held retail stock, Apple.

Apple (AAPL) is set to report earnings next week but a new note out from Goldman Sachs this morning does little to inspire confidence about the upcoming report and Apple's stock price, which Goldman has labeled "unsustainable". It has advised its clients to "avoid the stock".

Goldman says it doesn't think the company will give guidance for the September quarter due to uncertainty around Covid-19 and the potential that this fall's iPhone launch could be delayed.

"We are well aware of both supply and press speculation to the contrary but our experience and Apple’s strong supply chain presence suggest it is more likely to surprise on the upside in terms of execution. Should this be incorrect we estimate that a one month delay in the iPhone launch would result in ~7% lower FQ1’21 (to Dec) revenue in our model and ~6% lower EPS for that quarter," the note reads.

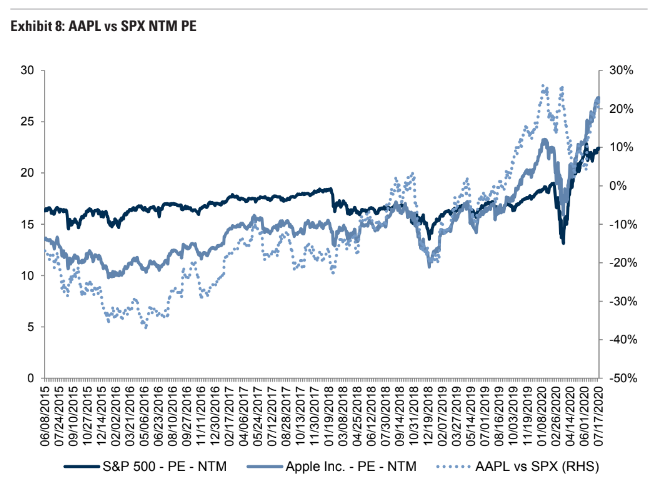

Goldman says that its thesis to avoid the stock is predicated on weaker 2021 numbers, as the bank is forecasting CY'21 EPS for Apple that is 16% below the consensus. The bank believes product unit sales, ASPs and service growth will all slow.

"On this basis we see Apple’s recent stock performance and absolute trading level as unsustainable and would continue to recommend that investors avoid the stock," the note says.

Additionally, the bank says that channel checks for iPhone shipments are turning up weak numbers for the quarter, though not as weak as once anticipated. The bank also says that Apple's online presence helped it during the pandemic and that the company likely received a tailwind from the government stimulus that went out to Americans.

As a result, the note raised CQ2 iPhone and wearables estimates, but left iPhone estimates static for the year:

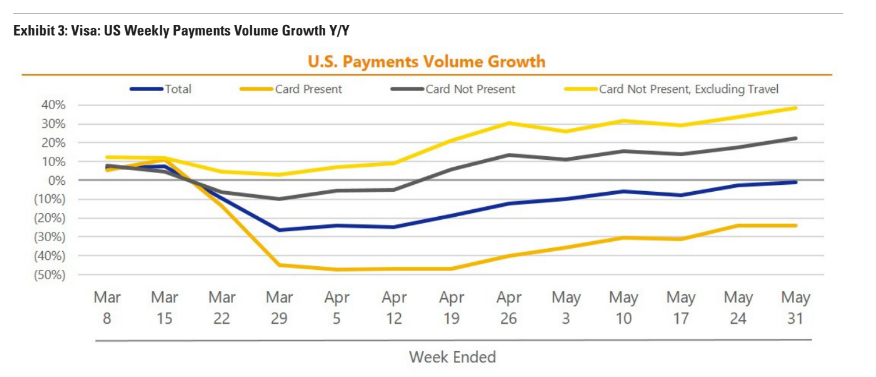

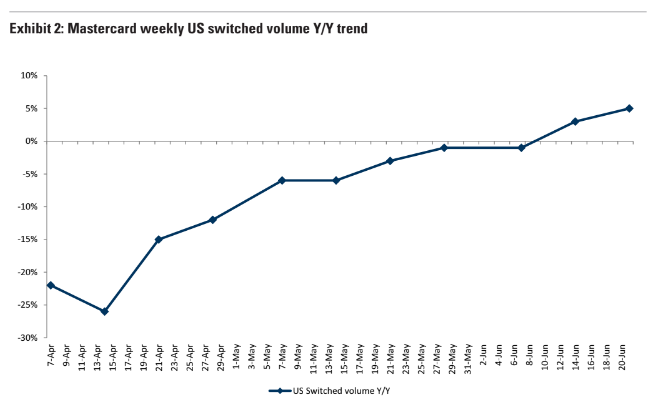

"Consistent with this we note that both Visa and Mastercard have indicated better y/y trends through May and June on a weekly basis as lockdown restrictions eased in the US. Also, we note improving US consumer indications on consumer confidence, retail spend, and unemployment in May and June after a weaker April. Driven by our checks and the positive macro in CQ2, we are increasing our CQ2 iPhone and Wearables/Home/Accessories estimates. We are leaving our CY’21 iPhone units estimates unchanged."

"We continue to see short term COVID-19 rebound forecasting as extremely difficult. However, with unemployment rate still high and the recent announcements of relatively higher income job cuts from companies, we believe that our below consensus unit and ASP forecasts for 2021 remain prudent," the bank writes. Goldman cites the following potential "upside risks":

- Better-than-expected iPhone demand. Our current iPhone estimates are below consensus expectations because we expect a slower recovery in consumer demand post COVID-19. Stronger than expected demand for 5G iPhones would pose upside risk to our revenue and EPS estimates.

- Stronger demand for wearables. Apple wearables growth has outpaced our expectations in the past few quarters. Our estimates could turn out to be conservative if the momentum in wearables continues.

- Services growth. Our services revenue estimate would face an upside risk if Apple announces new services that could drive material incremental revenue and profit. If the company is able to negotiate better TAC payments from Google, then our services growth estimate could also turn out to be conservative.

- Opex reductions. Should Apple control opex by more than our expectations our EPS estimate could turn out to be conservative.

Goldman moved its price target up to $299 from $263 as they "mark-to-market for higher S&P 500 multiple."

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

Apple's share price has reflected a potential slowdown for years now. More worrisome is Tesla being added to the S&P who's expansion is also limited despite what people say.

Why is that worrisome?

This will drag down the profitability of the S&P 500 and make it more expensive by most every metric. It is worrisome because it affects a lot of people's investments. Also it doesn't really properly reflect the slowdown making the stock an especially dangerous investment, more so than Apple.