Avis Pulls Away

Avis Soars After Earnings

After the close on Monday, Avis Budget Group (CAR) posted blowout earnings: $10.92 per share, versus consensus estimates of $6.53. Then on Tuesday, all hell broke loose. The stock was up more than 200% at one point, triggering trading halts; TD Ameritrade also placed restrictions on its customers trading the stock. At the end of the day, CAR closed up 108%. ZeroHedge pointed out that the rally was likely driven in part by heavy short-covering, as CAR had been part of a popular pair trade with Hertz Global Holdings (HTZZ). As of this writing, CAR appeared to be holding most of its gains on thin trading in Frankfurt Wednesday morning.

Road between green-leafed trees (Josh Sorenson/Pexels).

Our Second Top Name To Spike This Week

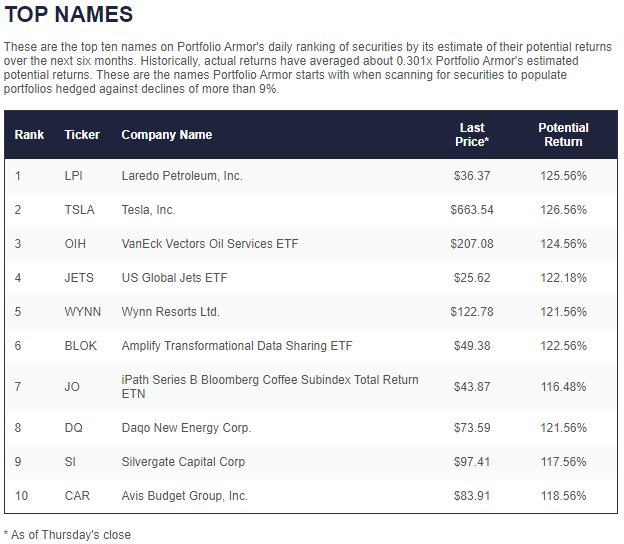

In our last post (Silvergate Soars Again), we noted that the crypto bank Silvergate Capital Group (SI) was one of our top ten names on May 6th, and we included the screen capture below showing all ten names from that date.

Screen capture via Portfolio Armor on 5/6/2021.

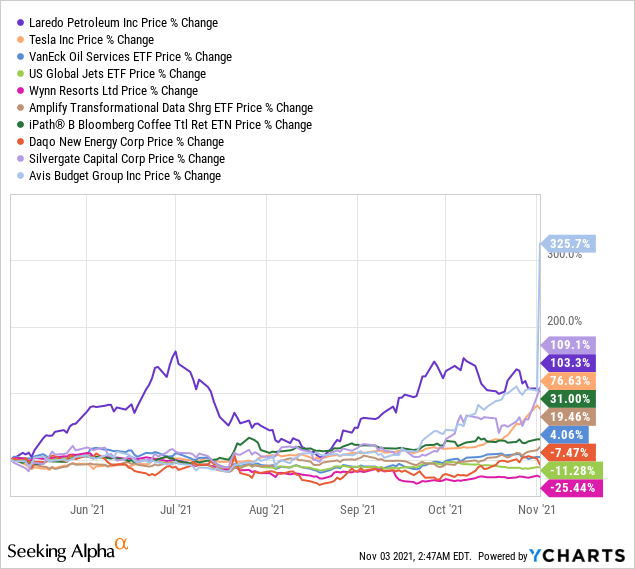

As you can see above, CAR was #10 on that top names list, just after SI. Both Silvergate and Avis appeared in our top ten names again multiple times since then, most recently last month (our system updates its potential return estimates for thousands of securities in its system every day the market is open). But so as not to clutter this post with multiple charts, we'll stick with the May 6th top names cohort, as that was the first one to feature CAR. Here's how those top names have performed since.

As of Tuesday's close, CAR was up 325%, while Silvergate and Laredo Petroleum (LPI) were each up over 100%. Tesla (TSLA) was in fourth place, up more than 76%. On average, our top names were up 62.5%, versus SPY which was up 10.94% over the same time frame.

Turning A Corner On Performance

We added a new gauge of options market sentiment as a factor to our security selection process at the end of May, in 2020. It generated significant alpha before peaking with cohorts created in late August of 2020. The performance of our May 6th, 2021 cohort, and the preliminary performance of some more recent top names cohorts, suggests we may be in another period of outperformance, perhaps one that will last longer this time. As always, though, we will go where the data takes us, and recalibrate as returns continue to come in.

If You Own Avis Now

If you own Avis now, congratulations. You may want to consider hedging though, to lock in some of your gains as you hold out for more. We showed how to use our iPhone app to scan for optimal hedges on Avis last month (when it was again one of our top names).

Video Length: 00:04:19

Obviously, you would need to scan for updated hedges now, but the video above shows you how to do so. Given the stock's potential for further outperformance, you may want to give more consideration to optimal put hedges, which allow for uncapped upside.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more