Aurora Cannabis Q3 Financials Unimpressive: Stock Declines

Aurora Cannabis Inc. Logo (CNW Group/Aurora Cannabis Inc.)

The information below compares Q3 2024 ended December 31st, 2023 with Q2 2023 and all figures are in Canadian dollars. Go here to convert into another currency.

Q3 Financial Highlights

- Net Revenue: UP 1.6% to $64.4M

-

- Adj. Gross Margin: UP to 50% from 44%

- Medical: UP 3.0% to $45.1M

- Adj. Gross Margin: DOWN to 62% from 63%

- Recreational: DOWN 3.3% to $11.6M

- Adj. Gross Margin: DOWN to 26% from 27%

- Plant Propagation: UP 1.4% to $7.3M

- Adj. Gross Margin: DOWN to 18% from 22%

-

- SG&A (incl. R&D) Exp.: DOWN 1.4% to $28.3M

- Adj. EBITDA: UP 26.5% to $4.3M from $3.4M

Q3 Operational Highlights

- Average net selling price of dried cannabis, excluding bulk sales, increased 0.4% to $4.77

- Kilograms sold increased by 5.9% to 14.4

Management Commentary

Miguel Martin, Chief Executive Officer, said:

-

"Fiscal 2024 is on track to be our strongest to date, driven by the continued strength of our differentiated business model and our focus on profitable global medical cannabis markets.

-

...Q3 marks our fifth consecutive quarter of positive adjusted EBITDA, driven by consistent performance in our Canadian business and substantial revenue growth internationally..."

Fiscal Q4 Expectations

- Expects revenue from Canadian medical and consumer segments to be steady quarter over quarter, while Europe and Australia should provide modest growth in their regions.

- Expects revenue increases, combined with ongoing cost control and the announcement yesterday that the Company has acquired the remaining approximately 90% equity interest of Indica Industries Pty Ltd ("MedReleaf Australia") will be accretive to Adjusted EBITDA and accelerate its efforts to generate positive free cash flow this calendar year.

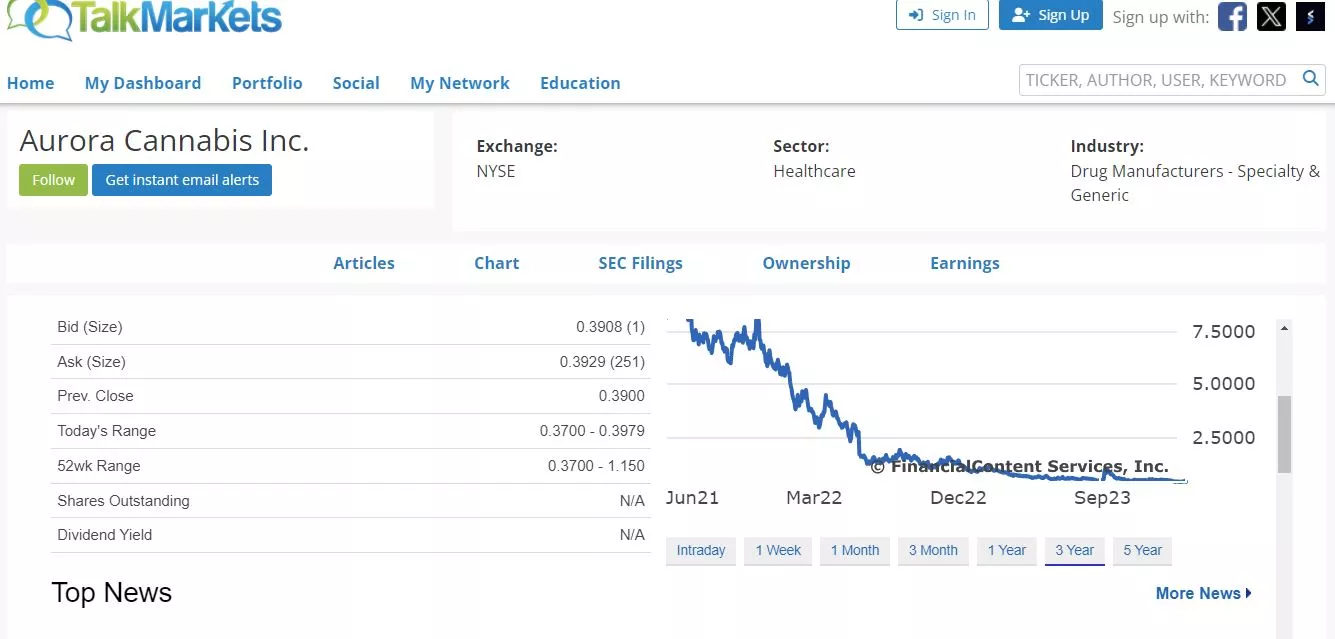

Stock Performance

Aurora's (ACB) stock price went DOWN 18.6% during Q3 (October - December) and has declined a further 18.8% as of mid-day today since then.

More By This Author:

Q3 Financials Drive Canopy Growth Stock Down Further: Now -26% YTD

These Top 15 Semiconductor Stocks Up 18% YTD

Bubble In These 20 AI Stocks Continues - Up 33% YTD

Disclosure: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

I have not been a fan of #Aurora. $ACB stock has been unimpressive for the last 2 years: